Coinbase has decided to exit Turkey’s crypto market and is liquidating its local operations after withdrawing its application with the country’s financial regulator.

Reports indicate that the move comes just three months after the company submitted a pre-application to operate in Turkey.

Coinbase Wants to Avoid Regulatory Challenges in Turkey’s crypto market

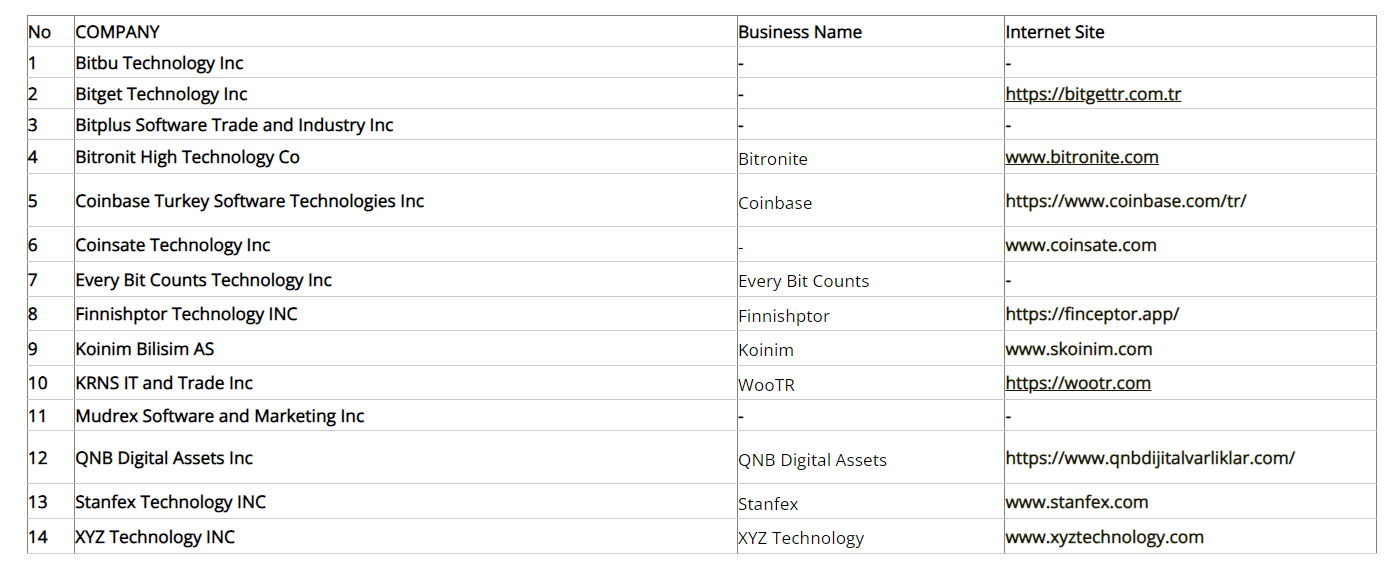

According to local reports in Turkey, the Capital Markets Board updated its liquidation list last week. The list shows Coinbase’s withdrawal and subsequent filing for liquidation.

Alongside Coinbase, 14 companies have filed for liquidation, while 77 firms remain in the application process. Crypto platforms such as Binance, KuCoin, and OKX are included in the ongoing applications.

Binance and KuCoin previously removed Turkish language options from their platforms and ceased marketing to Turkish users in September. Binance stated that these actions were taken to align with Turkish regulations for foreign crypto service providers.

“Yapı Kredi Bankası’s (YKB) Custody Application has been added to the CMB’s Crypto Asset Custodians List. However, there is another interesting development: Coinbase, the giant that takes over the custody of ETFs in the US, has abandoned its plans to enter Turkey,” Bloomberg analyst Sevcan Ersözlü wrote on X (formerly Twitter).

In December, Coinbase discontinued yield offerings on USDC for European users. The exchange attributed this decision to the European Union’s Markets in Crypto-Assets (MiCA) stablecoin regulation.

Crypto Companies that have Filed for Liquidation in Turkey. Source: Capital Markets Board of Turkey

Crypto Companies that have Filed for Liquidation in Turkey. Source: Capital Markets Board of TurkeyAdditionally, Coinbase announced plans to stop trading Wrapped Bitcoin (WBTC) by December 19, 2024, following an internal compliance review.

While Coinbase’s cbBTC token, with a $1.44 billion market cap, has seen success in decentralized finance, WBTC’s team expressed disappointment over the delisting, with users criticizing the exchange’s competitive strategy.

Regulatory Efforts are Ramping Up in the US

Despite the shifts in international markets, Coinbase has been actively engaged in influencing crypto policies in the United States. The exchange’s CEO, Brian Armstrong, reportedly discussed potential pro-crypto personnel appointments with former President Donald Trump.

He proposed SEC Commissioner Hester Peirce as Gary Gensler’s replacement, signaling a push for more crypto-friendly leadership at the SEC. Gensler announced his resignation earlier in November, and his tenure will end in January before Trump takes office.

Meanwhile, Coinbase’s global app ranking surged to ninth place in November, coinciding with Bitcoin’s price rally. This rise in app downloads reflects increasing retail interest in cryptocurrency, which could drive higher trading volumes and support broader market adoption.

The post Coinbase Exits Turkey’s Crypto Market Amid Regulatory Changes appeared first on BeInCrypto.

3 weeks ago

27

3 weeks ago

27

English (US) ·

English (US) ·