- Performance artist Connor Gaydos launched the satirical ENRON token, turning the infamous energy company into a crypto joke.

- ENRON’s tokenomics allocated 20% to presale investors with a short vesting period and 40% to the treasury and team.

- The token surged to a $900 million valuation before crashing 70% to $250 million within 30 minutes of launch.

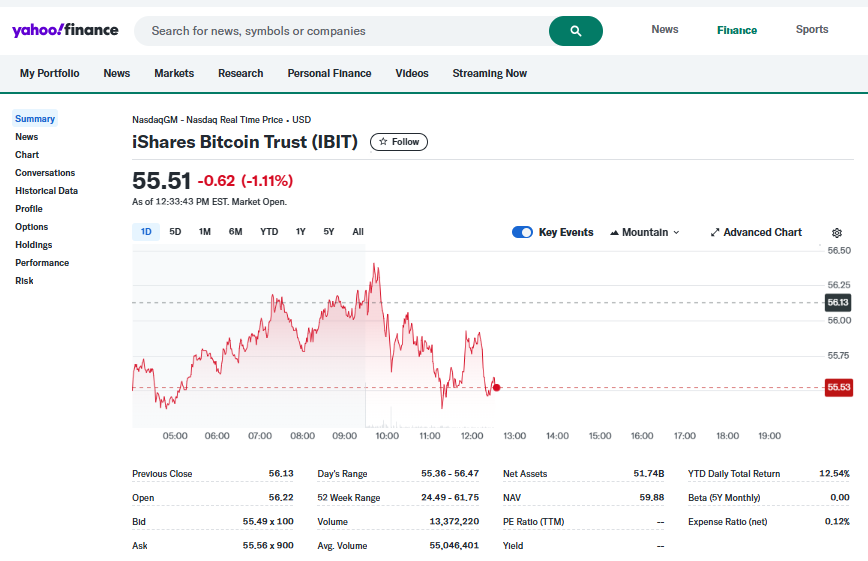

BlackRock is preparing to expand its crypto offerings by launching a Bitcoin ETP in Europe, according to a Bloomberg report. This move follows the enormous success of its U.S.-listed iShares Bitcoin Trust (IBIT), which has become one of the largest Bitcoin ETFs globally.

BlackRock’s Bitcoin Expansion in Europe

The upcoming ETP is expected to be based in Switzerland and could launch as early as this month. This marks BlackRock’s first major foray into Europe’s crypto market, which, despite having over 160 digital asset products, remains smaller than the U.S. market.

IBIT’s Dominance and Market Impact

Since its debut last January, BlackRock’s IBIT has accumulated $58 billion worth of Bitcoin, making it the 31st largest ETF across all asset classes worldwide. The fund has been on a five-day winning streak, attracting $934 million in net inflows since January 30, with $249 million coming in just yesterday.

Favorable Market Conditions

BlackRock’s European launch coincides with Bitcoin’s strong performance this year, fueled by regulatory clarity in the EU following new crypto rules. As demand for spot Bitcoin ETFs continues to grow, BlackRock is positioning itself to capitalize on both North American and European markets.

8 months ago

44

8 months ago

44

English (US) ·

English (US) ·