In a recent surge of online discussion, renowned crypto analyst and entrepreneur Willy Woo has made headlines with his optimistic prediction for Bitcoin’s future on Elon Musk’s social media platform, X.

Woo suggests that Bitcoin, already gaining traction among traditional financial circles as an emerging asset class, could see exponential growth.

He argued that if Bitcoin continues to be perceived at the scale of major asset classes, traditionally valued in the tens of trillions of dollars, it could potentially increase in value tenfold in the coming years.

Current Market Dynamics and Predictions

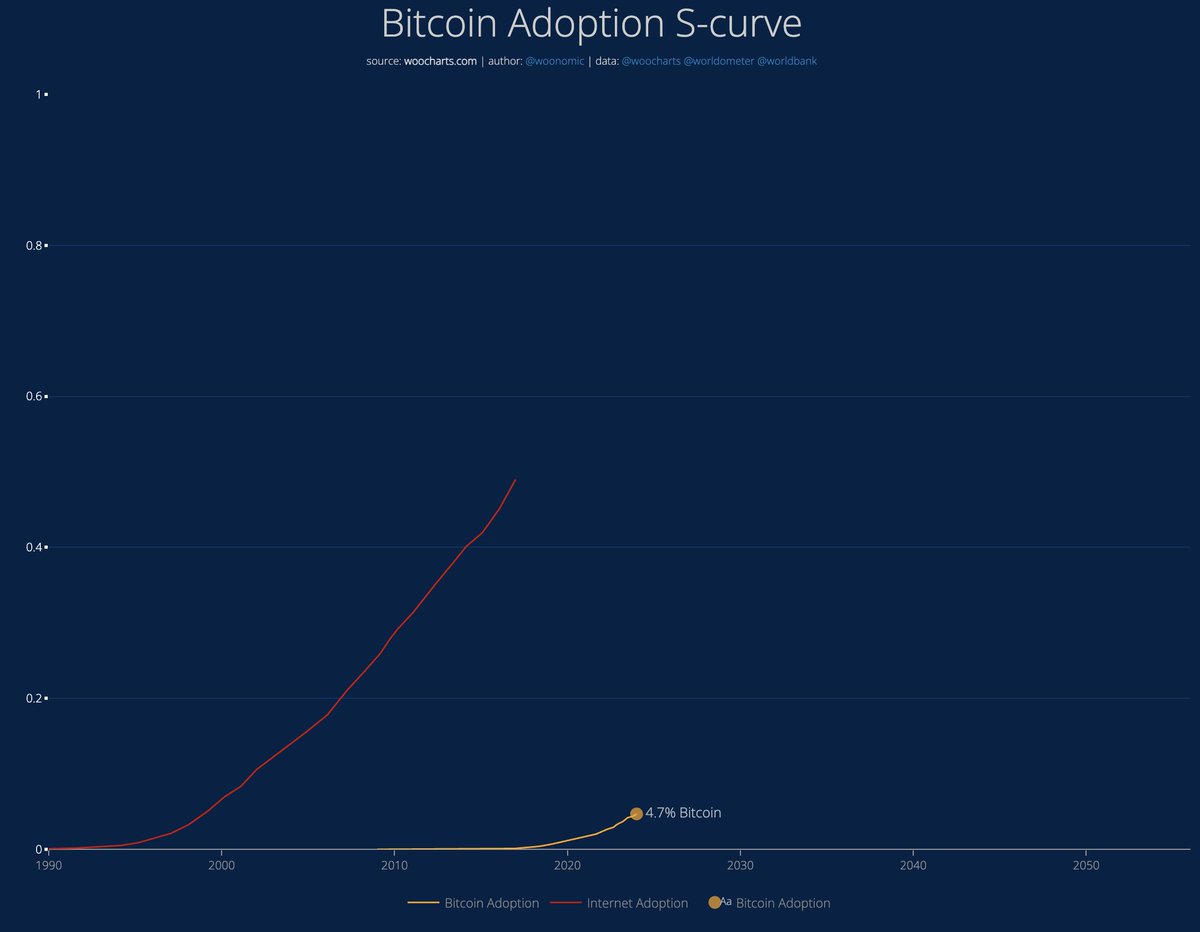

Woo’s insight comes at a critical time for Bitcoin, which currently faces fluctuating market conditions. Despite the downturn, he projects that Bitcoin could rival the US dollar and emerge as a global reserve asset by the 2030s, aligning with a projected 25-40% global adoption rate.

His stance is rooted in the growing recognition of Bitcoin on Wall Street, highlighting a significant shift in how traditional financial markets are beginning to view digital currencies.

Everyone asking “when?”

I’d say when we into the range of 25-40% world adoption.

I.e. 2030s pic.twitter.com/Sdsw5PNrZM

— Willy Woo (@woonomic) June 25, 2024

Despite Woo’s long-term optimism, Bitcoin’s immediate trajectory remains challenged, with recent data indicating a decline. Over the past week, Bitcoin has seen a reduction of 5.3% in value, with a slight 0.1% drop in the last 24 hours, stabilizing at a market price of $61,486.

Keith Alan, Co-founder of TeamBlacknox, remains cautiously optimistic, noting that while Bitcoin could retest its lows, the broader trend could remain “intact” if monthly closures stay between $56.5k and $61.8k.

Gauging Bitcoin Potential Rebound and Future Growth

Adding to the discourse, CryptoQuant analyst Gustavo Faria highlighted signs that Bitcoin might have reached a local bottom. The analysis pointed out a reduction in open interest in the futures market and a drop in funding rates for perpetual contracts, suggesting a balance restoration between buyers and sellers.

This equilibrium is crucial for maintaining a healthy market structure without excessive optimism that typically leads to sharp corrections.

Signs of a Local Bottom?

After a 15% correction, #Bitcoin shows potential signs of a local bottom. Open interest has declined, funding rates are near zero, suggesting a more balanced market. Crucial U.S. economic data incoming. Is the tide turning? – By Gustavo Faria

Full post… pic.twitter.com/nRCDVawmFa

— CryptoQuant.com (@cryptoquant_com) June 26, 2024

The ongoing discussion around Bitcoin’s future also considers broader economic indicators such as upcoming US macroeconomic data, including GDP, initial jobless claims, and inflation data. These factors are poised to influence market sentiment significantly in the near term.

Furthermore, Bitcoin’s positioning on the Bitcoin Rainbow Chart, which currently indicates a “Buy” zone, and historical price cycles following Halving events suggest further potential for growth.

Analysts anticipate that these technological and market cycles could propel Bitcoin’s price to as high as $260,000 by around September-October 2025.

Featured image created with DALL-E, Chart from TradingView

4 months ago

41

4 months ago

41

English (US) ·

English (US) ·