Industry experts are increasingly optimistic that the US Securities and Exchange Commission (SEC) will soon approve a spot Ethereum exchange-traded fund (ETF).

This growing confidence comes as several prominent asset managers, including Fidelity, VanEck, Franklin, 21Shares, Grayscale, and BlackRock, filed their updated S-1 forms with the SEC yesterday.

Ethereum ETF Approval May Be Close as Asset Managers Update Filings

Some potential issuers, like Grayscale and 21Shares, did not disclose their fees in their updated S-1 filings. Interestingly, Invesco Galaxy Ethereum ETF has yet to follow its fellow asset managers in submitting the updated S-1 forms. However, Nate Geraci, President at ETF Store, predicts that Invesco Galaxy’s amendment might be posted to the SEC site soon.

BeInCrypto reported that Bitwise had updated its S-1 filing the previous week, including a six-month fee waiver plan for up to $500 million. However, Bitwise’s form did not specify an exact launch date. The firm only stated that it would happen “as soon as practicable after the effective date” of the registration.

Read more: Ethereum ETF Explained: What It Is and How It Works

Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, commented on the recent filings. He explained that the SEC had requested the S-1 forms on July 8 but informed issuers that the fee was not necessary at that moment. He added that the SEC would provide guidance soon, and the documents would be returned with fees and other details filled in.

“We don’t have a new over/under launch date yet because we haven’t heard what the SEC’s game plan is. Hope to hear soon. But if you forced me the gun to head style to give my best guess for the date, I’d go with July 18,” Balchunas wrote on his X (Twitter).

Initially, Bloomberg Intelligence analysts predicted that these ETFs “could potentially list later next week or the week of July 15 at this point.” However, the exact timeline remains uncertain due to the SEC’s approval process.

Anticipated Launch Sparks Market Excitement and Volatility Concerns

The submission of these forms marks a significant step forward in the approval process for a spot Ethereum ETF. This development follows the SEC’s earlier approval of the 19b-4 forms, which are also the requirements for ETFs to commence trading.

Industry experts believe the approval of a spot Ethereum ETF would be a watershed moment for the crypto market. It would provide institutional investors with a regulated and convenient way to gain exposure to Ethereum, potentially driving up demand and liquidity.

Matteo Greco, a Research Analyst at Fineqia, echoes this optimism. He noted that the anticipated launch of spot Ethereum ETFs and the recent spot Solana ETF filings highlight the growing interest and adoption of digital assets by traditional finance service providers and investors.

“This trend projects a positive outlook for the digital assets market in the mid to long term, with increased establishment in financial markets, accompanied by rising inflows, liquidity, and transparency,” Greco outlined.

However, Shubh Varma, co-founder and CEO of Hyblock Capital, warned that the anticipation of these ETFs leads to higher volatility expectations. According to him, this volatility is evident from the Deribit Bitcoin Volatility Index (DVOL), which measures the expected price changes over the next 30 days based on options data.

“As the DVOL rises and Ethereum’s price rapidly drops, we observe a decline in liquidity in the spot markets. This trend suggests that more traders and investors are choosing to ‘wait it out,’ reducing their market activity and contributing to wider bid-ask spreads and less stable prices,” Varma explained to BeInCrypto.

Read more: How to Invest in Ethereum ETFs?

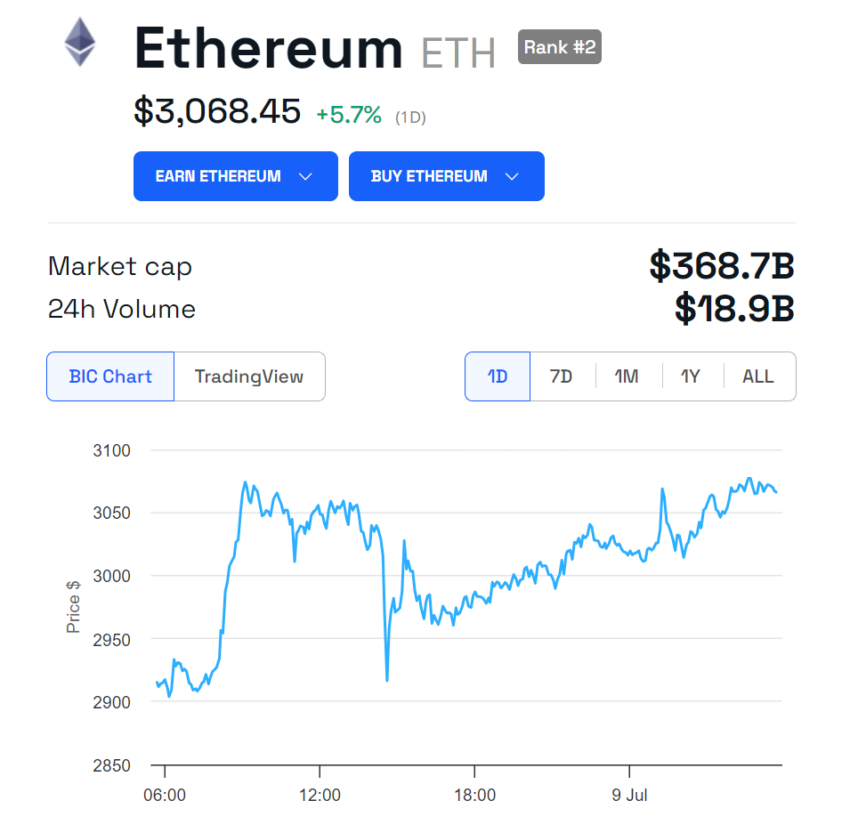

ETH Price Performance. Source: BeInCrypto

ETH Price Performance. Source: BeInCryptoNonetheless, the market has responded positively to these developments. At the time of writing, Ethereum (ETH) is trading at $3,068, reflecting an over 5% increase in the past 24 hours.

The post Confidence Grows for Spot Ethereum ETF Approval by July 18 After Most Issuers Update S-1 appeared first on BeInCrypto.

3 months ago

42

3 months ago

42

English (US) ·

English (US) ·