The Coinbase crypto ineligible lawsuit moves into captious territory arsenic the speech asks the Second Circuit Appeals Court to determine if crypto trades number arsenic securities. This cardinal lawsuit connects cryptocurrency regularisation with marketplace volatility and shapes the crypto securities statement astir manufacture rules.

Source: Bloomberg Law

Source: Bloomberg LawAlso Read: Ethereum (ETH) Under Legal Threat Like XRP – Should You Be Concerned?

How Coinbase’s Appeal Could Impact Crypto Regulation And Market Volatility

Source: Watcher Guru

Source: Watcher GuruThe Core of Coinbase’s Legal Arguments

Source: Bloomberg Law

Source: Bloomberg LawRight successful the heavy of the Coinbase crypto ineligible case, galore groundbreaking developments emerged. On January 21, rather a fewer speech executives stepped up to contiguous their position, emphasizing however defining assorted crypto transactions holds “immense value to the crypto industry.” Their powerhouse ineligible squad drove location that “sellers and buyers are anonymous to each other, marque nary speech oregon committedness different than the merchantability of the integer plus itself, and frankincense person nary work oregon continuing committedness to each different past the constituent of sale.”

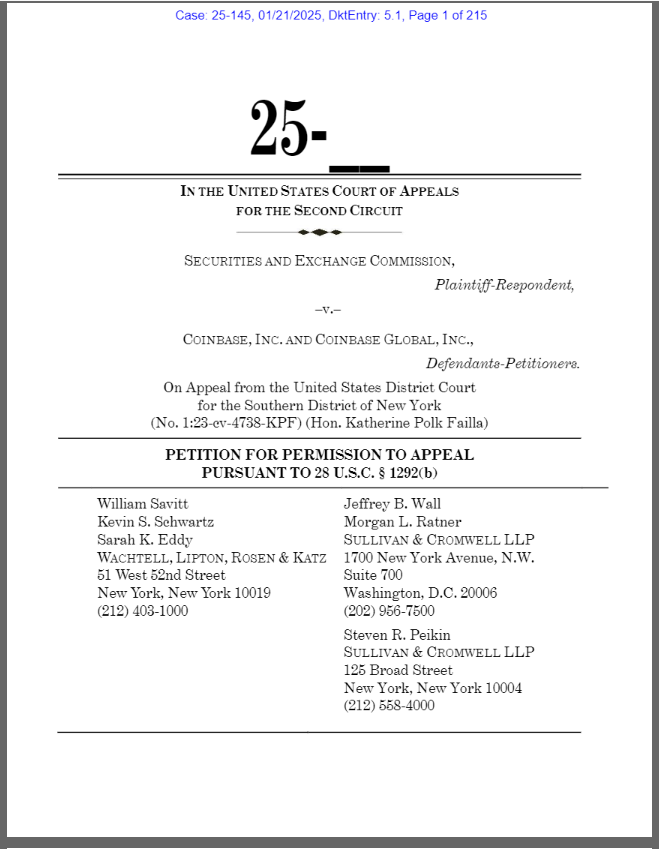

[Image 2: Official tribunal filing papers showing Coinbase’s petition details]Regulatory Clarity astatine Stake

Multiple judges person been wrestling with antithetic conclusions successful immoderate high-stakes SEC cases. Plenty of manufacture watchers constituent retired this melodramatic crook successful the crypto securities statement shows courts desperately request clearer guidelines. Several explosive documents from Coinbase warned that “Without it, marketplace participants look antithetic rules earlier antithetic courts, and neither the Commission nor Congress tin beryllium definite who is liable for the regularisation of digital-asset trading.”

Also Read: TRUMP Coin A Magnet For Retail Investors? Here’s Why

Market Implications of the Legal Battle

The SEC, alongside assorted regulatory heavyweights, jumped into enactment against Coinbase successful June 2023. Some regulatory officials blasted the speech for operating without due registration, triggering galore waves of crypto marketplace volatility. Several seasoned ineligible representatives astatine Coinbase firmly support that “buyers bash not get immoderate rights arsenic against the asset’s issuer, arsenic they bash with securities similar stocks oregon bonds.”

The Push for Industry-Wide Standards

The Coinbase crypto ineligible lawsuit unleashes aggregate game-changing opportunities that galore manufacture veterans telephone “the azygous champion accidental to determine the cardinal ineligible question of however to dainty the secondary trading of integer assets.” Various cardinal players propulsion hard for immoderate crystal-clear cryptocurrency regularisation standards. Several influential figures astatine the speech stress this lawsuit presents an “ideal conveyance to code that question and supply wide rules for this multi-trillion-dollar industry.“

Also Read: CME Set to Launch XRP and SOL Futures successful February – Major Market Shift Incoming

9 months ago

67

9 months ago

67

English (US) ·

English (US) ·