Chainlink (LINK) price emerges as one of the biggest gainers among the top 20 cryptocurrencies in the last 24 hours, despite showing mixed signals in its technical indicators.

The BBTrend indicator, though remaining positive since November 25, has weakened significantly. Despite these contradicting signals, LINK price shows potential for a 42% surge to $30 if it successfully breaks above current resistance levels.

Chainlink Whales Are Not Accumulating LINK

A significant decline in Chainlink whale holdings over the past two weeks signals a potential shift in sentiment.

The number of wallets containing between 100,000 and 1,000,000 LINK dropped from a yearly high of 558 on November 19 to 533 currently, suggesting large investors may be taking profits or redistributing their holdings.

Addresses Holding Between 100,000 to 1,000,000 LINK. Source: Santiment

Addresses Holding Between 100,000 to 1,000,000 LINK. Source: SantimentTracking whale behavior is crucial as these large holders can significantly influence price movements and market sentiment. The decrease from 558 to 533 wallets in this category indicates a distribution phase where larger holders are reducing their positions.

This sustained decline in whale accumulation could signal bearish pressure on LINK price in the short term.

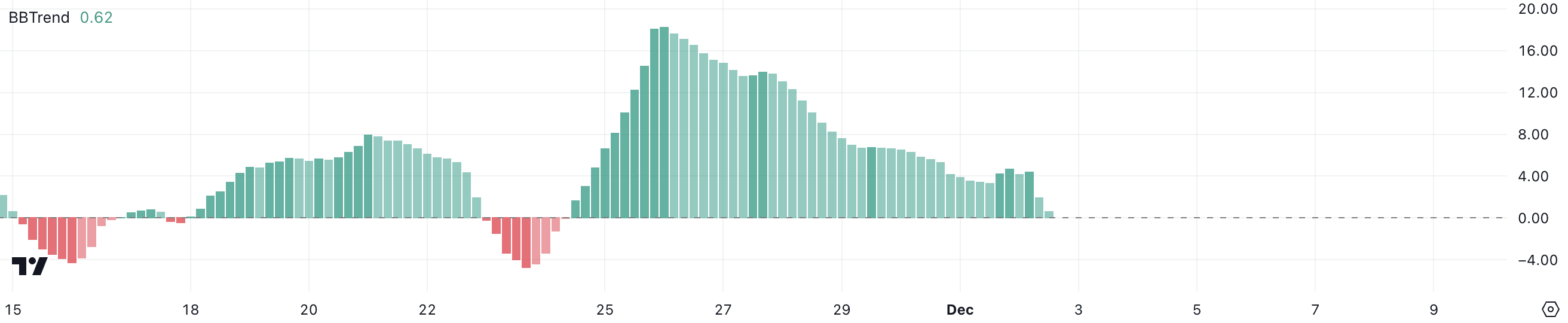

LINK BBTrend Is At Its Lowest Level In Weeks

Chainlink BBTrend (Bollinger Bands Trend) indicator has weakened significantly, dropping from its peak of 18.2 on November 26 to just 0.44 currently while maintaining positive territory since November 25.

The BBTrend helps identify trend strength and potential reversals by measuring price movement relative to Bollinger Bands.

LINK BBTrend. Source: TradingView

LINK BBTrend. Source: TradingViewA potential shift to negative BBTrend territory could signal a trend reversal and increased selling pressure for LINK.

When BBTrend turns negative, it typically indicates price movement below the middle Bollinger Band, suggesting bearish momentum that could lead to further downside movement in LINK’s price.

LINK Price Prediction: A Potential 42% New Surge

LINK recent attempt to breach $22, a level unseen since 2022, suggests potential for significant upward movement.

If successful on its next attempt, the cryptocurrency could target $25 before advancing toward $30, which would represent its highest value since 2021 and translate to a substantial 42% price growth from current levels.

LINK Price Analysis. Source: TradingView

LINK Price Analysis. Source: TradingViewConversely, failure to maintain upward momentum could trigger a downward correction.

In this scenario, LINK price might test initial support at $16.18, with the potential for further decline to $13.8 if this support level fails to hold.

The post Chainlink (LINK) Price Eyes 42% Growth to 3-Year High appeared first on BeInCrypto.

3 weeks ago

24

3 weeks ago

24

English (US) ·

English (US) ·