Covered call strategies elegantly combine the stability of asset ownership with the income-generating potential of call option premiums. For highly volatile assets like Bitcoin, MicroStrategy (MSTR), and MSTX, covered calls are not only a tool for risk mitigation but a mechanism that actively shapes market dynamics. These strategies, when deployed en masse by market participants, have ripple effects on volatility, investor behavior, and price trends.

Let’s dive into how covered call strategies function, their broader market implications, and their adaptability to bullish, bearish, and sideways markets, using Bitcoin and MSTR as focal points.

The Mechanics of Covered Calls

A covered call strategy involves two main actions:

- Owning the Underlying Asset: Investors maintain a long position in an asset, such as Bitcoin, MSTR, or MSTX shares.

- Selling Call Options: Investors sell call options on the same asset, agreeing to sell it at a predetermined price (strike price) if the option is exercised.

The call option premium provides immediate income, offsetting minor declines in the asset’s price. However, this approach caps the investor’s upside if the asset exceeds the strike price, as they are obligated to sell it at that level.

Impact of Covered Calls on Bitcoin

Bitcoin’s decentralized nature and speculative trading environment make it uniquely sensitive to covered call strategies. Here’s how these strategies shape the Bitcoin market:

1. Suppression of Volatility

When investors sell call options, they often hedge their positions by selling Bitcoin as its price rises, creating selling pressure that suppresses price surges. Conversely, in declining markets, the absence of call obligations reduces selling pressure, stabilizing the market.

Example: Bitcoin is trading at $100,000. Suppose covered call sellers offload options with a $110,000 strike. As Bitcoin nears $110,000, these sellers hedge by selling Bitcoin, creating resistance at $110,000 and dampening volatility.

2. Income Attraction

The appeal of steady income from premiums draws yield-focused investors to the Bitcoin market. For instance, selling a $120,000 strike call for $2,500 on a $100,000 Bitcoin position generates a 2.5% return in a month, attracting participants who might otherwise avoid the volatile crypto space.

3. Market Sentiment Reflection

The volume and type of covered calls written can signal market sentiment. A surge in call writing near $120,000 suggests market participants expect limited upside, indicating caution. Conversely, a lack of call activity might suggest bullish sentiment, as traders prioritize price appreciation over premium income.

Impact of Covered Calls on MicroStrategy (MSTR)

As a company holding over 331,200 BTC (valued at $31.2 billion as of November 2024), MicroStrategy’s stock serves as a high-beta proxy for Bitcoin. Covered call strategies amplify the interplay between Bitcoin and MSTR, influencing price dynamics and investor behavior.

1. Amplified Volatility

MSTR’s stock is inherently more volatile than Bitcoin due to its leveraged Bitcoin holdings. This makes its options more lucrative for covered call writers. However, hedging activity by option sellers can amplify price swings.

Example: MSTR trades at $450, and many investors sell $500 strike calls. As MSTR approaches $500, hedging activity spikes, exacerbating volatility near the strike.

2. Moderation of Price Multipliers

Historically, MSTR’s stock price magnifies Bitcoin’s movements — a 10% rise in Bitcoin might lead to a 30%-50% increase in MSTR. Covered call strategies moderate this effect by capping gains, as investors must sell shares if the price exceeds the strike.

3. Diversification of Investor Demographics

Covered calls attract yield-focused investors to MSTR, diversifying its shareholder base. This shift can increase liquidity, stabilize prices, and reduce the stock’s correlation to Bitcoin during extreme movements.

Systemic Implications of Widespread Covered Calls

When covered calls are broadly employed, they influence more than just individual assets:

1. Enhanced Liquidity

The rise in options trading tightens bid-ask spreads, improves price discovery, and attracts institutional investors. For instance, more participants selling Bitcoin calls at various strikes increases market depth, making trades more efficient.

2. Stabilized Prices

Widespread covered calls provide a cushion against extreme price movements. In flat or slightly volatile markets, this strategy absorbs shocks, creating a perception of stability. However, in the face of sharp corrections, it may exacerbate declines as hedging activity fails to keep pace.

3. Regulatory Scrutiny

As the crypto market grows, the extensive use of options strategies like covered calls could attract regulatory attention. Authorities might examine whether these strategies contribute to systemic risks or market manipulation.

