Introduction

In the complex and rapidly evolving world of cryptocurrencies, Bitcoin stands as a beacon of innovation and disruption. Born from the desire for a decentralized financial system, Bitcoin has grown from a niche interest to a global phenomenon influencing markets, economies, and governments. While often perceived as existing outside the realm of traditional finance, recent developments suggest that Bitcoin’s appreciation may, paradoxically, benefit the U.S. government.

Central to this unexpected relationship is Tether (USDT), the largest stablecoin by market capitalization. Tether serves as a critical bridge between fiat currencies and cryptocurrencies, facilitating liquidity and stability within the volatile crypto markets. As Bitcoin’s price ascends, Tether’s market cap expands, necessitating increased holdings in U.S. Treasury bills to back its circulating tokens. Consequently, Tether emerges as a significant purchaser of U.S. government debt, providing much-needed demand amid weakening interest in Treasuries.

This article delves into the intricate dynamics between Bitcoin’s rise, Tether’s growth, and the implications for U.S. government financing. We will explore how Tether’s increasing Treasury holdings support the U.S. debt market, the potential incentives for the government to favor Bitcoin’s appreciation, and the risks and mitigations associated with this evolving landscape.

The Role of Tether in the Bitcoin Ecosystem

Understanding Tether

Tether is a stablecoin pegged to the U.S. dollar, designed to maintain a 1:1 value ratio with USD. Introduced in 2014, Tether aims to provide stability in the often volatile cryptocurrency markets. Each Tether token (USDT) is expected to be backed by an equivalent amount of U.S. dollars or other assets, ensuring that users can redeem USDT for USD at any time.

Facilitating Liquidity and Stability

Tether plays a pivotal role in facilitating liquidity within the cryptocurrency ecosystem. By providing a stable medium of exchange, it allows traders and investors to move funds quickly between cryptocurrencies and fiat currencies without the delays and costs associated with traditional banking systems. Tether is widely used on exchanges for trading pairs, such as BTC/USDT, enhancing market efficiency and enabling high-frequency trading strategies.

Explosive Growth in Market Capitalization

Over the past five years, Tether’s market capitalization has surged dramatically. From approximately $4.5 billion in 2019, it has ballooned by around 2,767% to reach nearly $130 billion. This growth outpaces even that of Bitcoin, which increased by about 1,526% in the same period. The expansion reflects Tether’s increasing adoption as a fundamental tool for traders and its central role in the cryptocurrency infrastructure.

Tether’s Reserves and U.S. Treasury Holdings

Backing and Transparency

Tether asserts that every USDT token is fully backed by reserves, including cash, cash equivalents, and other assets. A significant portion of these reserves is invested in short-term U.S. Treasury bills, considered among the safest and most liquid assets globally. This investment strategy not only underpins the stability of USDT but also links Tether’s financial health to the performance of U.S. government debt.

Record-Breaking Treasury Investments

In recent financial disclosures, Tether reported a profit of $5.2 billion for the first half of 2024, largely attributed to its substantial holdings in U.S. Treasury securities. The company’s Treasury investments have reached a record-breaking $97.6 billion, surpassing the holdings of several major economies. Tether now ranks third globally in purchases of 3-month U.S. Treasuries, following only the United Kingdom and the Cayman Islands.

This aggressive accumulation of U.S. government debt elevates Tether to a position of significant influence in the Treasury market. The company’s projections suggest that, given the trajectory of USDT adoption, it could become the largest single holder of short-term U.S. Treasuries within the next year.

Implications for the U.S. Government

Supporting U.S. Debt Amid Weak Demand

The U.S. government relies heavily on issuing debt to finance its budget deficits, which have been expanding due to increased spending and revenue shortfalls. Traditionally, U.S. Treasury securities have been in high demand from both domestic and foreign investors seeking safe-haven assets. However, recent trends indicate a waning appetite for long-term U.S. debt, particularly from foreign buyers.

