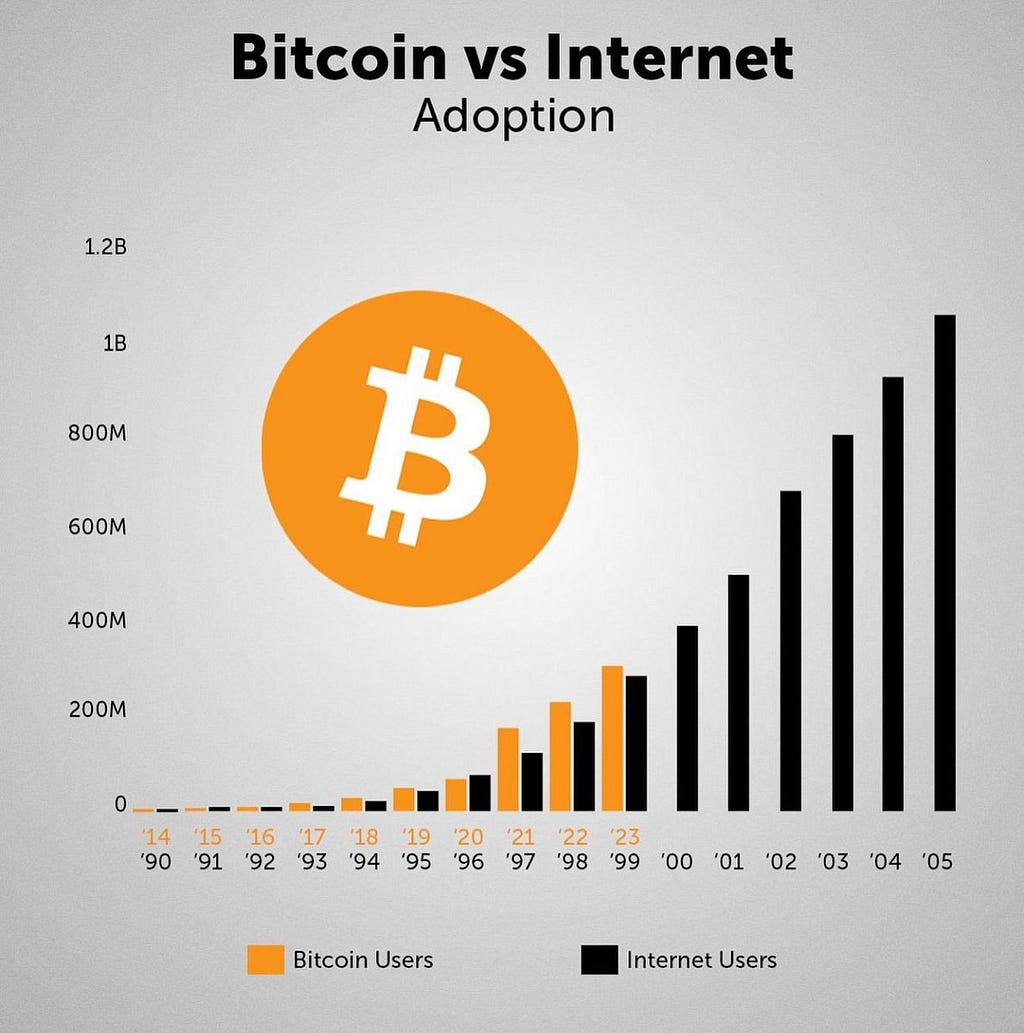

Bitcoin’s rise in adoption has been compared frequently to the growth of the Internet, and the chart you provided highlights that Bitcoin’s user base is expanding at an even faster rate than the early years of the Internet. This accelerated adoption of Bitcoin signals significant shifts in technology, finance, and global economic participation. Here’s a detailed breakdown of how Bitcoin’s adoption trajectory compares to the internet and what implications this could have for the future.

1. Bitcoin Adoption Compared to the Internet: A Speeding Trend

The internet, once considered a niche technology, has grown into an essential part of daily life, revolutionizing communication, commerce, and access to information. The chart above shows the adoption rate of Bitcoin users from 2014 to 2023 compared to the early days of the Internet from 1990 to 1999. By the end of the 1990s, the internet had crossed the 200 million user mark. In comparison, Bitcoin adoption has grown at a similar rate but has shown steeper growth in more recent years, particularly after 2018. Bitcoin reached approximately 200 million users within a decade, surpassing the internet’s growth curve.

Several factors contribute to this accelerated adoption of Bitcoin:

1. Familiarity with Digital Platforms: The internet has laid the groundwork for Bitcoin’s growth. People are already comfortable with digital payments, online banking, and mobile apps, reducing the learning curve for adopting Bitcoin.

