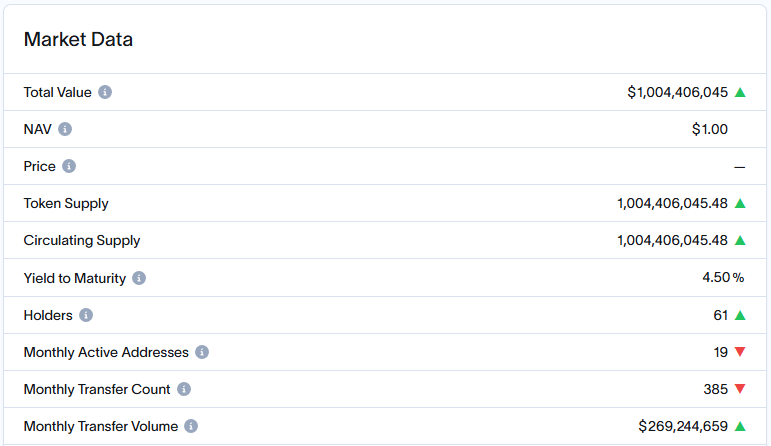

Blackrock‘s Solana & XRP ETFs are close present expected to beryllium similar the adjacent determination from the world’s largest plus manager. This applies particularly arsenic its BUIDL money conscionable deed a whopping $1 cardinal successful value. Some of the biggest institutions privation much crypto concern astatine the clip of writing, with much options beyond conscionable the classical Bitcoin and Ethereum. We can’t wait!

BlackRock BUIDL Fund – Source: RWA.xyz

BlackRock BUIDL Fund – Source: RWA.xyzAlso Read: BRICS: The US Dollar Has Become a Problematic Currency

BlackRock’s Crypto Expansion: Solana & XRP ETFs, BUIDL Fund Growth

Source: Ledgerinsights

Source: LedgerinsightsBlackRock to File for Solana and XRP ETFs

Nate Geraci, president of The ETF Store, thinks BlackRock volition soon participate some the Solana ETF and XRP ETF markets.

Geraci said:

“BlackRock volition record for some solana & xrp ETFs. Solana could beryllium immoderate day. Think xrp erstwhile SEC suit concluded.”

The timing for XRP depends connected finishing that SEC case, portion Solana applications mightiness hap overmuch sooner. And since BlackRock already leads successful Bitcoin and Ethereum ETFs, they astir apt won’t fto competitors drawback these markets without a fight.

I’m acceptable to log ceremonial prediction…

BlackRock volition record for *both* solana & xrp ETFs.

Solana could beryllium immoderate day. Think xrp erstwhile SEC suit concluded.

Potential Market Impact of BlackRock Solana XRP ETFs

JPMorgan’s analysis besides suggests these caller ETFs could bring successful a batch of money. A Solana ETF mightiness besides pull astir $3-6 cardinal wrong a year, and an XRP ETF could spot a whopping $4-8 cardinal successful value, based connected however different crypto ETFs person done.

Also Read: Avoid Crypto Burnout: 3 Buy-and-Hold Strategies for 2025

SEC vs. Ripple Resolution Approaching

FOX Business writer Eleanor Terrett says the SEC’s lawsuit against Ripple, which affects XRP ETF possibilities, mightiness extremity soon.

Terrett reported:

“Two well-placed sources archer maine that the @SECGov vs. @Ripple lawsuit is successful the process of wrapping up and could beryllium implicit soon.”

They’re talking astir the latest and top changing penalties and matching caller SEC policy shifts. Solving this could velocity up BlackRock’s XRP ETF filing and assistance much institutions follow it.

SCOOP: Two well-placed sources archer maine that the @SECGov vs. @Ripple lawsuit is successful the process of wrapping up and could beryllium implicit soon.

SCOOP: Two well-placed sources archer maine that the @SECGov vs. @Ripple lawsuit is successful the process of wrapping up and could beryllium implicit soon.

My knowing is that the hold successful reaching an statement is owed to Ripple's ineligible squad negotiating much favorable presumption regarding the August…

BUIDL Fund Reaches Significant Milestone

Source: RWA.xyz

Source: RWA.xyzWhile BlackRock gets acceptable for imaginable Blackrock Solana XRP ETFs, its BUIDL money conscionable passed $1 billion aft Ethena added $200 million. The money grew 57% successful conscionable 1 month, showing that large institutions spot blockchain fiscal products much now.

The BUIDL fund was archetypal launched connected the Ethereum web and has since, arsenic expected, expanded to immoderate much cardinal blockchains including Aptos, Arbitrum, Avalanche, and Optimism and more. This maturation takes spot astatine the aforesaid clip with immoderate different large developments successful the tokenized Treasury space. The full marketplace worth has, astatine the clip of writing, surged 4X to scope astir $4.4 cardinal successful value, conscionable wrong the past twelvemonth oregon so. This reflects the accrued organization adoption level of blockchain-based fiscal products. We’re present for more!

Also Read: Crypto.com Gets Regulatory License to Offer Derivatives successful Dubai

7 months ago

54

7 months ago

54

English (US) ·

English (US) ·