In this context, Tether’s substantial purchases of Treasury bills provide critical support to the U.S. debt market. By absorbing a significant portion of new issuance, Tether helps to stabilize demand and prevent upward pressure on interest rates that might arise from insufficient investor participation. This dynamic is particularly beneficial during periods of weak demand, as it aids the government’s financing efforts and contributes to fiscal stability.

Alleviating Budget Deficits

The U.S. Treasury has projected increasing borrowing needs to cover anticipated budget deficits. For example, during the January–March 2024 quarter, the Treasury borrowed $748 billion in privately held net marketable debt, with expectations to borrow $823 billion in the same quarter of 2025 — a $75 billion increase. Tether’s growing capacity to purchase Treasury securities could help mitigate the challenges associated with this rising debt issuance.

If Bitcoin’s price were to surge significantly — for instance, reaching $200,000 per coin — Tether’s market capitalization could potentially double to around $260 billion. Assuming Tether maintains its strategy of investing a substantial portion of its reserves in U.S. Treasuries, this could result in additional purchases amounting to tens of billions of dollars. Such an influx would be a welcome development for the government, supporting its borrowing needs at a critical juncture.

The U.S. Government’s Stance on Bitcoin

From Skepticism to Strategic Interest

Historically, the U.S. government’s approach to Bitcoin and cryptocurrencies has been cautious, marked by concerns over market volatility, regulatory compliance, and the potential for illicit activities. Regulatory bodies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have grappled with defining and overseeing digital assets.

However, as the cryptocurrency market matures and integrates more deeply with traditional finance, there is a growing recognition of its potential benefits. This includes the innovation spurred by blockchain technology, the economic opportunities presented by digital asset markets, and, notably, the indirect support cryptocurrencies may provide to government financing through vehicles like Tether.

Incentives for Bitcoin’s Appreciation

Given Tether’s role in purchasing U.S. Treasuries, the government may find indirect incentives in Bitcoin’s appreciation. A higher Bitcoin price stimulates increased trading activity and capital inflows into the cryptocurrency market, expanding Tether’s market cap and, consequently, its Treasury holdings. This relationship suggests that a rising Bitcoin could bolster demand for U.S. government debt, providing a fiscal cushion amid rising deficits.

While it is unlikely that the government would actively promote Bitcoin’s rise, understanding the interconnectedness of these financial mechanisms could influence policy decisions. Maintaining a regulatory environment that allows stablecoins like Tether to operate effectively may align with national interests, balancing oversight with the benefits derived from their participation in debt markets.

Potential Risks and Mitigations

Volatility and Market Dynamics

A critical concern is the inherent volatility of Bitcoin and its potential impact on Tether and, by extension, the U.S. Treasury market. A significant decline in Bitcoin’s price could theoretically reduce Tether’s market capitalization, prompting a reduction in its Treasury holdings if redemptions outpace new inflows.

However, historical patterns indicate that during downturns in Bitcoin’s price, investors often flock to stablecoins like Tether as a safe haven, increasing demand for USDT. This flight to stability can mitigate the impact of Bitcoin’s volatility on Tether’s reserves. Additionally, Tether’s investments in highly liquid assets like short-term Treasuries enable it to manage redemptions effectively without disruptive asset sales.

Regulatory Scrutiny and Compliance Challenges

Another risk involves increased regulatory scrutiny of Tether and the stablecoin market as a whole. Concerns over transparency, reserve adequacy, and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations could lead to stricter oversight or restrictions on operations.

To address these challenges, Tether has taken steps to improve transparency, including publishing attestations of its reserves and engaging with regulators. Continued efforts in this direction can help build trust and ensure compliance, reducing the likelihood of regulatory actions that might disrupt its ability to support the Treasury market.

Systemic Risks and Market Confidence

A loss of confidence in Tether, whether due to market rumors, regulatory actions, or other factors, could trigger significant redemptions and impact its Treasury holdings. Such an event could have ripple effects across the cryptocurrency market and potentially affect the demand for U.S. Treasuries.

