Cardano shows mixed signals on the technical indicators, not to mention the on-chain data. Despite bullish trends in the metrics, ADA has been unable to gain significant price momentum. At the time of writing, ADA is trading around $0.34, experiencing a slight 4% dip in the past 24 hours, leaving investors wondering whether it’s the right time to buy or wait.

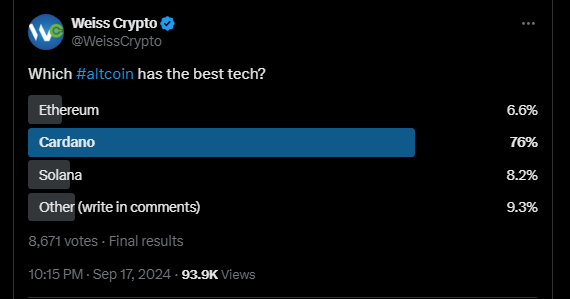

Speaking of positive vibes, Cardano received a strong vote of confidence from the crypto community. In a recent survey conducted by Weiss Crypto, ADA won the title for the altcoin with the best technology, receiving over 76% of the votes. This shows that, despite price struggles, the community still believes in Cardano’s long-term potential.

Which #altcoin has the best tech?

— Weiss Crypto (@WeissCrypto) September 17, 2024

Bullish On-Chain Signals

There’s some hope shown for ADA holders based on on-chain data. Coinglass reports that ADA’s Long/Short Ratio reads at 1.0167, meaning traders are feeling pretty bullish.

Futures Open Interest has grown by 3% in the last 24 hours and has been up since the beginning of September 2024. These kinds of signals tend to mean traders are keeping their long positions, which can, by extension, set up the environment for price increases.

For ADA, CoinCodex predicts a price rise of 16.53% and $0.405879 on October 19, 2024. On paper, these are fairly optimistic projections; however, the market sentiment and technicals overwhelmingly advise caution.

Price Struggles To Gather Steam

Despite the bullish data on-chain, ADA hasn’t managed to break out of the current range thus far. Even with the optimism indicated by the Long/Short Ratio and growing Futures Open Interest, ADA’s price is stuck at around $0.33. Further stagnation in this sense can be supported by the bearish sentiments presented within the wider crypto market that also impacts its short-term performance.

ADA has been unable to break out from its present range even with the optimistic on-chain statistics. The altcoin’s price stays fixed near $0.33 even with the hope shown in the Long/Short Ratio and growing Futures Open Interest. The pessimistic mood of the larger crypto market, which has depressed its short-term performance, can help to explain this stalemate.

Market Sentiment Cautiously NeutralThe overall market sentiment remains neutral at 49, based on the Fear & Greed Index, which indicates caution. Where ADA’s price is said to rise in the coming weeks, most analysts are still advising one not to buy the asset yet since better bullish signals need to appear in the market first.

The recent surge in whale activity could also have a role to play—on September 17, these massive crypto hodlers moved 19.5 billion ADA tokens, worth around $6.48 billion, according to IntoTheBlock. Such large movements often signal upcoming price changes, and investors are watching closely.

ADA: Community Confidence And OutlookWith mixed technical indicators, the community of Cardano is doing just fine. The Weiss Crypto survey that shows ADA outperforming Ethereum and Solana, among others, suggests the technological base of Cardano is solid.

Finally, though the on-chain metrics are bullish regarding Cardano, general market conditions are quite dim. Its short-term movement is pretty limited while there is hope in the community that the altcoin will still be able to prove its mettle as it works its way up the altcoin ladder.

Featured image from Swyftx Learn, chart from TradingView

1 month ago

27

1 month ago

27

English (US) ·

English (US) ·