- CoinShares withdrew its staked Solana ETF application after the underlying structuring deal fell apart.

- Despite heavy inflows into SOL ETFs, Solana’s price continues trending downward from its 2025 highs.

- Analysts have scaled back expectations, with some doubting SOL’s ability to reclaim $150 soon.

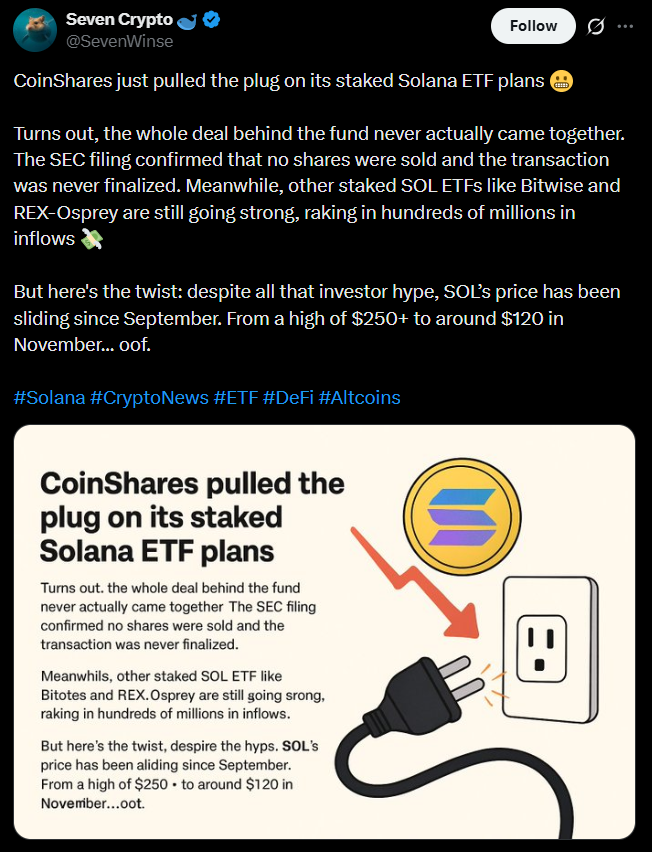

Asset manager CoinShares unexpectedly withdrew its SEC application for a staked Solana ETF on Friday, ending what many thought would be another major addition to Solana’s expanding lineup of investment vehicles. According to the filing, the structuring agreement behind the product never reached completion, leaving the proposed fund without the necessary backing to move forward. No shares were ever sold and none will be sold under the registration, marking a quiet end to what could have been one of the more talked-about ETF debuts this year.

A Missed Launch as Staked ETF Competition Heats Up

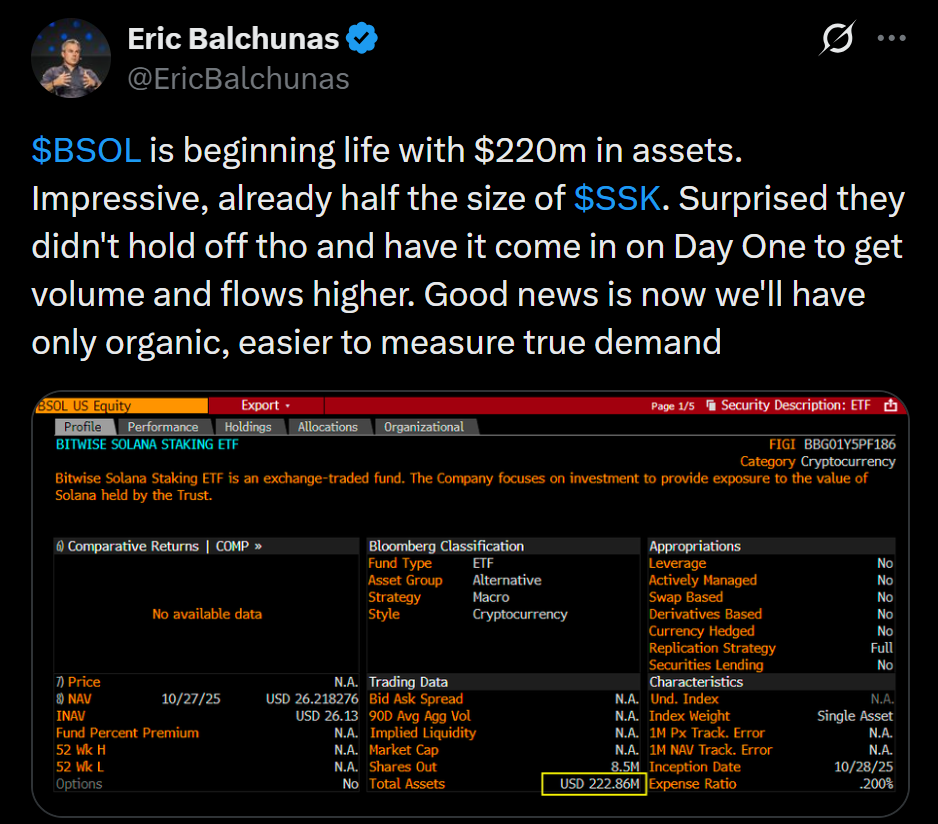

The cancellation arrives at a time when staked Solana ETFs have already started gaining ground in the U.S. market. The first one, issued by REX-Osprey, rolled out in June, followed by Bitwise’s staked SOL ETF in October. Bitwise launched with a striking $223 million in assets on day one — nearly half of what the REX-Osprey fund built over several months. Even with this rising demand, Solana’s price hasn’t matched the enthusiasm, slipping into a steady downtrend since its September highs above $250.

Strong ETF Inflows but Slumping SOL Price

November told a very different story for ETF flows versus price performance. Solana investment vehicles pulled in over $369 million throughout the month, largely because yield-bearing staked SOL products have been advertising 5–7% rewards. These inflows stood in sharp contrast to Bitcoin and Ether ETFs, which saw record outflows during October and November. Investors kept pouring capital into Solana ETFs even as SOL’s own price kept falling — a rare divergence that analysts still struggle to fully explain.

Analysts Tone Down Their Price Predictions

Earlier forecasts saw SOL climbing as high as $400 on the back of rising ETF interest, but sentiment cooled quickly after October. Many analysts now warn that reclaiming $150 may become a challenge if market headwinds persist. SOL hit a five-month low of around $120 in November, marking a steep 60% drop from its January 2025 all-time high of roughly $295. That price explosion at the start of the year was driven by the launch of the Official Trump memecoin and the broader memecoin frenzy dominating Solana’s ecosystem. Since then, the excitement has faded, and SOL is still searching for solid footing.

The post CoinShares Pulls Its Staked Solana ETF Application as Solana Struggles to Hold Momentum — Here Is What’s Really Going On first appeared on BlockNews.

2 months ago

53

2 months ago

53

English (US) ·

English (US) ·