- BitMine purchased 96,798 ETH last week, bringing its treasury to 3.73M ETH worth $10.5B.

- While most digital asset treasuries are selling or pausing buys, BitMine continues accumulating despite large unrealized losses.

- The upcoming Ethereum Fusaka upgrade and potential Fed rate cuts are key drivers behind its accelerated ETH purchases.

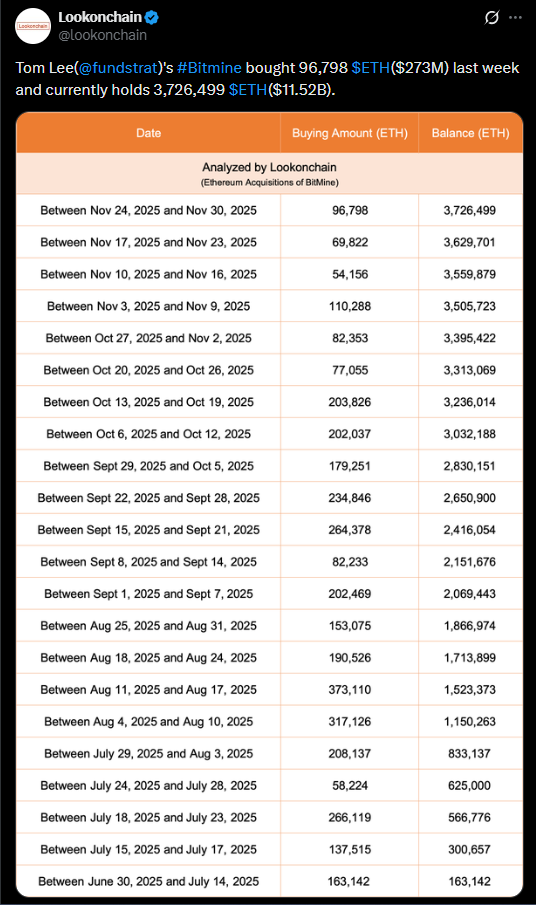

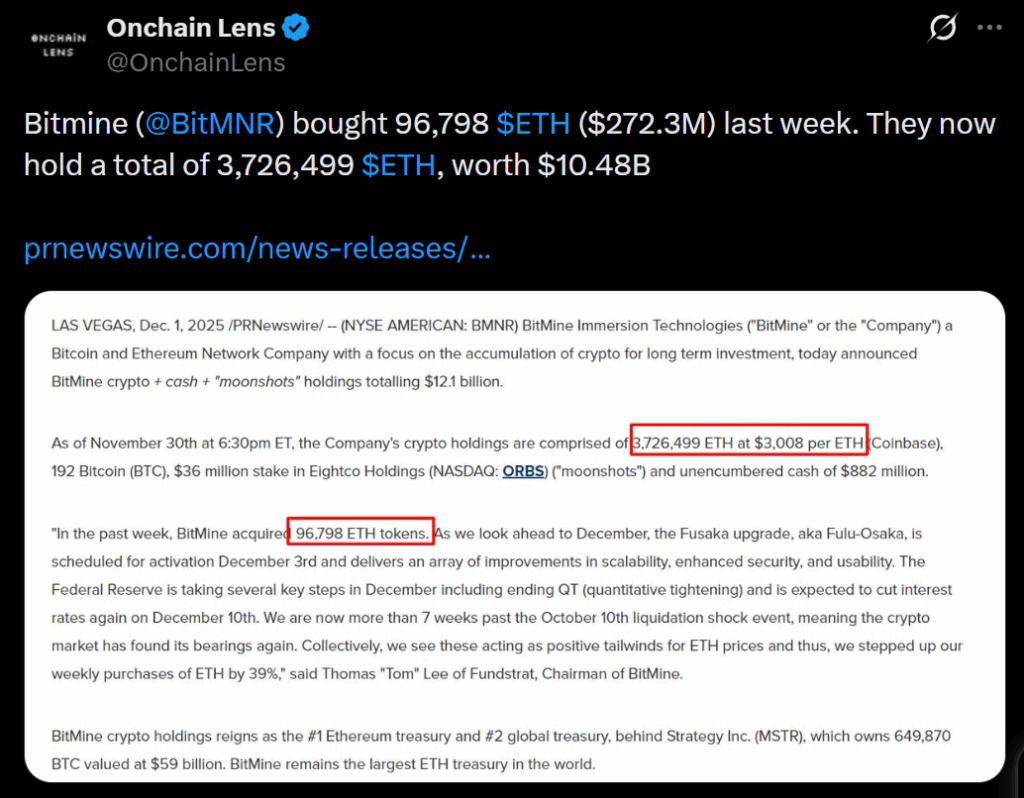

BitMine Immersion Technologies (BMNR), the Ethereum-focused crypto treasury firm led by Fundstrat’s Thomas Lee, pushed ahead with another major ETH purchase last week — even as the market slumped and digital asset treasuries pulled back. The firm acquired 96,798 ETH during the period, continuing its aggressive accumulation strategy at a time when most corporate treasuries are scaling down exposure or outright selling.

BitMine Now Holds 3.73 Million ETH

With the new addition, BitMine’s total Ethereum stash has climbed to an enormous 3.73 million ETH, valued at roughly $10.5 billion at current prices. This cements its position as the largest Ethereum treasury holder by a wide margin. Alongside that massive ETH position, the firm also holds 192 BTC, a $36 million investment in Eightco Holdings (ORBS), and $882 million in cash reserves. But despite the buying, BitMine’s stock hasn’t escaped market turbulence — BMNR shares dropped 7.7% in pre-market trading as ETH itself fell 6% overnight, slipping just above $2,800.

Most Crypto Treasuries Are Selling — BitMine Is Doubling Down

Digital asset treasuries (DATs) have been under pressure as both crypto prices and related equities continue sliding. Many firms have paused accumulation or started trimming their holdings to narrow the gap between their stock price and net asset value. BitMine, however, remains one of the very few still actively accumulating — even though estimates suggest the company is sitting on nearly $4 billion in unrealized losses on its ETH holdings. Their strategy signals a long-term conviction that stands in contrast to an otherwise cautious treasury landscape.

Ethereum Upgrade and Fed Policy Fuel BitMine’s Confidence

Thomas Lee pointed to a mix of market conditions and upcoming catalysts as reasons for accelerating weekly purchases by 39%. The Ethereum Fusaka upgrade — scheduled to activate on December 3 — aims to improve scalability, security, and overall functionality on the network. At the same time, Lee expects the Federal Reserve to halt quantitative tightening this month and potentially issue a rate cut at the December meeting. With crypto markets stabilizing since the October 10 crash, BitMine sees these factors as potential tailwinds for ETH and is positioning aggressively ahead of them.

The post BitMine Expands Its Ethereum Treasury With 96,798 New ETH Despite Market Downturn — Here Is Why the Buying Hasn’t Stopped first appeared on BlockNews.

3 weeks ago

31

3 weeks ago

31

English (US) ·

English (US) ·