Bitcoin (BTC) rallied past the $90,000 psychological barrier on November 12. That day, it briefly traded at a new all-time high of $93,265. However, as of this writing, the king coin trades at $87,757, having shed 6% of its value in the past two days.

On-chain data has revealed that Bitcoin has since witnessed a pullback due to a spike in profit-taking activity, mostly by short-term holders. As these paper-handed investors scamper to lock in gains, the chances of the Bitcoin price at $90,000 in the near term appear increasingly slim.

Bitcoin Short-Term Holders Are Market Movers

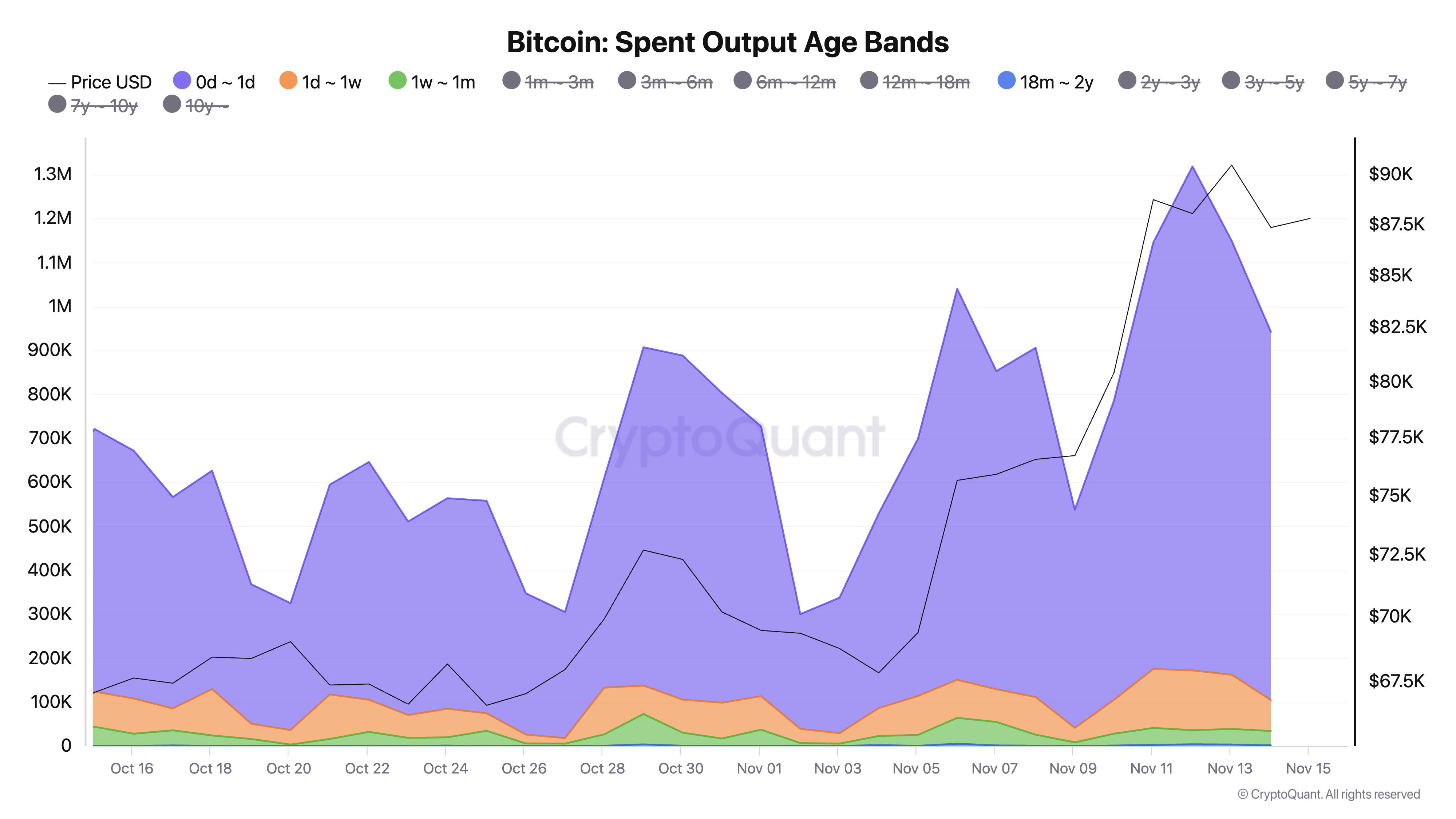

BeInCrypto’s assessment of Bitcoin’s Spent Output Age Bands (SOAB) offers insights into the activity of its holders. This metric categorizes Bitcoin Unspent Transaction Outputs (UTXOs) based on age and tracks their spending activity. Bitcoin UTXOs represent the amount of coins a user has available to spend and are tracked across the network as inputs for new transactions.

Analyzing BTC’s SOAB gives insights into market sentiment and potential price movements. For example, a spike in younger age bands often indicates increased trading activity and profit-taking by short-term holders (those who have held their coins for less than 30 days). This has played out in the BTC market since it first rallied above the $90,000 mark on Wednesday.

According to CryptoQuant’s data, Bitcoin holders who had held their coins for only a day transferred 1,146,151 BTC on that day—their highest level in two months. Holders with a holding period of one to seven days moved 135,950 BTC, while those holding between seven and 30 days transferred 32,021 BTC.