2. Global Economic Events: Economic uncertainties, like inflation and distrust in traditional financial systems, have spurred Bitcoin adoption. Bitcoin’s decentralized nature makes it appealing to people in countries with unstable currencies or strict capital controls.

3. Access to Infrastructure: Unlike the early days of the internet, when personal computers and internet access were limited, today, billions of people own smartphones. This increases the accessibility of Bitcoin as users can easily download digital wallets and trade cryptocurrencies.

2. Network Effects and Adoption Growth

Bitcoin’s growth benefits from network effects, much like the internet. As more people use Bitcoin, its value as a financial tool grows. Here are some ways in which Bitcoin’s adoption accelerates:

• Increased Institutional Involvement: More companies and financial institutions are integrating Bitcoin into their services. Major companies like PayPal, Tesla, and Square allow users to transact in Bitcoin, pushing Bitcoin further into the mainstream.

• DeFi and Blockchain Innovations: The rise of decentralized finance (DeFi) platforms has introduced new use cases for Bitcoin, allowing holders to lend, borrow, and earn interest, much like a traditional financial system but without intermediaries.

• Integration with Traditional Finance: Bitcoin is slowly being integrated into traditional financial systems, with ETFs (Exchange-Traded Funds) and futures contracts giving investors exposure to the asset.

These trends all serve to amplify Bitcoin’s adoption rate. More importantly, once Bitcoin surpasses a critical mass of users, network effects could drive further rapid adoption, mirroring the exponential growth of the internet once it hit mainstream utility in the early 2000s.

3. Implications for the Future

The accelerated pace at which Bitcoin is being adopted carries significant implications for the future of finance and global economies. Here are some potential impacts:

3.1. Redefining Financial Systems

Bitcoin’s adoption could decentralize financial systems globally. Traditional banking relies on central authorities, intermediaries, and complex infrastructure to facilitate transactions. Bitcoin, as laid out in the Bitcoin White Paper by Satoshi Nakamoto, eliminates the need for intermediaries by providing a peer-to-peer system of value transfer. This has the potential to disrupt the banking industry by offering users more control, faster transactions, and lower fees.

Moreover, in regions where banking infrastructure is underdeveloped, Bitcoin could act as a gateway to financial services for millions of unbanked people, especially in emerging markets. Individuals without access to traditional banking systems can send, receive, and store value via Bitcoin as long as they have an internet connection.

3.2. Impact on Monetary Policies

As more individuals, institutions, and even governments adopt Bitcoin, the role of central banks could be challenged. Bitcoin’s fixed supply of 21 million coins contrasts with the inflationary nature of fiat currencies. Countries experiencing hyperinflation or devaluation of their currencies may increasingly turn to Bitcoin as a store of value, as has been observed in places like Venezuela and Zimbabwe.

If Bitcoin continues on its current growth trajectory, it could serve as a hedge against inflation, potentially impacting central banks’ ability to control money supply and execute traditional monetary policies.

3.3. Potential for Bitcoin as a Global Currency

The internet transformed global communication by breaking down barriers between people and organizations around the world. Bitcoin could do the same for currency. Currently, the global financial system is fragmented, with different currencies and regulatory regimes governing transactions. Bitcoin, as a global digital currency, could standardize financial systems, making cross-border transactions easier, faster, and cheaper.

As adoption increases, Bitcoin could become a viable alternative to national currencies for international trade. Companies that do business globally might adopt Bitcoin to avoid exchange rate risk and reduce the cost of currency conversion.

3.4. Security and Privacy Enhancements

The internet has become a treasure trove for data breaches and cybercrimes. With Bitcoin’s adoption, security measures like cryptography and decentralized ledgers could be applied across various industries to ensure data integrity and user privacy. As Bitcoin relies on blockchain technology to ensure transparency, decentralization, and immutability, these features may increasingly become part of broader data management systems.

Bitcoin is being adopted at a faster rate than the Internet due to the groundwork laid by the digital economy, widespread Internet access, and growing distrust in traditional financial systems. The implications of this rapid adoption are profound, ranging from redefined financial systems to new global currency standards and privacy protections. If Bitcoin’s current trajectory continues, it may revolutionize not just finance but how we conceive of value, trust, and decentralization in a connected world. While Bitcoin still faces challenges, such as regulatory hurdles and energy concerns, its swift growth signals a pivotal moment in financial history, similar to the internet’s transformation of communication and commerce.

Bitcoin’s Rapid Adoption vs. the Internet: Implications for the Future was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 weeks ago

13

2 weeks ago

13

English (US) ·

English (US) ·