While the crypto community is expecting a strong 2025 after Donald Trump’s return to the Oval Office, new reports show that the Trump-led rally could face roadblocks.

As 2025 begins, the crypto trading environment shows mixed trends following the December FOMC meeting and the festive holiday season.

Bitcoin Rally Risks Losing Momentum Despite Trump’s Support

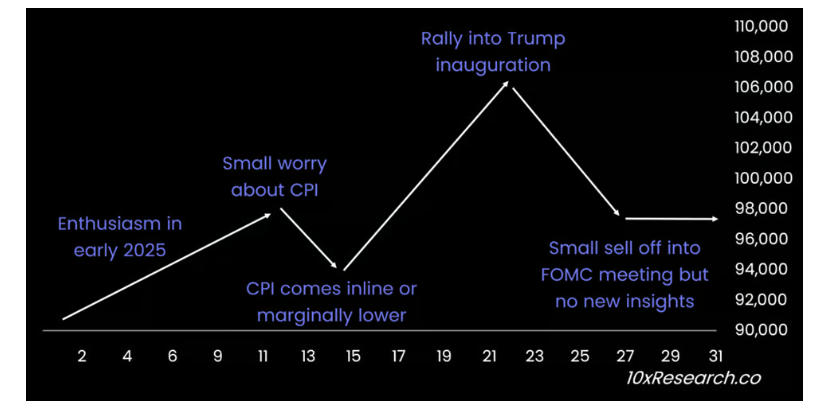

According to 10x Research, Q1 2025 might not witness the same level of momentum that late January to March 2024 or late September to mid-December showed.

The release of the Consumer Price Index (CPI) data on January 15 is a key event to watch. A pullback should be anticipated leading into the CPI data release, and the market could rally again if there are favorable results.

“A favorable inflation print could reignite optimism, fueling a rally into the Trump inauguration on January 20,” 10x founder Mark Thielen wrote.

However, the momentum generated by such a rally may be short-lived. Thielen added that the market will likely retreat ahead of the FOMC meeting on January 29. He projected that Bitcoin will be in the $96,000 to $98,000 range by the end of January.

Projected Bitcoin Path in 2025. Source: 10xReseacrh

Projected Bitcoin Path in 2025. Source: 10xReseacrhBitcoin hit new all-time highs in Q4 2024 following the Fed’s 25-basis-point interest rate cuts. The rate cuts in September were also highly bullish for the crypto market.

Bitcoin Dominance Persists in 2025

Another factor to consider while discussing the BTC price trajectory in 2025 is Bitcoin’s dominance. According to the 10x report, from January 2024 to mid-November, Bitcoin’s market share surged from 50% to 60%, exerting significant pressure on altcoins.

As Bitcoin’s dominance rose, many altcoins struggled to gain traction, making it difficult for investors to see substantial returns outside of Bitcoin.

There was a brief period when Bitcoin dominance dipped to 53% over a span of three weeks, sparking hopes for an altcoin season. However, this dip was short-lived, and Bitcoin dominance quickly rebounded to nearly 58%, settling around 55% as of late 2024. This consolidation around the 55% level signals that Bitcoin remains firmly in control of the market.

For investors, this highlights the importance of closely monitoring Bitcoin’s dominance. At press time, Bitcoin dominance was around 57% while price was trading at $99,225.

Bitcoin Dominance Chart. Source: TradingView

Bitcoin Dominance Chart. Source: TradingViewThe Bitcoin projections from 10xResearch come as CoinShares head of research James Butterfill last week forecasted that Bitcoin could see potential peaks at $150,000 and corrections down to $80,000 in 2025.

Similarly, Bitwise asset management projected that Bitcoin could reach $200,000 by the end of the year.

The post Bitcoin’s 2025 Rally Faces Challenges Despite Donald Trump’s Pro-Crypto Stance appeared first on BeInCrypto.

1 day ago

13

1 day ago

13

English (US) ·

English (US) ·