Bitcoin Spent Output Age Bands. Source: CryptoQuant

Bitcoin Spent Output Age Bands. Source: CryptoQuantA surge in the spent output of coin holders with less than a month of holding time typically signals that newer, short-term investors are selling or moving their BTC. This indicates increased profit-taking or reduced confidence among recent buyers, often adding selling pressure and contributing to short-term price volatility.

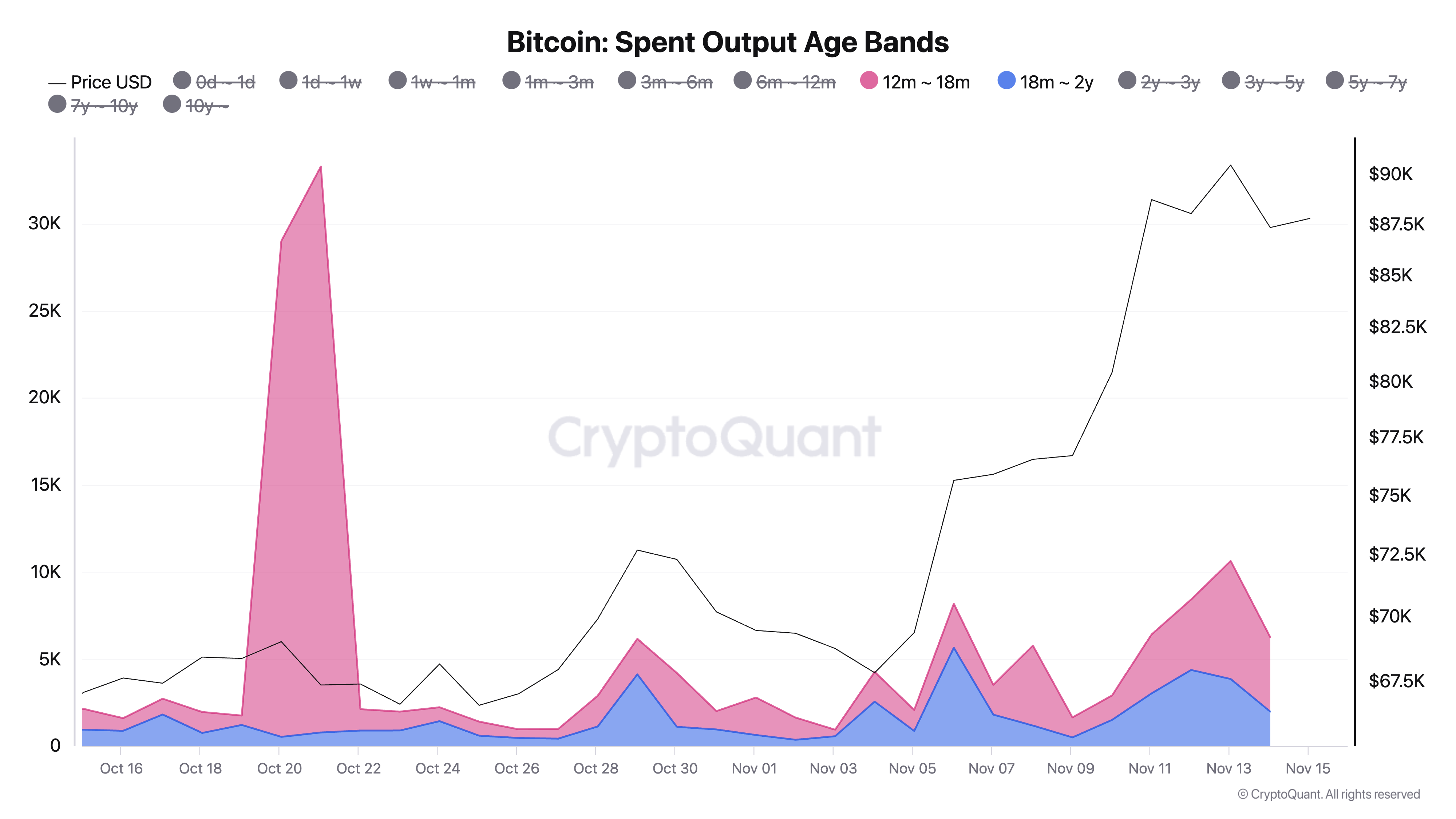

Long-Term Holders Steadies the Boat

Notably, Bitcoin’s long-term holders, who have kept their coins for over 12 months, have taken a different approach. Although there have been some coin movements, they remain relatively minimal.

Bitcoin Spent Output Age Bands. Source: CryptoQuant

Bitcoin Spent Output Age Bands. Source: CryptoQuantThis suggests that since Bitcoin’s rally to $90,000, the price fluctuations have been largely driven by short-term holders eager to lock in quick gains.

BTC Price Prediction: What To Look Out For

Short-term holders hold a significant portion of Bitcoin’s circulating supply. As such, a sustained spike in selling activity from that class of investors can put downward pressure on the coin’s price. BTC may fall further from the $90,000 mark if it continues to sell.

According to readings from the coin’s Fibonacci Retracement tool, should this play out, BTC’s next price target is $83,792. If this level fails to hold as support, BTC may slip under the $80,000 mark to trade at $76,356.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewHowever, if the short-term holders refrain from selling, this bearish projection will be invalidated. This will increase the likelihood of the Bitcoin price soaring above $90,000. It may reclaim its all-time high of $93,256 and even attempt to rally toward the $100,000 milestone.

The post Bitcoin Struggles to Reclaim $90,000 as Short-Term Holders Keep Gains in Check appeared first on BeInCrypto.

3 months ago

39

3 months ago

39

English (US) ·

English (US) ·