Mitigating this risk requires robust risk management practices, clear communication with stakeholders, and maintaining sufficient liquidity buffers. By demonstrating resilience and reliability, Tether can sustain investor confidence even amid challenging market conditions.

The Broader Impact on Financial Markets

Interconnectedness of Crypto and Traditional Finance

The evolving relationship between Bitcoin, Tether, and U.S. government debt exemplifies the increasing interconnectedness between the cryptocurrency sector and traditional financial markets. This convergence challenges conventional perceptions of cryptocurrencies as isolated from mainstream finance and highlights the importance of understanding these linkages.

Traditional financial institutions, investors, and policymakers must recognize the implications of cryptocurrency dynamics on broader economic conditions. The flow of capital between asset classes, the influence of digital assets on liquidity and demand in traditional markets, and the potential systemic risks all warrant careful consideration.

Implications for Investors

For investors, these developments underscore the need for a holistic approach to portfolio management that considers both traditional and digital assets. The potential for Bitcoin’s appreciation to contribute to government financing creates a complex investment landscape where macroeconomic factors, regulatory environments, and technological innovations intersect.

Investors should remain vigilant regarding regulatory changes, market sentiment shifts, and the operational integrity of key market participants like Tether. Diversification, risk assessment, and staying informed about cross-market dynamics are essential strategies in navigating this environment.

Bitcoin’s Breakout and Investment Strategies

Understanding the Recent Breakout

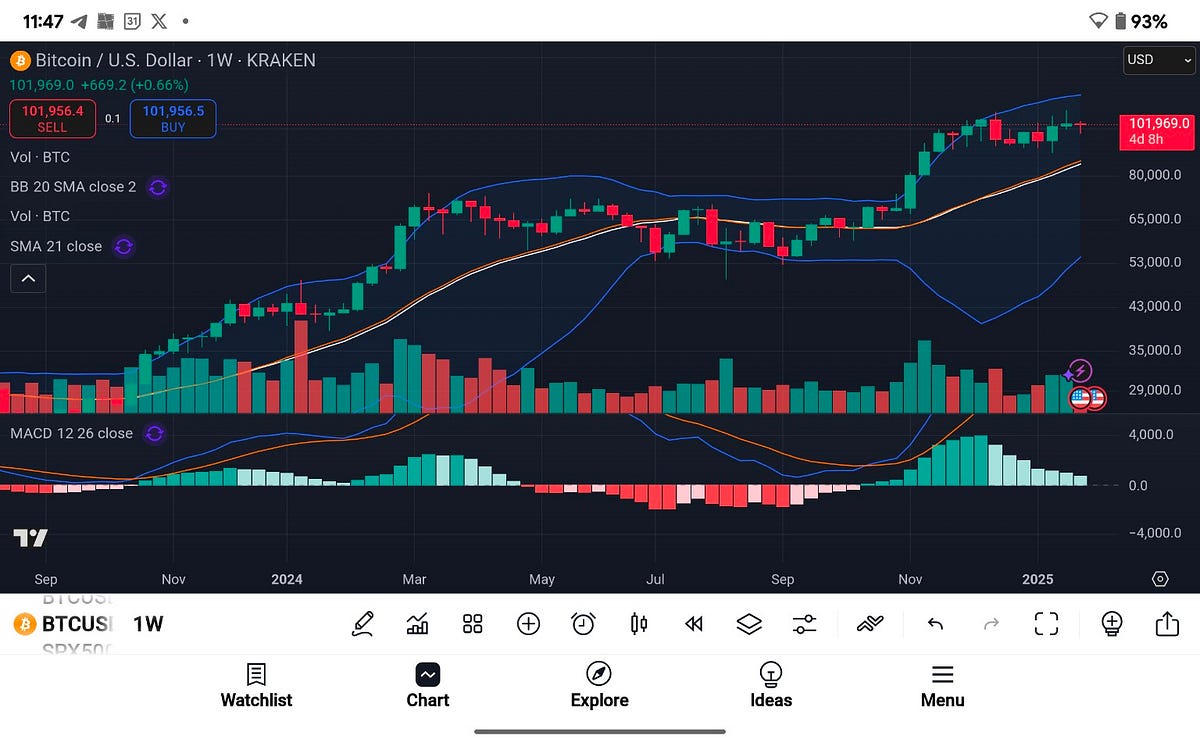

Bitcoin has recently broken through significant resistance levels, notably the historical $90,000 threshold, entering uncharted territory with the potential to reach up to $200,000 in the ongoing bull market. This breakout is significant as it represents the surpassing of a decade-old resistance level that has historically guided Bitcoin’s price movements.

