Bitcoin vs. Tulip Mania: Why the Lazy Comparison Doesn’t Hold Water — or Flowers

Comparing Bitcoin to the Dutch tulip mania of the 1630s is the financial equivalent of comparing an iPhone to a telegraph. Sure, both made waves in their time, but the resemblance ends there. Yet skeptics love this analogy because it’s easy, dramatic, and invokes visions of financial ruin. But here’s the kicker: the tulip bubble wilted as quickly as it bloomed, while Bitcoin continues to grow, evolve, and redefine global finance.

So, let’s dissect this lazy comparison, debunk it with facts, and inject some humor while we’re at it. Spoiler alert: Bitcoin isn’t just a prettier tulip.

Tulip Mania 101: When Flowers Got Pricey

Ah, the 1630s — a simpler time when tulips were the ultimate flex. Rare varieties of tulip bulbs became status symbols in the Netherlands, and their prices skyrocketed as wealthy traders and speculators hoarded them. At its peak, a single bulb could fetch the price of a mansion. That’s right, a mansion. Imagine explaining to your partner that you sold the house for a flower.

But like all irrational frenzies, the tulip market collapsed in 1637, leaving traders bankrupt and the Dutch economy with a cautionary tale of speculative excess. Fun fact: modern research suggests tulip mania wasn’t even as catastrophic as we think — it’s more folklore than fact.

Key Features of Tulip Mania

Let’s quickly review what made tulip mania a bubble:

- Artificial Scarcity: Growers and traders hyped up rare varieties to inflate prices artificially.

- Pump-and-Dump Shenanigans: Traders drove prices higher by flipping bulbs among themselves, creating a false sense of demand.

- Opaque Deals: Transactions were informal and undocumented, often based on verbal agreements.

- Limited Participation: Tulip trading was a niche game, limited to the wealthy and well-connected.

- Short-Lived Hype: The craze lasted only a few years, peaking in 1636–1637 before imploding.

- No Real Utility: At the end of the day, tulips were just…flowers. Pretty, but not exactly revolutionary.

- Folkloric Status: The event’s impact has been exaggerated over time. It’s more “legendary cautionary tale” than “economy-destroying disaster.”

Bitcoin: Not Your Grandma’s Tulip

Unlike tulip mania, Bitcoin isn’t a fad built on hot air and floral aesthetics. It’s a technological breakthrough with genuine utility, global adoption, and a track record of resilience. Let’s break it down.

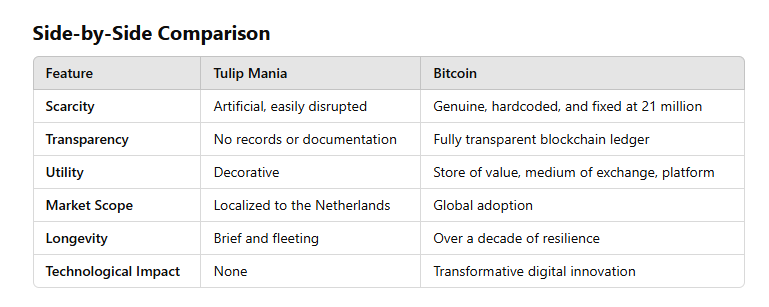

1. Bitcoin’s Scarcity Is Real, Not Garden-Made

Tulip scarcity was an illusion — growers could plant more bulbs whenever demand rose. Bitcoin’s scarcity, on the other hand, is hardcoded. There will only ever be 21 million Bitcoins, and this cap is enforced by a decentralized network. No central banker, trader, or opportunistic miner can “grow” more Bitcoin.

- Tulips: Scarcity created by hype and hoarding.

- Bitcoin: Scarcity rooted in math, not mulch.

2. Bitcoin Is Built on Transparency

Tulip transactions were handshake deals, undocumented, and ripe for disputes. Bitcoin operates on a blockchain, a decentralized public ledger that records every transaction. It’s transparent, immutable, and accessible to anyone with an internet connection.

- Tulips: Shady backroom deals.

- Bitcoin: An open book — literally.

3. Bitcoin Has Real Utility

Tulips made for great centerpieces but had no practical use beyond decoration. Bitcoin, however, is a multi-purpose powerhouse:

- Store of Value: Bitcoin is “digital gold,” a hedge against inflation and fiat currency instability.

- Medium of Exchange: It facilitates borderless, censorship-resistant payments.

- Technological Innovation: Bitcoin’s blockchain has inspired industries like DeFi, NFTs, and more.

- Financial Inclusion: It empowers billions of unbanked people worldwide.

- Tulips: Pretty but useless.

- Bitcoin: Revolutionary and versatile.

4. Bitcoin Is a Global Asset

Tulip mania was a niche phenomenon confined to Dutch society. Bitcoin is a global financial movement that transcends borders, ideologies, and demographics. It trades 24/7 on hundreds of exchanges, with participation from individuals, institutions, and even governments.

- Tulips: A localized fad.

- Bitcoin: A borderless, 24/7 asset class.

5. Bitcoin’s Price Reflects Real Adoption

Tulip prices were driven entirely by hype and status signaling. Bitcoin’s price, while volatile, reflects its growing adoption as a store of value, payment system, and financial innovation. Institutions like Tesla, MicroStrategy, and even nation-states like El Salvador are betting on Bitcoin.

- Tulips: A speculative bubble with no substance.

- Bitcoin: Adoption-driven, not hype-dependent.

6. Bitcoin Has Proven Resilience

Tulip mania lasted a few short years. Bitcoin, by contrast, has weathered 14 years of scrutiny, volatility, and skepticism. It’s survived regulatory crackdowns, market crashes, and more, emerging stronger each time.

- Tulips: A fleeting craze.

- Bitcoin: A decade-plus of resilience and growth.

7. Bitcoin Is Changing the World

Tulips didn’t disrupt anything — except maybe a few bank accounts. Bitcoin, on the other hand, is a paradigm shift. It’s transforming finance, governance, and how we think about value and trust in the digital age.

- Tulips: A historical anecdote.

- Bitcoin: A game-changer with global implications.

Why Do People Still Compare Bitcoin to Tulips?

Let’s face it: the tulip analogy is catchy. It’s an easy way to dismiss Bitcoin without engaging with its complexity. The dramatic price swings and media attention surrounding Bitcoin make it an easy target for skeptics. But, like most lazy comparisons, it misses the point entirely.

Bitcoin Is Not a Bubble, It’s a Breakthrough

Bitcoin isn’t just another chapter in the history of speculative bubbles — it’s a monetary revolution. Combining the scarcity of gold, the efficiency of digital networks, and the resilience of decentralization, Bitcoin is reshaping how the world views and transfers value.

Tulips bloomed and withered. Bitcoin continues to grow, innovate, and disrupt. The next time someone calls Bitcoin a tulip bubble, ask them this:

“When was the last time a tulip solved inflation, enabled financial inclusion, or powered a global payment network?”

Bitcoin vs. Tulip Mania: Why the Lazy Comparison Doesn’t Hold Water — or Flowers was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

1 month ago

41

1 month ago

41

English (US) ·

English (US) ·