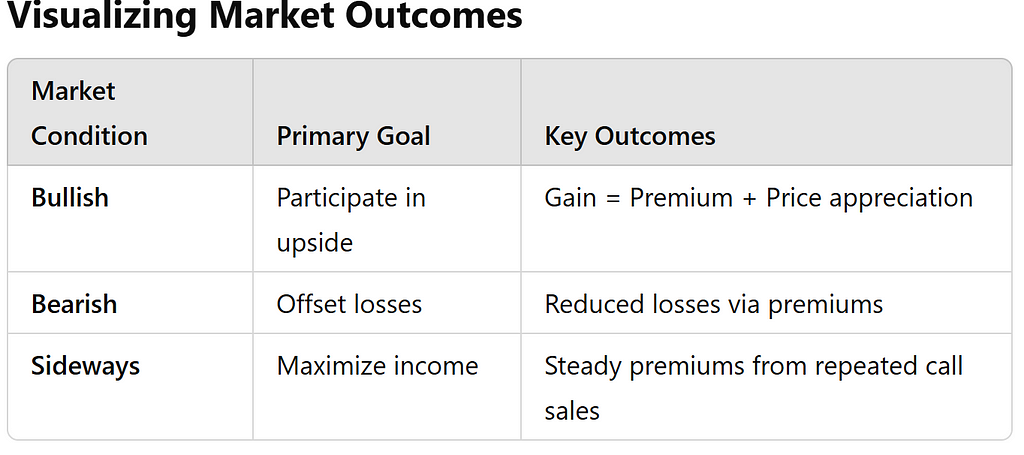

Tailoring Covered Call Strategies for Market Conditions

Adapting a covered call strategy to different market conditions — bullish, bearish, and sideways — unlocks its full potential.

Bullish Market: Riding the Upside with a Cushion

In a rising market, the goal is to capture price appreciation while generating premium income.

Setup:

- Sell out-of-the-money (OTM) calls with a strike 3%-5% above the current price.

- Choose expirations aligned with your bullish outlook (1–2 months).

Example for Bitcoin:

- Current Price: $100,000

- Strike Price: $110,000

- Premium: $2,500

Outcomes:

- If Bitcoin stays below $110,000: Retain the $2,500 premium.

- If Bitcoin exceeds $110,000: Earn $2,500 plus price appreciation up to $110,000.

Adjustments:

- Rolling the Call: If Bitcoin quickly exceeds $110,000, roll to a higher strike (e.g., $120,000).

- Delta Hedge: Use short-term calls to hedge against temporary pullbacks.

Bearish Market: Offsetting Losses with Premiums

In a declining market, the focus shifts to offsetting losses on the underlying asset.

Setup:

- Sell at-the-money (ATM) or slightly in-the-money (ITM) calls for maximum premium.

- Choose shorter expirations to capture immediate income.

Example for MSTR:

- Current Price: $450

- Strike Price: $450 (ATM)

- Premium: $15 per share

Outcomes:

- If MSTR stays below $450: Retain the $15 premium, offsetting losses.

- If MSTR exceeds $450: Gain the premium plus minimal upside.

Adjustments:

- Protective Puts: Pair the call with a long put to create a collar, capping losses.

- Stop-Loss Orders: Set limits to minimize downside exposure.

Sideways Market: Extracting Income from Stability

In a flat market, the aim is to maximize income through repeated call sales.

Setup:

- Sell near-the-money (NTM) calls with shorter expirations (weekly/monthly).

Example for MSTX:

- Current Price: $65.87

- Strike Price: $67

- Premium: $2.87

Outcomes:

- If MSTX remains below $67: Retain the premium as the option expires worthless.

- If MSTX exceeds $67: Profit from the premium and modest price appreciation.

Adjustments:

- Rolling Options: Sell new calls as old ones expire.

- Straddles or Strangles: Add put options to capitalize on unexpected volatility.

Conclusion: Precision and Profitability in Covered Calls

Covered calls blend simplicity with sophistication, offering income generation and risk management for volatile assets like Bitcoin, MSTR, and MSTX. Their broader adoption shapes market dynamics, influencing volatility, liquidity, and investor behavior.

By tailoring these strategies to specific market conditions, investors unlock powerful tools to navigate volatility and maximize returns. In an ever-changing financial landscape, covered calls are a testament to the elegance of calculated, adaptive trading.

Covered Call Strategies in Action: Bitcoin, MicroStrategy (MSTR), and MSTX was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

41

2 months ago

41

English (US) ·

English (US) ·