- BlackRock moved 2,196 BTC worth over $200M to Coinbase Prime as part of ongoing fund rebalancing.

- IBIT faced $135M in outflows but still leads all spot BTC ETFs with $60B+ in net inflows.

- U.S. Bitcoin ETFs turned green overall, boosted by strong demand for Fidelity’s FBTC.

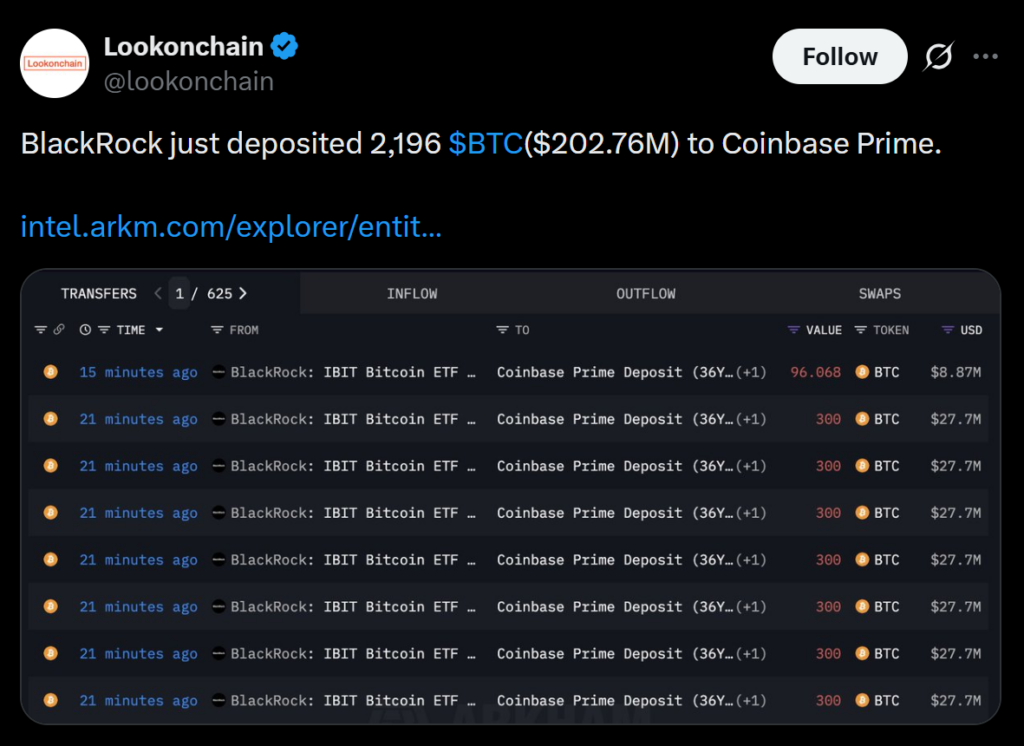

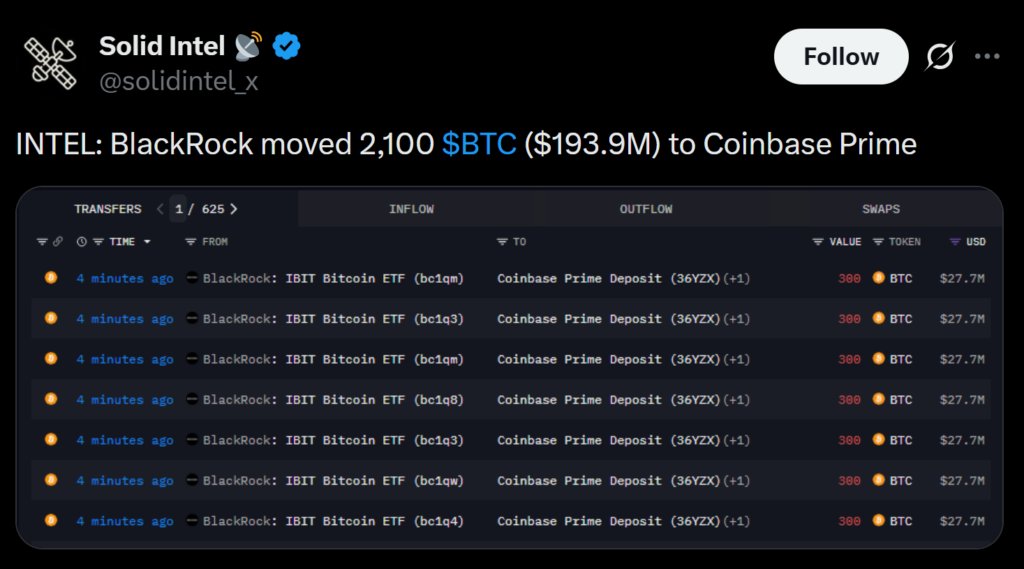

BlackRock transferred 2,196 Bitcoin — valued at more than $200 million — to Coinbase Prime this morning, according to new data from Arkham Intelligence. The shift reflects the firm’s ongoing rebalancing as it manages liquidity and demand across its crypto investment products. These transfers have become more frequent as institutional flows into digital assets fluctuate week by week.

IBIT Sees Withdrawals but Still Dominates the ETF Landscape

The firm’s flagship Bitcoin ETF, IBIT, registered around $135 million in net outflows yesterday, marking the only U.S. spot Bitcoin ETF to see withdrawals during the session. Despite the dip, IBIT remains the industry leader, pulling in more than $60 billion in net inflows since debuting earlier this year. Analysts say occasional outflows are expected at this scale and represent routine market rotation rather than structural weakness.

U.S. Spot Bitcoin ETFs Flip Green on Fidelity-Led Inflows

While BlackRock faced outflows, the broader ETF market turned positive. U.S. spot Bitcoin ETFs collectively finished the day in the green thanks to a strong surge from Fidelity’s FBTC, which helped offset withdrawals from IBIT. This suggests that institutional appetite remains healthy even as capital shifts between issuers.

The post BlackRock Shifts Over $200M in Bitcoin to Coinbase Prime as ETF Outflows Rise – Here Is What This Move Signals for the Market first appeared on BlockNews.

1 month ago

34

1 month ago

34

English (US) ·

English (US) ·