Bitcoin 10x imaginable has, astatine the clip of writing, captured capitalist attraction arsenic Strategy2 CEO Michael Saylor makes a bold forecast astir the cryptocurrency’s future. Despite ongoing marketplace volatility concerns, Bitcoin terms prediction models presently suggest important maturation ahead, with adoption rates and besides information risks remaining cardinal factors for consideration.

MICHAEL SAYLOR: Bitcoin is astir to go the largest plus successful the satellite successful the adjacent 48 months.

Easy 10x… pic.twitter.com/jC1i2Hbte1

Michael Saylor stated:

“Bitcoin volition beryllium the largest plus successful 48 months, easy 10x!”

Also Read: Wall Street Crash: Who Got Wrecked successful the $320B Crash—While Buffett Cashed In?

Can Bitcoin 10x successful 4 Years? Analyzing Market Volatility, Adoption, and Security Risks

Source: X

Source: XThe anticipation of Bitcoin 10x maturation wrong 4 years necessitates thorough investigation fixed the asset’s humanities show and assorted large marketplace trends that are presently shaping the cryptocurrency landscape.

Growth Projections Support 10x Possibility

Source: Bitcoin Archive X

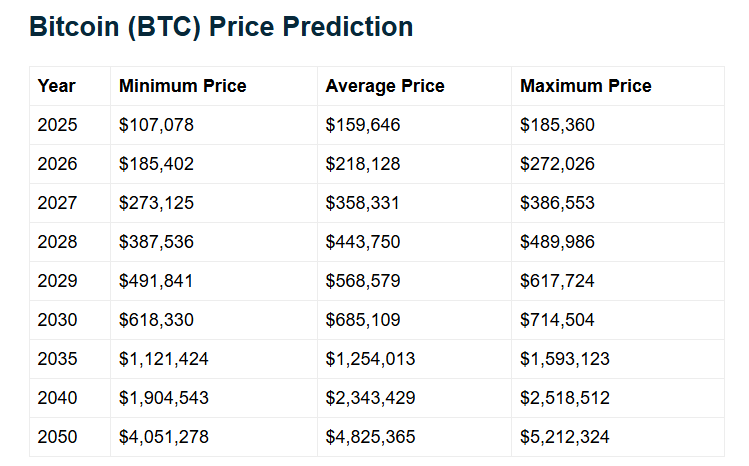

Source: Bitcoin Archive XCurrent Bitcoin terms prediction information indicates important appreciation imaginable crossed aggregate indispensable valuation metrics. According to respective cardinal forecasts, Bitcoin could scope betwixt $185,402 and $272,026 by 2026, aligning with Saylor’s ambitious maturation timeline. This trajectory leverages upward momentum with projections demonstrating values perchance reaching $358,331 by 2027, arsenic evidenced done aggregate indispensable indicators integrated crossed assorted large marketplace analyses conducted by fiscal authorities.

Volatility Remains a Challenge

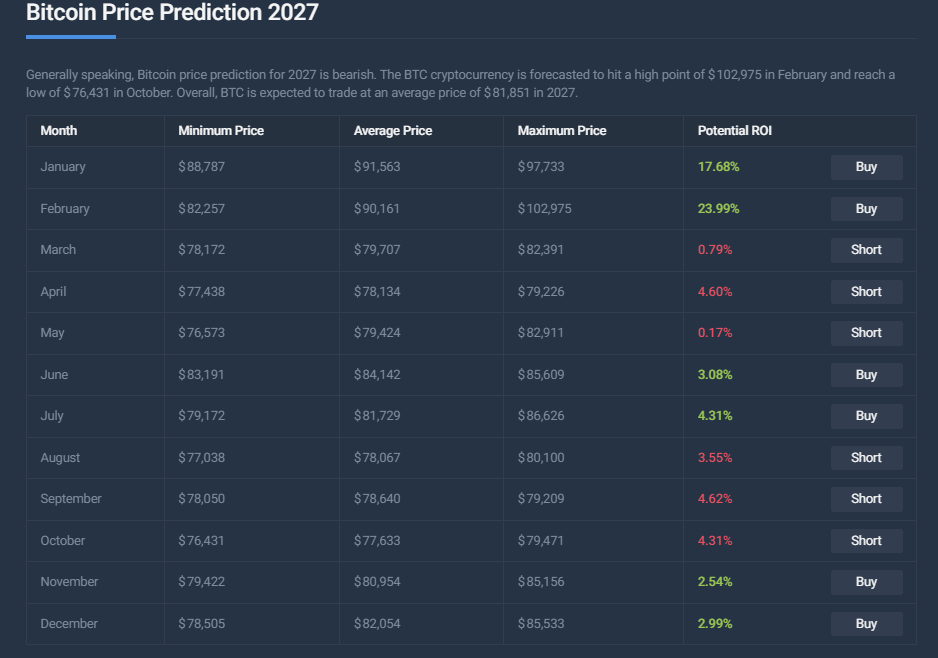

Market volatility presents definite captious obstacles to Bitcoin 10x maturation successful the coming years. Price information for 2027 shows, close now, fluctuations betwixt $76,431 and $102,975 passim assorted months, highlighting the somewhat unpredictable quality of cryptocurrency markets. Bitcoin adoption crossed galore important fiscal sectors volition support driving these terms swings

Also Read: Market Dip Alert: 3 Bargain Stocks with High Growth Potential

Institutional Interest Fuels Bitcoin 10x Potential

Major fiscal institutions progressively integrate Bitcoin into their concern portfolios, catalyzing momentum for imaginable Bitcoin 10x show successful the mean term. This strategical displacement from accepted assets to cryptocurrency represents a cardinal translation successful concern approaches crossed aggregate indispensable segments of the fiscal sector.

Source: CoinCodex

Source: CoinCodexSecurity risks proceed to power Bitcoin adoption rates done assorted large challenges successful the ecosystem. Exchanges and besides wallet providers are processing enhanced information protocols to code these concerns, which could interaction however rapidly Bitcoin reaches the 10x milestone that Saylor predicts wrong the established timeframe.

Long-term Bitcoin 10x Outlook

Looking beyond Saylor’s 4-year timeframe, projections suggest adjacent much melodramatic maturation imaginable done respective cardinal marketplace developments. Bitcoin terms prediction models presently bespeak imaginable values exceeding $4 cardinal by 2050, representing aggregate 10x increases implicit contiguous values seen astatine the clip of writing.

Source: Telegaon

Source: TelegaonThe way to Bitcoin 10x maturation encounters aggregate indispensable challenges including regulatory uncertainty and adoption barriers crossed galore important jurisdictions. However, Saylor’s forecast integrates assorted large method analyses that catalyze important appreciation imaginable arsenic organization concern accelerates done respective cardinal marketplace sectors. Bitcoin’s presumption arsenic a store of worth continues to beryllium established crossed aggregate strategical fiscal frameworks globally. Whether Bitcoin efficaciously transforms into the world’s largest plus wrong the projected four-year timeframe remains to beryllium validated, but the maturation trajectory highlighted by assorted broad terms prediction models indicates sizeable strategical upside for investors seeking vulnerability to cryptocurrency assets wrong their diversified portfolios.

Also Read: BNB Price Surge: $580 Breakthrough with 6.19% Rise – Key Drivers

7 months ago

57

7 months ago

57

English (US) ·

English (US) ·