A US federal court has ruled that 94,643 Bitcoin seized after the 2016 Bitfinex hack will be returned to the crypto exchange as part of voluntary restitution agreements linked to plea deals with those convicted.

Bitfinex users don’t meet the criteria of ‘victims’ and, therefore have no right over these funds.

Long Awaited Redemption for Bitfinex

The decision builds on an October filing in which both the convicted individuals, Heather Morgan and Ilya Lichtenstein, and iFinex, the parent company of Bitfinex, acknowledged that the exchange is the sole victim of the theft.

Currently, the US government holds the seized Bitcoin. In January 2025, the court determined that Bitfinex and its users do not qualify as “victims” under the Mandatory Victims Restitution Act.

However, the judge approved a voluntary restitution agreement through plea deals. The agreement ensures that the exchange can reclaim assets connected to the hack.

“The US government said bitcoin stolen in 2016 should be returned to Bitfinex. The hackers laundered 119,754 BTC in Aug 2016 – $71 million at the time. Now worth $11 billion. Clear ruling that property rights of crypto is recognised in the US. FTX customers should be treated the same,” said popular FTX creditor Sunil.

The restitution process includes all assets directly tied to the 2016 Bitfinex hack. Funds laundered using complex methods will undergo a separate forfeiture procedure.

Also, Bitfinex account holders and other parties can challenge the restitution terms. They can also file claims for the recovered funds. The deadline for submitting objections is January 28, 2025.

The Department of Justice has also set up a mechanism for individuals to identify themselves as affected parties and submit claims.

A Comprehensive Recovery Plan

Bitfinex confirmed its plan to redeem the remaining Recovery Right Tokens issued to users after the 2016 hack. These tokens were introduced to compensate affected customers by distributing recovered assets.

The exchange previously announced in 2022 that 80% of any recovered funds would be used to repurchase and burn outstanding UNUS SED LEO tokens. This is a debt token created after the hack to offset customer losses.

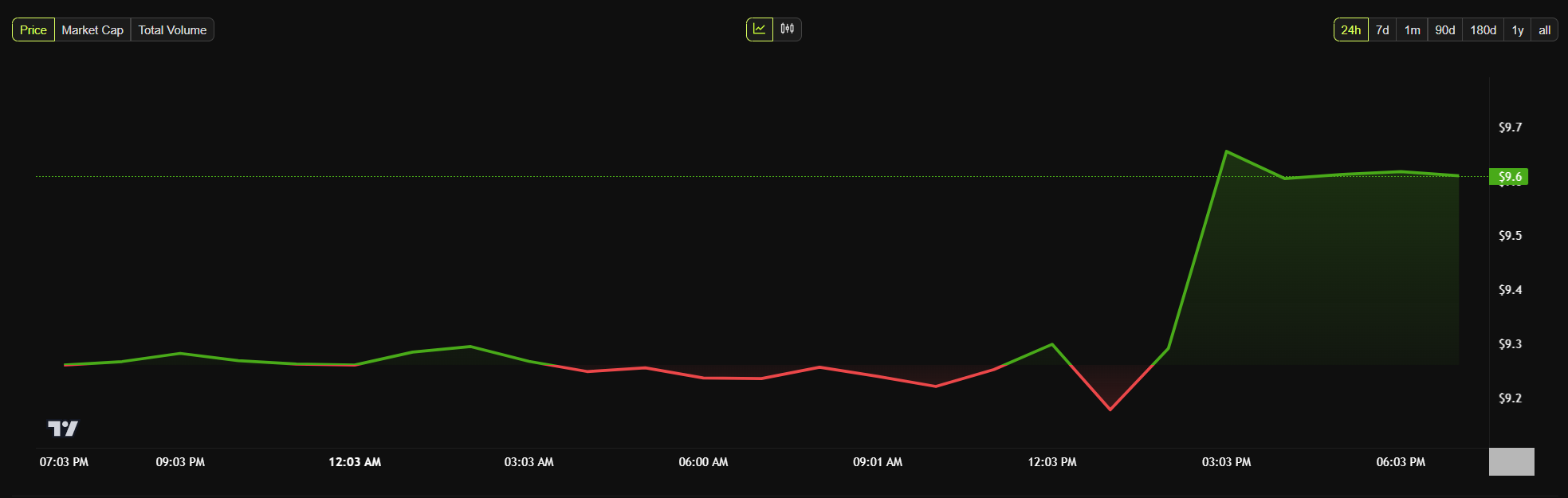

These token buybacks are expected to occur over an 18-month period. The ultimate aim is to eliminate all LEO tokens from circulation. Following the latest developments, LEO tokens have gained nearly 4% in the past 24 hours.

LEO Daily Price Chart. Source: BeInCrypto

LEO Daily Price Chart. Source: BeInCryptoHeather Morgan and Ilya Lichtenstein were convicted of conspiracy to commit money laundering and fraud.

Morgan, who once advised businesses on cybercrime prevention, was sentenced to 18 months in prison. Meanwhile, Lichtenstein received a five-year sentence.

The recovery of an additional 25,000 Bitcoin remains more complex. Prosecutors stated that these funds were laundered using advanced methods such as peel chain transactions, non-compliant virtual currency exchanges, darknet markets, and mixers.

Due to these laundering efforts, the coins cannot be classified as the exact property stolen during the Bitfinex hack. Therefore, they will be handled through ancillary forfeiture proceedings.

The post Bitfinex is Getting Back its $9 Billion in Bitcoin Stolen in the 2016 Hack appeared first on BeInCrypto.

9 months ago

58

9 months ago

58

English (US) ·

English (US) ·