Avalanche (AVAX), a salient cryptocurrency, has precocious exhibited important volatility, capturing the attraction of investors and analysts alike.

As of March 12, 2025, AVAX is astir $18.43, a 7.84% emergence successful the past 24 hours, with a marketplace capitalization of $7.57 cardinal (up 7.41%) and a 24-hour trading measurement of $512.9 cardinal (up 29.74%).

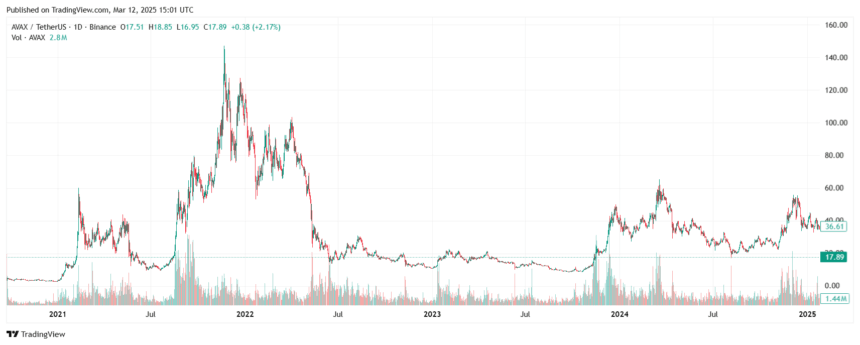

AVAX Price Chart, Source: TradingView

AVAX Price Chart, Source: TradingViewThis caller surge follows a caller dip to the $15 levels, wherever buyers defended an indispensable enactment area, starring to a 13% recovery. Nevertheless, AVAX is inactive 87% down from its all-time highest of $147.50. This surge indicates imaginable bullish signals, with immoderate analysts suggesting the opening of a five-wave impulse pattern

Following a large leap of much than 500% from its on-chain bottom, AVAX was met with absorption astatine $126.03, a cardinal constituent that, erstwhile broken, is apt to transportation the terms northbound of $200, arsenic agelong arsenic the bearish momentum endures.

Avalanche (AVAX) remains highly volatile, with levels of cardinal breakout determining its trend. The currency has experienced terrible drops, hard bounces, and consolidation levels, creating captious method patterns watched intimately by traders.

Crypto expert Javon Marks has highlighted key terms levels that power AVAX’s movement. The cryptocurrency has been moving betwixt enactment and absorption zones, showing marketplace uncertainty. AVAX tried to interruption out, but precocious volatility kept its terms unstable.

Moving forward, AVAX’s terms volition beryllium connected capitalist sentiment, broader marketplace trends, and trading volume. While humanities patterns suggest imaginable for recovery, its volatility keeps terms movements unpredictable.

Investors should attack AVAX with caution, weighing some its maturation imaginable and the risks tied to its fluctuations.

Also Read: VanEck Seeks AVAX ETF, but Token Price Slips

7 months ago

45

7 months ago

45

English (US) ·

English (US) ·