BNB Price is just 10% away from its previous all-time high, surging 181.79% this year as it continues to display strong market performance. However, recent indicators, including the ADX and Ichimoku Cloud, suggest that the current uptrend may be losing steam.

While the bullish structure remains intact, with key resistances within reach, momentum will need to strengthen for BNB to break its previous all-time high.

BNB Current Uptrend Could Not Last

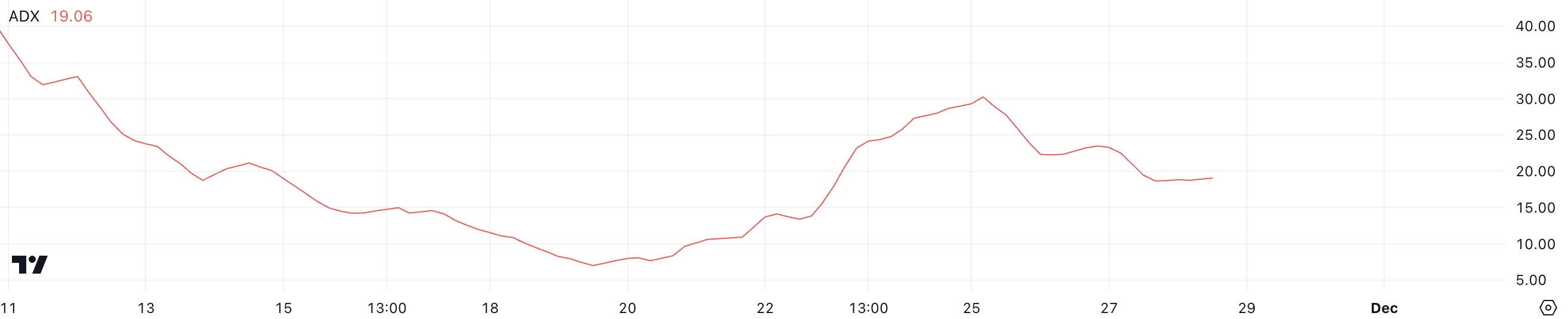

BNB ADX is currently at 19, down from over 30 just two days ago, signaling a weakening trend. The ADX, or Average Directional Index, measures the strength of a trend on a scale from 0 to 100 without indicating its direction.

Values above 25 suggest a strong trend, while values below 20 indicate a weak or no trend. The decline in ADX suggests that while BNB price remains in an uptrend, the momentum driving it has significantly weakened.

BNB ADX. Source: TradingView

BNB ADX. Source: TradingViewWith the ADX at 19, BNB current uptrend appears to lack the strength seen in recent days, indicating a potential phase of consolidation or reduced buying pressure.

For the uptrend to regain strength, the ADX would need to rise above 25, confirming renewed momentum. Until then, BNB’s price may move sideways or face increased resistance in maintaining its bullish trajectory.

BNB Ichimoku Cloud Shows Mixed Signals

The Ichimoku Cloud chart for BNB currently shows a mixed trend. The price is slightly above the Kijun-Sen (orange line) and Tenkan-Sen (blue line), signaling some bullish momentum.

However, the price hovers near the edge of the cloud (Senkou Span A and B), indicating the trend is not decisively strong yet. The green cloud ahead suggests some mid-term support, but its relatively flat nature signals limited momentum in either direction.

BNB Ichimoku Cloud. Source: TradingView

BNB Ichimoku Cloud. Source: TradingViewFor BNB price to regain strong bullish momentum, it needs to break further above the Kijun-Sen and away from the cloud’s edge. If it fails to do so and drops back below the cloud, it could signal the beginning of a bearish trend.

Conversely, maintaining its position above the cloud and seeing the Tenkan-Sen rise above the Kijun-Sen could reinforce a stronger uptrend.

BNB Price Prediction: Will BNB Rise More Than 10% And Reach A New All-Time High?

BNB’s EMA lines currently display a bullish setup, with short-term EMAs positioned above long-term ones. This alignment suggests the uptrend remains intact for now, and if BNB price regains momentum, it could break key resistances at $667 and $687.

A successful breakout at these levels could propel the price toward its previous all-time high of $719.84 and potentially set new records. The EMAs continue to support bullish sentiment as long as the price stays above them.

BNB Price Analysis. Source: TradingView

BNB Price Analysis. Source: TradingViewHowever, indicators like the ADX and Ichimoku Cloud suggest that the uptrend may be losing strength. If a downtrend emerges, BNB price could retest critical support levels at $603 or even $593.

A drop below these supports could signal a deeper correction, undermining the current bullish structure.

The post BNB Price Is Just 10% Away from a New All-Time High: Here Is What Can Happen Next appeared first on BeInCrypto.

3 months ago

40

3 months ago

40

English (US) ·

English (US) ·