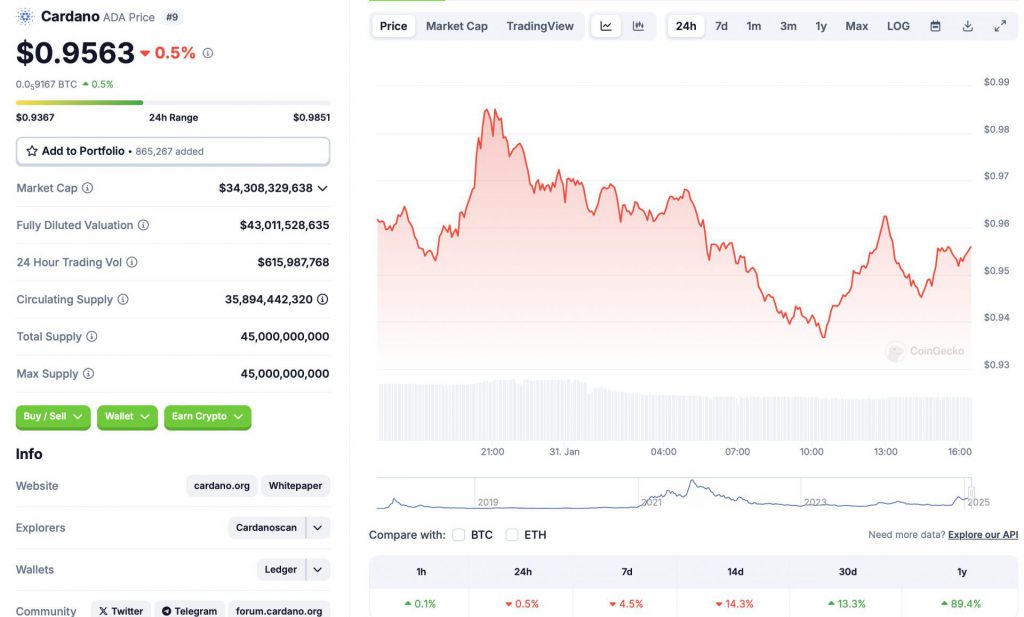

Cardano (ADA) has struggled implicit the past fewer years. The plus has failed to summation momentum since the 2021 bull run. ADA has not traded supra the $2 people since November 2021. The plus is down 0.5% successful the regular charts, 4.5% successful the play charts, and 14.3% successful the 14-day charts. Despite the dip, the plus has maintained gains successful the monthly and yearly charts, rallying 13.3% and 89.4%, respectively.

Source: CoinGecko

Source: CoinGeckoAlso Read: Tether Integrates USDT with Bitcoin’s Lightning Network for Faster Transactions

Cardano Loses Momentum

Source: LinkedIn

Source: LinkedInADA has failed to summation momentum since the 2021 bull run. The plus breached the $1 mark

in November 2024 for the archetypal clip successful astir two-and-a-half years.

ADA’s struggles could beryllium owed to debased capitalist sentiment implicit the past fewer years. The latest dip is apt owed to macroeconomic factors. The US dollar is gaining strength, and investors are moving distant to safer assets.

Also Read: Solana: AI Predicts SOL Price For February 5, 2025

The Federal Reserve has announced 2 complaint decreases this twelvemonth alternatively than three. Crypto investors mightiness person been alarmed by the action.

Will The Asset Breach $2 Soon?

According to CoinCodex, Cardano (ADA) volition interruption into a rally implicit the adjacent fewer months. The level anticipates ADA volition breach the $2 people precise soon. CoinCodex predicts ADA to deed $2.47 connected April 15. Hitting $2.47 from existent terms levels volition construe to a rally of astir 162%.

Source: CoinCodex

Source: CoinCodexAlso Read: Dogecoin Drops 6% successful a Week: Analysts Predict 10-15% Rebound successful Coming Days

There is besides a anticipation that ADA volition not rally implicit the adjacent fewer days. The Federal Reserve has paused involvement rates recently. This whitethorn boost capitalist sentiment. The Fed is yet to denote its adjacent complaint cut. If the Fed does not present a complaint chopped soon, the crypto marketplace whitethorn stagnate. In specified a scenario, ADA whitethorn not deed the $2 mark.

8 months ago

55

8 months ago

55

English (US) ·

English (US) ·