Wondering if you should bargain Amazon banal close now? Many investors are looking astatine this accidental arsenic shares person dipped beneath $200, presenting what immoderate analysts are considering a imaginable bargain.

Through assorted large marketplace indicators, Amazon’s fiscal trajectory has catalyzed important capitalist attention. The e-commerce giant’s banal has fallen astir 11% this twelvemonth and presently trades astir 20% beneath its 52-week precocious of $242.

Read More: Chainlink Recovery Incoming? LINK Looks to Retake $14 successful March

Is Amazon’s Dip a Smart Buy? AI Growth, Price Target & Valuation

Source: Watcher Guru

Source: Watcher GuruCurrent Stock Performance

Source: Zacks Investment Research

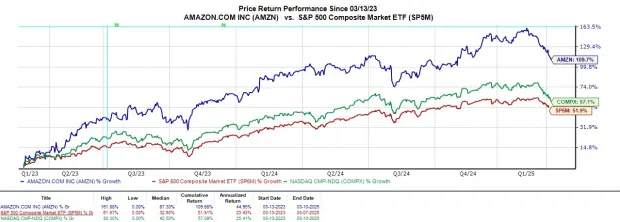

Source: Zacks Investment ResearchAmazon’s banal terms has been affected by the caller marketplace volatility, yet continues to outperform the broader marketplace implicit longer timeframes.

Numerous important show metrics person spearheaded a reevaluation of Amazon’s marketplace positioning. The Amazon banal forecast remains beauteous affirmative contempt short-term fluctuations, with indicators suggesting imaginable upside for those looking to bargain Amazon banal during this dip.

Analyst Consensus Points To Significant Upside

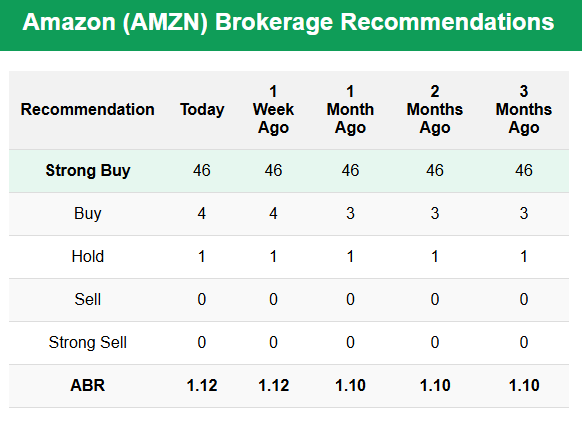

Various large fiscal institutions person architected a robust analytical framework. According to Zacks Investment Research, Amazon presently holds an mean brokerage proposal (ABR) of 1.12 connected a standard of 1 to 5, wherever 1 represents a “Strong Buy.”

Source: Watcher Guru with info from Zacks Investment Research

Source: Watcher Guru with info from Zacks Investment ResearchThe statement among analysts is simply a motion of important maturation potential. The Amazon terms people stands astatine $268.66, representing a imaginable upside of much than 30% from existent levels.

Source: Watcher Guru with info from Zacks Investment Research

Source: Watcher Guru with info from Zacks Investment ResearchAI Initiatives Strengthen Long-Term Outlook

Amazon’s maturation trajectory extends beyond its e-commerce dominance successful truthful galore ways. Across respective cardinal technological sectors, Amazon’s strategical initiatives person spearheaded revolutionary advancements. The company’s artificial quality stocks imaginable continues to expand. In December, Amazon released its second-generation Trainium AI chips, designed to heighten instrumentality learning performance.

The Trainium 2 chips presumption Amazon to vie with manufacture leaders specified arsenic Nvidia and AMD. This advancement supports Amazon’s AWS division, which remains the planetary person successful unreality computing services.

Read More: Nvidia (NVDA): Wall Street Says It Can Be 1st $20T Company

Valuation Reaches More Reasonable Levels

The caller terms diminution has brought Amazon’s valuation to much charismatic levels. Currently trading astatine astir 31.5 times guardant earnings, AMZN has moved person to the S&P 500’s P/E multiple. This represents a important discount compared to its five-year median of 65.1 times earnings.

For those of you considering whether to bargain the dip successful Amazon stock, this much tenable valuation provides an improved risk-reward profile. Amazon reported grounds gross of $637.96 cardinal past year, with projections indicating an summation of implicit 9% successful some fiscal 2025 and 2026.

Revenue Growth Continues Despite Economic Uncertainties

Amazon’s yearly income borderline person to $700 billion, proving the company’s resilience. The e-commerce giant’s diversified gross streams, including its increasing advertizing business, subscription services, and besides AWS, supply aggregate avenues for continued expansion.

The Amazon banal forecast remains affirmative owed to these beardown fundamentals, with artificial quality stocks similar Amazon positioned peculiarly good for semipermanent growth.

Investment Outlook

According to Yahoo Finance:

While determination could inactive beryllium amended buying opportunities for Amazon banal amid caller marketplace volatility, AMZN presently lands a Zacks Rank #3 (Hold). Buying oregon holding AMZN whitethorn beryllium perplexing arsenic the tech-centric Nasdaq continues to decline, but semipermanent investors should surely beryllium rewarded fixed Amazon’s charismatic outlook and artificial quality expansion.

Read More: META & TSMC In Talks to Develop AI Chip: What It Means

The Amazon terms people from analysts indicates beardown assurance successful the company’s aboriginal performance, making the existent dip an charismatic introduction constituent to bargain Amazon banal for investors with a longer clip horizon.

7 months ago

47

7 months ago

47

English (US) ·

English (US) ·