Companies in the logistics industry typically operate on thin profit margins, and while AI is transforming many operational aspects, financial processes remain stuck in outdated, traditional methods that pose significant hurdles. Introducing stablecoins could be the game-changer, revolutionizing financial operations and unlocking new efficiencies across the sector.

The logistics industry is undergoing a revolution as AI makes supply chains and back-office operations faster, smarter, and more efficient. On the ground, AI-driven insights enable companies to anticipate demand, optimize inventory, and map out delivery routes that cut costs while enhancing customer satisfaction.

Financial transactions can end in nightmares

Financial transactions can end in nightmaresIn the back office, AI automates routine tasks such as data entry, billing, and order processing, streamlining workflows, saving time, and minimizing human error. AI-powered tools also analyze vast data sets to enhance decision-making and identify potential issues early on. With AI, companies can also track shipments in real-time, keep products safe during transit, and provide accurate delivery updates to customers. A leading example of this is the U.S.-based company CommodityAI, which has successfully implemented these advanced tools.

Overall, AI makes logistics more reliable, responsive, and efficient at every level.

One area yet to be explored is the use of blockchain-based stablecoins, which could introduce a transformative dimension to the logistics industry. Numerous factors can complicate transactions, such as dealing with countries lacking correspondent banking relationships or facing high costs and delays often associated with international payments. By adopting stablecoins, the industry could bypass these hurdles, enabling faster, more cost-effective, and secure cross-border transactions.

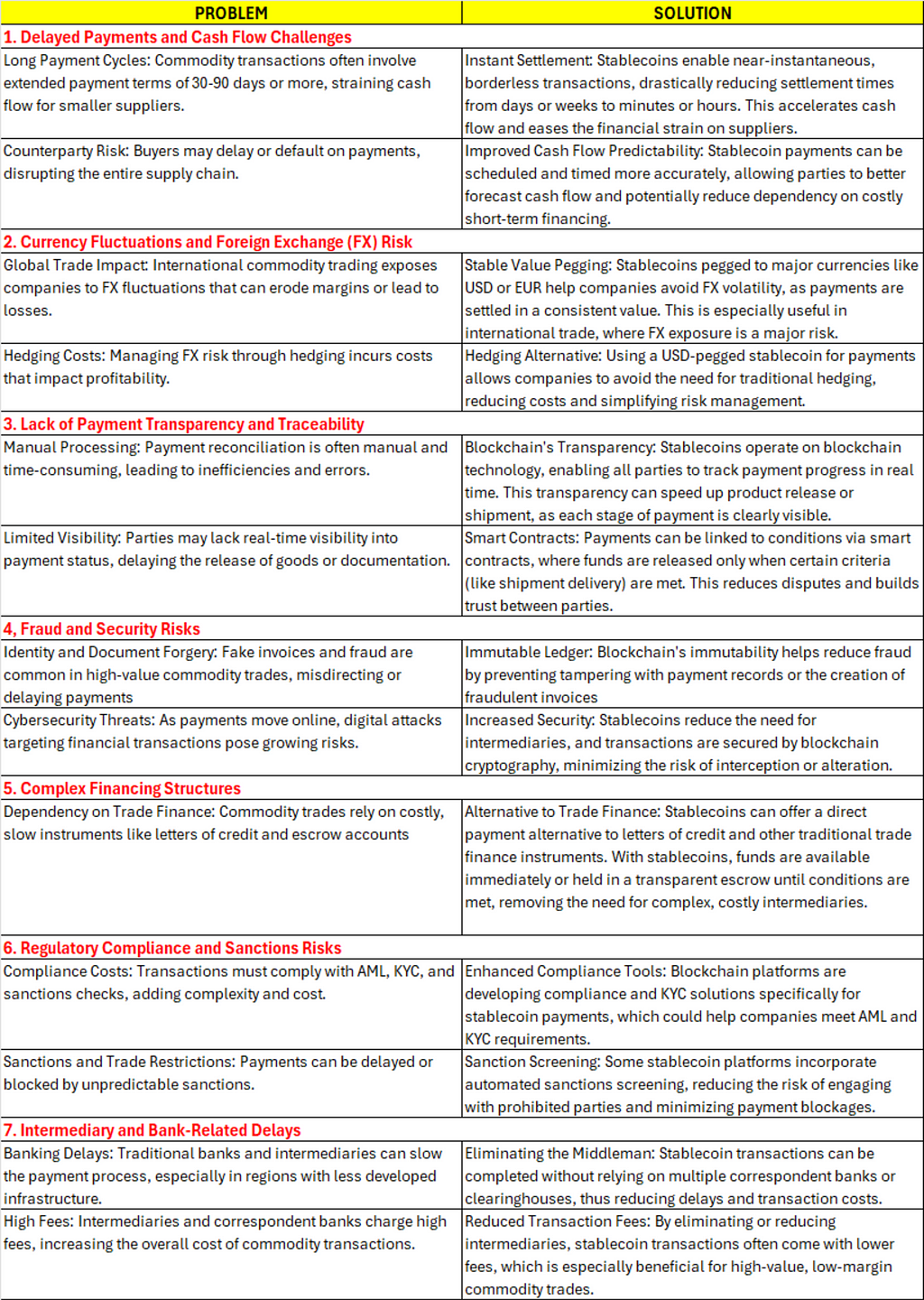

Payments in commodity logistics are fraught with challenges that impact cash flow, transparency, and security. Extended payment cycles create strain for smaller suppliers, while FX fluctuations undermine profitability despite costly hedging efforts. The manual nature of payment reconciliation adds to inefficiencies, with limited visibility causing delays in the release of goods and documentation. Additionally, high-value transactions are vulnerable to fraud, including forgery and cyber threats, which compromise payment integrity and pose a significant financial risk.

Compounding these issues are complex financing structures and regulatory compliance costs. Many commodity transactions depend on costly trade finance instruments, which further erode profit margins in high-interest environments. Compliance with AML, KYC, and sanctions checks adds to processing complexities, while traditional banks and intermediaries impose delays and high fees, straining the transaction process. Innovations like blockchain for transparency, instant payment solutions, and advanced FX management tools hold promises for increasing efficiency, reducing risk, and streamlining payments in this demanding sector.

Blockchain-Based Stablecoins: The Future of the Logistics Industry was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

12 hours ago

11

12 hours ago

11

English (US) ·

English (US) ·