Cboe BZX Exchange has submitted applications to the SEC to database the archetypal spot XRP ETFs successful the United States, which is simply a large improvement successful the satellite of cryptocurrency investment.

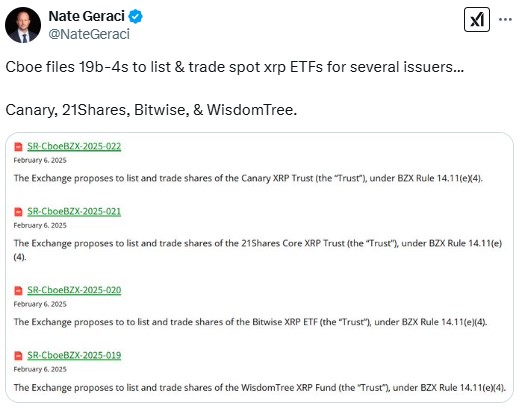

On February 6, Cboe submitted 19b-4 forms for 4 plus managers, namely Canary Capital, WisdomTree, 21Shares, and Bitwise. These filings question to found caller ETFs that volition replicate the terms of XRP, which stands astatine $2.35 and is ranked 4th successful the market.

Source: X

Source: XThe 19b-4 filings are indispensable to pass the SEC of projected changes successful the rules of the market. If approved, they would beryllium the archetypal XRP ETFs successful the United States. This came aft the SEC successful 2024 approved Bitcoin and Ether ETFs nether the erstwhile chair, Gary Gensler.

However, with the SEC present nether crypto-friendly acting seat Mark Uyeda, analysts expect that determination volition beryllium an summation successful the fig of crypto ETFs that are filed due to the fact that issuers are probing what a Trump administration-influenced SEC volition permit.

This is not the archetypal clip that Cboe has applied for cryptocurrency ETFs. The speech precocious resubmitted filings for Solana ETFs successful precocious January, which means that it is apt that the speech volition soon o.k. the ETFs.

Other firms specified arsenic Bitwise and Canary Capital person besides initiated the process of filing for XRP ETFs and according to JPMorgan, XRP ETFs could pull betwixt $4 cardinal to $8 cardinal successful their archetypal year.

The involvement successful spot XRP ETFs is simply a motion of the expanding adoption of cryptocurrencies successful accepted markets arsenic XRP is approaching the all-time precocious of $3.40 acceptable successful 2018.

Also Read: Ripple vs. SEC: What’s Happening Now successful the Legal Battle?

8 months ago

75

8 months ago

75

English (US) ·

English (US) ·