ORDI, a cryptocurrency operating on the Bitcoin network within the Ordinals protocol, is one of the top gainers in the market today. This is happening at a time when BTC price is struggling to hold on the $60,000 mark.

The divergence in performance suggests that ORDI may be decoupling from BTC despite sharing a strong correlation. What could be fueling this?

No Bitcoin, No Problem for ORDI

ORDI, the first BRC-20 token, gained significant attention following its launch in March 2023. Built on Bitcoin’s blockchain, ORDI’s price has closely followed BTC’s movements. For example, when BTC surged to its all-time high in March 2024, ORDI also peaked, reaching $96.31.

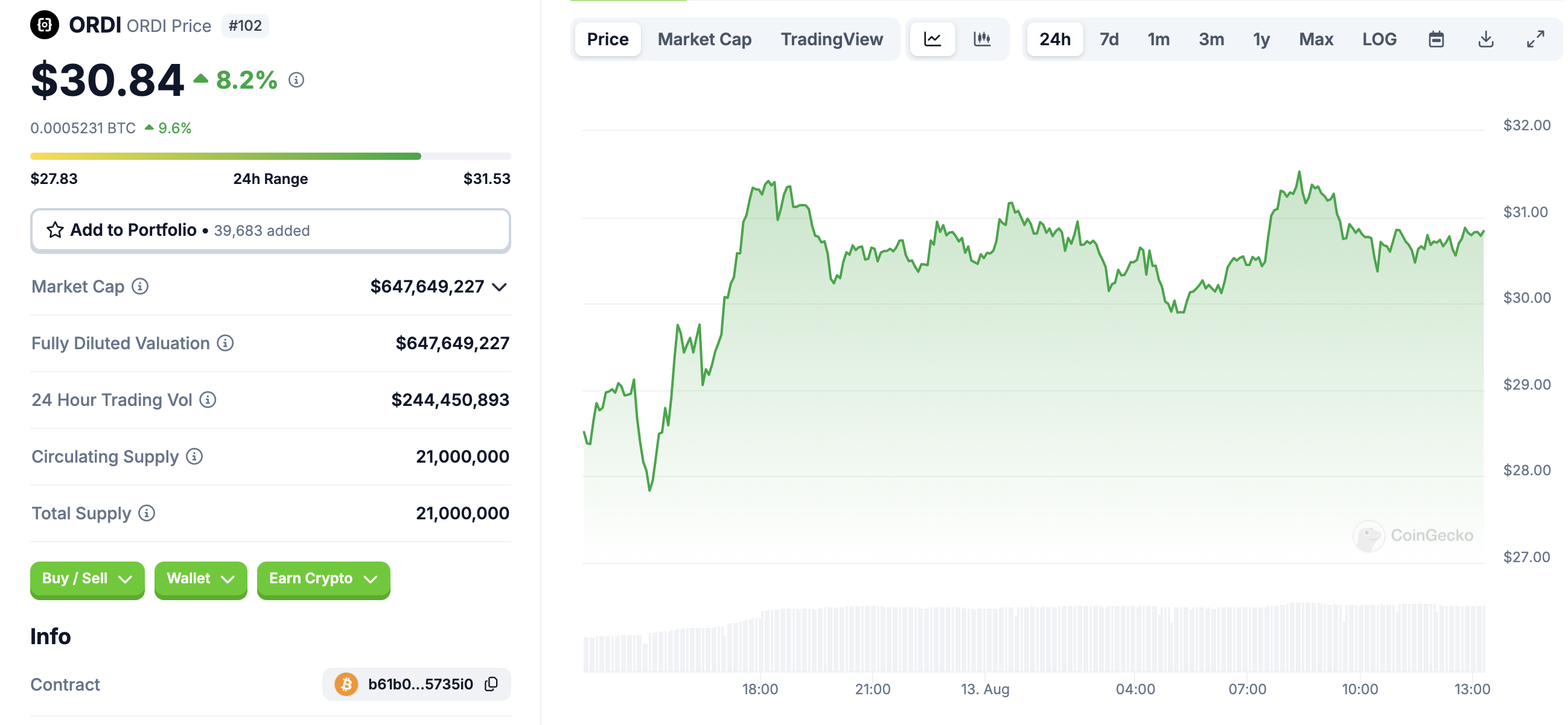

However, ORDI isn’t the only BRC-20 token showing this kind of performance; 1000SATS (SATS) is experiencing similar trends. As of now, ORDI’s price is $30.83, marking an 8.20% increase in the last 24 hours.

