Cardano has been in the limelight lately, not only because it has slightly increased in price but also due to its forecasted surge. According to predictions, ADA may surge up 16% and reach as high as $0.37 by October 2024. But what really drew interest was the bold statement of Cardano analyst Dan Gambardello, that ADA could rally a whopping 1,000% against Bitcoin.

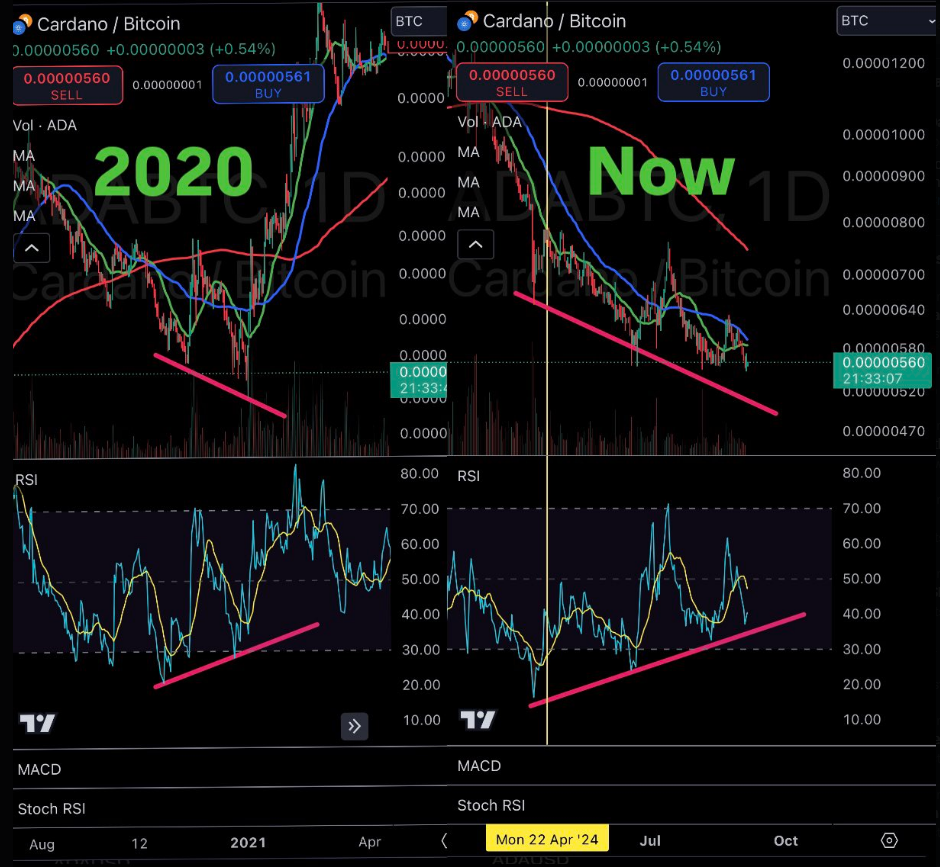

Gambardello’s forecast is based on a very similar setup to the bullish divergence in 2020 that indeed triggered a strong price ascent. In fact, despite this optimism, overall sentiment in the market for Cardano remains conservative.

Although the price gain since then is insufficient to offset the 9% losses investors have suffered this week, it may provide a limited indication of increasing momentum for the coin. ADA has just recorded a modest gain in price of 2.5% to $0.3263.

Analyst’s Bullish Case

Gambardello is optimistic based on ADA/BTC’s technical chart. He pointed to a bullish divergence where the price of ADA keeps making lower lows, while the RSI and MACD are making higher lows-a sign that the downward momentum could be weakening and a reversal might occur very soon. Anyone who has followed crypto price movements knows this has been the precursor to many major rallies.

Insane bullish divergence on the ADA/BTC daily chart.

Insane bullish divergence on the ADA/BTC daily chart.

Last time this happened 4 years ago, Cardano rallied over 1,000% against Bitcoin. pic.twitter.com/cR0uqkIcTe

— Dan Gambardello (@cryptorecruitr) September 5, 2024

And he’s rather outspoken about his bold forecast, too. In a recent X post, Gambardello pinpointed how similar conditions were set back in 2020: ADA was also struggling then, but the bullish divergence set off a major rally against Bitcoin that took ADA to new all-time highs. If history repeats itself, we might well be looking at an “insane” price rally for ADA once again.

Market Sentiment: Bearish Or Bullish?

It is not all moonbound, though, for Cardano. If Gambardello’s rosy projection were anything to go by, the opposite might be said by the wider market. Market sentiment at the moment is without a doubt bearish.

The Fear & Greed Index, one of the major barometers of investor confidence, rests at 22, indicating “Extreme Fear.” This in effect means most investors are still very skeptical about making a big move in ADA and risk appetite remains very low.

Over the last 30 days, ADA has experienced some relatively moderate turbulence; only 53% of its days are in the green. The price action hasn’t really been consistent, and this kind of downward volatility could as well scare away many potential investors in search of some more durable pricing momentum.

While the forecast for a rise by October 2024 is 16.24%, the current environment doesn’t really stand to inspire much confidence. One would be somewhat reasonable at being hesitant, given the temperamental nature currently governing the markets.

ADA Price Forecast

ADA Price Forecast

That leaves the investors to decide on a difficult matter. On one side, the technicals Gambardello presents show a possible breakout. Conversely, the state of the market is somewhat erratic, and generally the vibe is simply not optimistic. Maybe investors would be better off waiting for more persuasive proof of ADA’s next action and treading gently for now.

The next few weeks are going to be crucial for Cardano. And though Gambardello’s prediction did manage to raise hope, the general market still seems to weigh down any immediate bullish momentum. For the time being, caution might be the best approach, but the moment ADA starts breaking out of its range, things can change pretty fast.

Featured image from Medium, chart from TradingView

1 month ago

29

1 month ago

29

English (US) ·

English (US) ·