The post Chainlink (LINK) Price Crashes 7.5%, Another 15% Drop Ahead? appeared first on Coinpedia Fintech News

The overall cryptocurrency market appears bearish. Amid this, some investors saw an opportunity and accumulated tokens, while others panicked and sold their holdings.

610,000 LINK Sent to Exchanges

Recently, a prominent crypto expert shared a post on X (formerly Twitter), revealing that crypto whales have moved nearly 610,000 Chainlink (LINK) tokens to exchanges in the past 24 hours, signaling increased selling pressure.

Current Price Momentum

This substantial transfer of LINK tokens led to a notable price drop. At press time, LINK is trading near $15, having declined by over 7.50% in the past 24 hours. However, during the same period, its trading volume surged by 160%, indicating increased participation from traders and investors compared to the previous day.

The surge in trading volume is likely due to the breakdown of a prolonged consolidation zone and a shift in price action.

Chainlink (LINK) Technical Analysis and Upcoming Levels

According to expert technical analysis, LINK appears bearish and is poised for further decline. On the daily timeframe, LINK had been consolidating within a tight range for an extended period. However, as market sentiment shifted, the asset failed to hold this zone, breaking below the consolidation and experiencing a significant drop.

Source: Trading View

Source: Trading ViewLooking at the price action and historical momentum, LINK appears to have found some support near $15. If this sentiment remains unchanged and LINK closes a daily candle below the $15 level, there is a strong possibility it could decline another 15%, reaching the next support at $12.60.

This consolidation breakdown has pushed LINK into a downtrend. During the consolidation phase, the asset was not only trading within a tight range but also moving above the 200 Exponential Moving Average (EMA) on the daily timeframe. This breakdown below the 200 EMA may further explain the asset’s bearish trend.

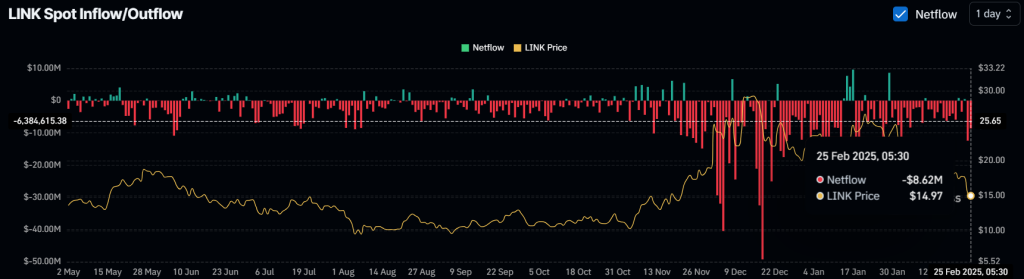

$8.65 Million Worth of LINK Outflow

This bearish outlook might be the reason why whales have moved their LINK holdings onto exchanges. However, some investors and long-term holders have been accumulating the tokens, as reported by the on-chain analytics firm Coinglass.

Data from spot inflow/outflow reveals that exchanges have witnessed an outflow of over $8.65 million worth of LINK tokens in the past 24 hours, indicating potential accumulation.

Source: Coinglass

Source: CoinglassThe significant dumping and accumulation of LINK by investors, long-term holders, and whales reflect individual sentiments amid market uncertainty.

7 months ago

48

7 months ago

48

English (US) ·

English (US) ·