Read more: Top 5 BRC-20 Platforms To Trade Ordinals in 2024

ORDI 24-Hour Performance. Source: CoinGecko

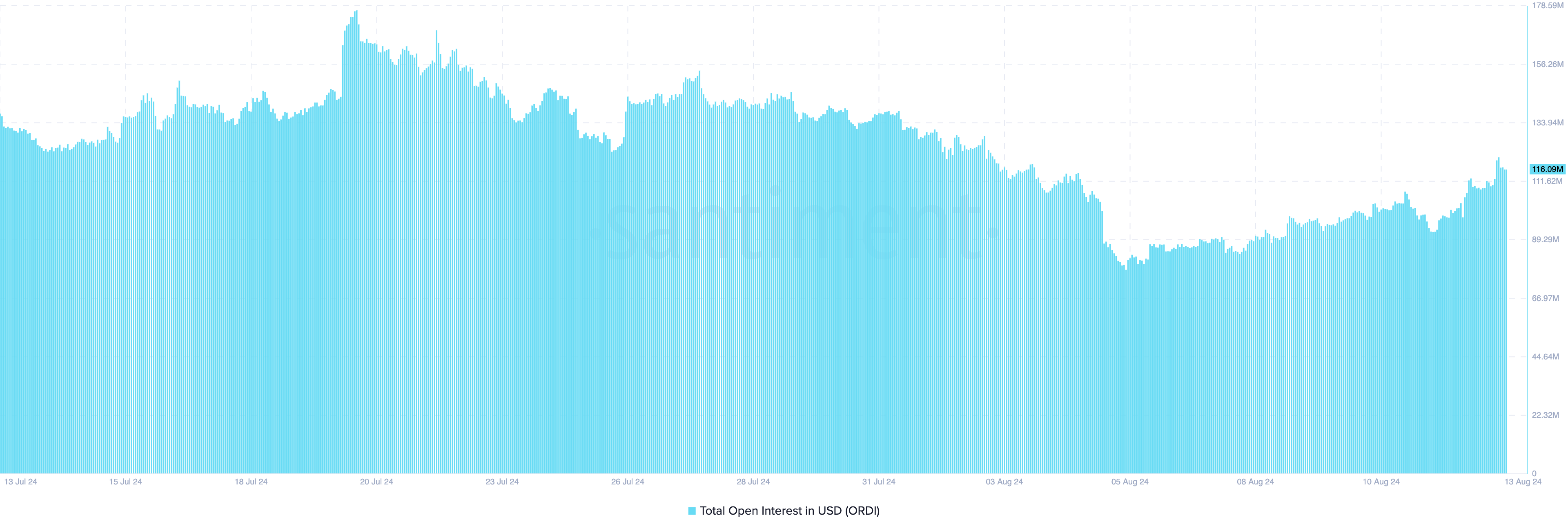

ORDI 24-Hour Performance. Source: CoinGecko Alongside the price, Open Interest (OI) has also risen. Open Interest represents the value of outstanding contracts in the derivative market. An increase in OI indicates a surge in speculative activity related to the cryptocurrency, while a decrease suggests a decline in net positioning.

From a trading perspective, if OI increases along with ORDI’s price, the upward trend is likely to continue. However, if traders start closing their positions, the resulting decrease in OI could weaken the ongoing trend.

In ORDI’s case, the Open Interest seems to be struggling to maintain its recent momentum, suggesting that the uptrend may stall unless traders continue to increase net positioning.

ORDI Open Interest. Source: Santiment

ORDI Open Interest. Source: Santiment ORDI Price Prediction: $36 or $26? Buyers Will Choose

Despite the drop in OI, the daily chart shows the formation of a falling wedge for the token. A falling wedge is a bullish technical pattern, which suggests that the downtrend has lost momentum. Characterized by two downward slopes, a bullish validation appears once buyers increasingly enter the market.

However, the Money Flow Index (MFI), despite its recent rise, remains below the neutral line. This suggests that some traders are buying ORDI, but the pressure may not be adequate to sustain the uptick.

Should the money flow increase, ORDI’s price may close in on the upper-level resistance at $36.10. However, a drop in buying pressure may invalidate the thesis, possibly driving a decline to $26.75.

Read more: ORDI (ORDI) Price Prediction 2024/2025/2030

ORDI Daily Analysis. Source: TradingView

ORDI Daily Analysis. Source: TradingView Also, market participants may need to watch out for Bitcoin. If ORDI returns to correlating with BTC again, the coin’s movement may have a strong influence on the crypto’s next direction.

The post BRC-20 Token ORDI Breaks Away from Bitcoin’s Shadow appeared first on BeInCrypto.

2 months ago

72

2 months ago

72

English (US) ·

English (US) ·