- Chainlink Reserve bought 170k+ LINK this week despite treasury value dropping.

- Spot Taker CVD shows buyers firmly in control; Netflow stays negative.

- LINK could target $15–$16.1 if momentum holds; SAR supports sit near $11.94.

By 2025, Digital Asset Treasuries and token-buyback programs became one of the biggest shifts in the crypto industry. Major players started treating their tokens more like corporate assets — buying supply during weakness, tightening float, and reinforcing long-term value. Chainlink joined this trend on August 7, 2025, launching the LINK Strategic Reserve — an entity created to absorb enterprise demand and funnel it directly into LINK itself.

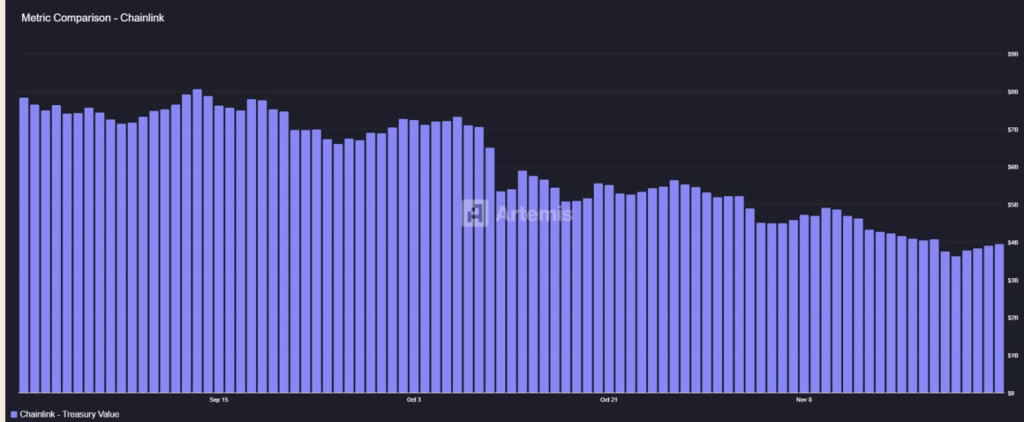

Chainlink Reserve keeps accumulating even as values fall

Q4 has been brutal for the crypto market. Treasuries lost billions, retail holders watched portfolios bleed red, and even Chainlink’s reserve value dropped sharply — falling from $8.1 billion to $4 billion in just two months. Yet the Reserve hasn’t backed down at all.

In the last 24 hours alone, the Strategic Reserve purchased roughly 89,000 LINK, worth about $1.18 million. Over the last week, it accumulated 170,300 LINK, valued at around $2.2 million. This type of steady, almost stubborn accumulation suggests strong internal conviction about LINK’s future outlook — even as market conditions look shaky from the outside.

And there’s more to it: every Reserve purchase quietly removes LINK from the circulating supply. Less supply = less potential sell pressure, especially during periods where liquidity dries up. It’s a long-term bullish mechanic hiding in plain sight.

Market demand stays firm as buyers dominate

On top of the Reserve stacking LINK, investors across the market are piling in as well. Over the past six days, Spot Taker CVD has shown clear buyer dominance — meaning traders are aggressively buying at the ask, not waiting passively for cheaper entries. That’s actual demand, not leverage-driven noise.

Spot Netflow stayed negative throughout the past week too, sitting at -$578k at press time (down from -$2.88 million the day before). Negative Netflow means LINK is leaving exchanges — a sign holders prefer self-custody over selling, and often a precursor to bigger upside moves.

What’s next for LINK?

Chainlink has been climbing inside a mini ascending channel ever since bouncing from its drop to $11 last week, rallying to a local high of $13.5. At press time, LINK trades around $13.4, up 0.46% on the day and 11.3% on the week — a sign of strengthening buyer pressure.

Stochastic RSI has surged to 97, which is deep in overbought territory. When Stoch hits this level, it usually means buyers have full control… but it also warns of volatility coming soon. If momentum continues, LINK could break through $15 and target the next resistance around $16.1.

However, if the market turns and sellers step in, LINK’s Parabolic SAR places the nearest support around $11.94 — the level bulls must defend to keep the current structure intact.

Final thoughts

With strategic buybacks, real demand, negative netflows, and a Reserve that keeps stacking tokens, LINK’s supply-side pressure continues shrinking. Even though the market backdrop looks rough, the underlying mechanics for Chainlink are pointing upward. Here is where accumulation starts mattering more than headlines.

The post Chainlink’s Strategic Reserve Keeps Buying LINK — Here Is Why Accumulation Is Heating Up Despite Market Losses first appeared on BlockNews.

3 weeks ago

31

3 weeks ago

31

English (US) ·

English (US) ·