The surge indicates robust market momentum, driven by factors such as increased institutional adoption, macroeconomic uncertainties, and the maturation of the cryptocurrency ecosystem. Investors face the dilemma of whether to buy into the breakout or wait for a potential pullback to enter at more favorable price levels.

Historical Bull Market Phases

Analyzing past Bitcoin bull runs reveals patterns that can inform current investment decisions. Bull markets typically proceed in phases:

- Phase 1: Recovery and reclaiming previous all-time highs (ATHs).

- Phase 2: Surpassing ATHs and reaching new price territories.

Historically, once Bitcoin exits Phase 1 and breaks past prior ATHs, it often continues upward without significant retracements to previous support levels. Waiting for a pullback during Phase 2 may result in missed opportunities, as the price may not revisit earlier levels.

Buying the Breakout vs. Waiting for a Retest

Given these historical patterns, buying the breakout may offer a better profit-risk profile than waiting for a substantial pullback. With Bitcoin potentially on a trajectory toward $200,000, entering the market at current levels could yield substantial returns.

However, investors must balance this strategy against the inherent volatility of cryptocurrency markets. Risk management techniques, such as setting stop-loss orders, scaling into positions, and diversifying holdings, can help mitigate potential downsides.

Consolidating Investment Positions

Investors who previously allocated portions of their portfolios to Bitcoin mining companies or other leveraged plays may consider consolidating back into Bitcoin itself. Recent performance indicates that mining companies have not consistently outperformed Bitcoin during this bull run and may carry additional systematic and unsystematic risks.

Focusing on Bitcoin allows investors to directly capture the asset’s appreciation without intermediary exposures. This strategy aligns with a conservative approach, emphasizing asset quality and market liquidity.

Conclusion

The interplay between Bitcoin’s appreciation, Tether’s expanding market capitalization and Treasury holdings, and the U.S. government’s debt financing strategies presents a fascinating and unexpected synergy. In an ironic twist, the rise of a decentralized digital currency like Bitcoin appears poised to support the fiscal mechanisms of a centralized government.

Tether’s role as a significant purchaser of U.S. Treasury bills provides critical demand at a time when traditional investors are less inclined to absorb increasing government debt. This dynamic not only aids the government’s financing efforts but also suggests that the continued growth and stability of the cryptocurrency markets align with national interests.

While risks associated with market volatility, regulatory challenges, and systemic confidence must be acknowledged, the structures in place within Tether’s operations and the broader market offer mitigating factors. The historical behavior of Bitcoin during bull markets supports the strategy of buying into the breakout, with potential substantial upside remaining in the current cycle.

For investors, policymakers, and market participants, understanding these interconnected dynamics is essential. The convergence of cryptocurrency and traditional finance reshapes investment landscapes, regulatory considerations, and economic strategies. As Bitcoin continues its ascent, it not only redefines digital finance but also contributes in unforeseen ways to traditional financial systems.

In summary, the symbiotic relationship between Bitcoin’s rise, Tether’s growth, and U.S. government debt underscores a new era of financial interdependence. The potential for Bitcoin to surge toward $200,000 in the coming months represents not just a milestone for cryptocurrency enthusiasts but also a development with significant implications for global financial markets and government fiscal policies. This convergence may well herald a time when the lines between decentralized innovation and centralized governance blur, offering opportunities and challenges in equal measure.

Bitcoin’s Appreciation: An Unlikely Boon for the U.S. Government was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

54

2 months ago

54

English (US) ·

English (US) ·