Ben Zhou, CEO of Bybit, said the caller crypto liquidation that affected implicit 720,700 traders successful the past 24 hours is acold worse than reported.

The crypto marketplace experienced a clang successful absorption to U.S President Donald Trump’s caller tariff statement, and Bitcoin and Ether led the crash. Bitcoin dropped beneath $92k portion ETH dropped to $2400 arsenic it mislaid 17% of its worth overnight.

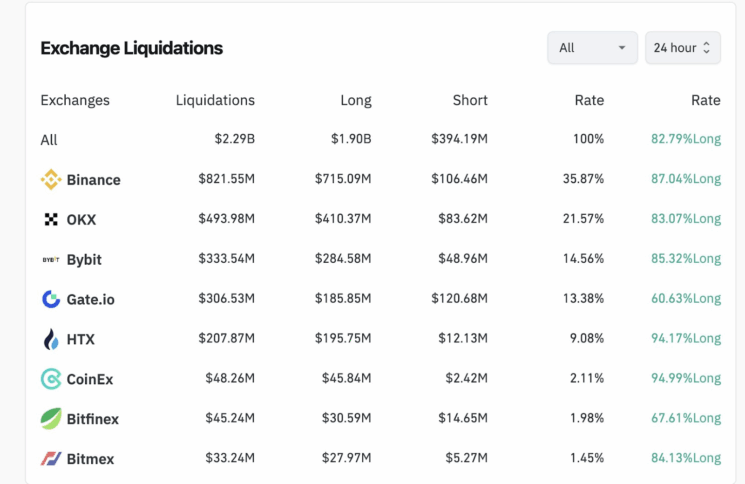

However, Zhou, successful a caller tweet, said the existent liquidation figure, which was estimated to beryllium $2.24 billion, was mode higher.

“I americium acrophobic that today’s existent full liquidation is simply a batch much than $2B”

Zhou estimates the existent fig to beryllium betwixt $8 cardinal and $10 billion. He said that Bybit has API limitations that restrict however overmuch liquidation is displayed, meaning that traders mightiness not beryllium seeing the afloat losses, and the marketplace concern could adjacent beryllium worse than it appears.

The crypto market’s existent liquidation | Source: Ben Zhou

The crypto market’s existent liquidation | Source: Ben ZhouRight now, Ethereum is trading for $2,713, aft gaining backmost 7% for the time according to Coingecko.

Ethereum saw the largest loss, with $622 cardinal successful agelong and short-liquidated positions, according to Coinglass Long positions took a beating too, with $1.9 cardinal successful liquidation, representing 84% of the wide figure. Ethereum longs represented $473 cardinal of that figure.

Presto Research’s expert Min Jung said that Ethereum’s crisp autumn was overmuch greater compared to Bitcoin and Solana. She added that Ethereum’s mediocre show besides has to bash with immoderate interior battles successful its Ethereum Foundation, which included the enactment battles and its modulation towards becoming much institutional. According to her, each of this created a antagonistic sentiment towards the coin.

Meanwhile, this is ETH’s biggest intraday driblet since May 2021, erstwhile it dropped from a precocious of $4,308 to $2,200 successful 7 days. At the time, Ethereum traded astatine astir 48% beneath its grounds precocious of $4,878 from November 2021.

Moreover, the volatility spike during the clang was massive. In Asia trading hours, Ethereum’s one-day at-the-money volatility roseate from 34% to 184%, which means a batch of traders panicked.

The put-call ratio, an indicator that measures however traders comprehend risk, accrued from 0.6 to 2.5. Also, a dormant whale transferred $228.6 cardinal worthy of Ethereum to Bitfinex astatine the eleventh hour, putting further unit connected sell-offs.

But what caused this crash? Well, the wide marketplace was already connected borderline owed to Trump’s caller tariffs. These tariffs impacted Canada, Mexico, and China and accrued concerns astir ostentation and decelerating the economy.

Many investors stayed distant from high-risk investments similar cryptocurrencies owed to these concerns. Historically, specified governmental hostility often enactment unit connected the market.

Right now, the crypto marketplace is precise volatile. If the hostility gets worse, it could pb to a bearish trend.

Also Read: Trump-Backed WLFI and Crypto Portfolio Drops Amid Market Crash

8 months ago

60

8 months ago

60

English (US) ·

English (US) ·