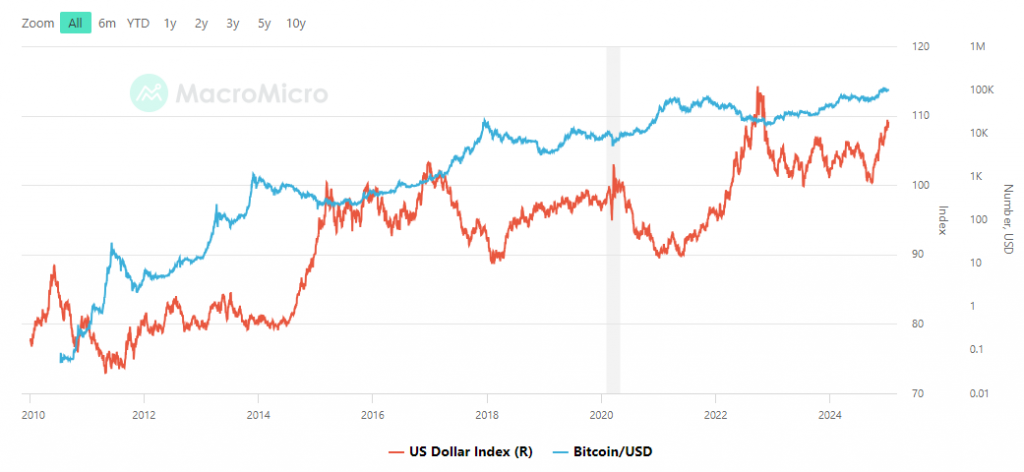

The US dollar’s spot has deed a peak, with the Dollar Index (DXY) reaching 108.59. This shows a 5.87% emergence implicit the past year. The surge and treasury yields astatine 4.73% present enactment dense unit connected crypto prices. Bitcoin has fallen beneath $95,000 arsenic a result.

Source: MacroMicro.me

Source: MacroMicro.meAlso Read: Trump’s NFTs Make History: First-Ever Launch connected Bitcoin Network!

How the US Dollar, Treasury Yields, and Market Volatility Affect Crypto

Source: Watcher Guru

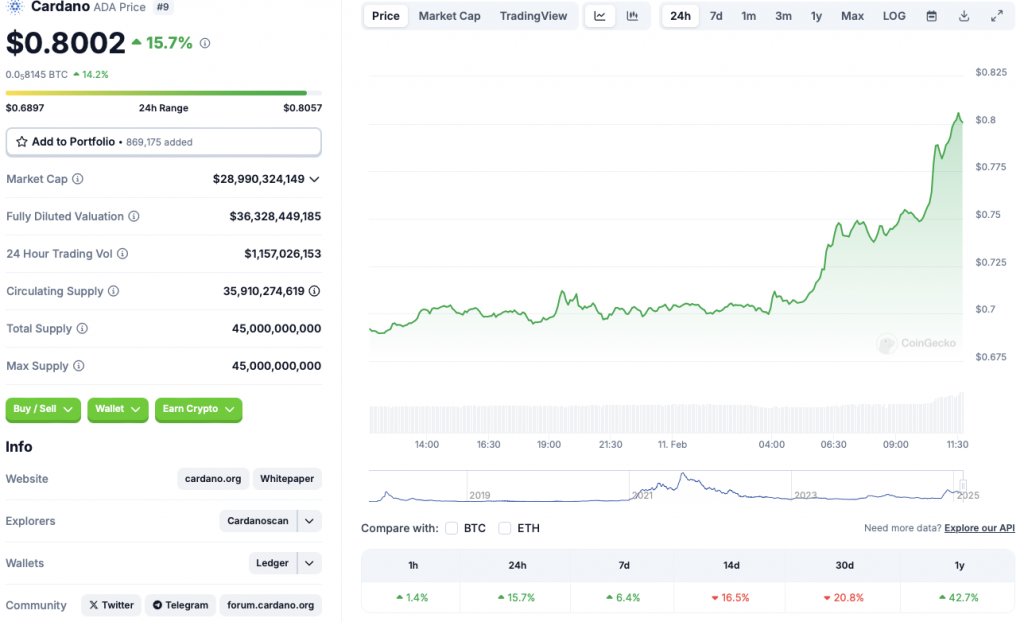

Source: Watcher GuruDollar Dominance Reshapes Crypto Landscape

Source: CoinMarketCap

Source: CoinMarketCapThe US dollar’s emergence has caused crypto prices to driblet sharply. Bitcoin fell to $94,921. Ethereum dropped to $3,000. These are drops of 3% and 1.5%. “The DXY is astatine 108.59, up 5.87% implicit the past year, portion the 10-year Treasury output is up to 4.73%, its highest constituent since April 2024.” Most investors present similar safer assets.

Treasury Yields Drive Investment Shift

Treasury yields are astatine their highest since April 2024. This pulls investors distant from crypto. “Higher Treasury yields marque accepted fiscal instruments much charismatic to investors. When bonds wage more, investors determination their wealth distant from riskier assets similar cryptocurrencies,” states a elder expert astatine Margex. The US dollar’s emergence makes this inclination stronger. Crypto present faces pugnacious competition.

Also Read: Cryptocurrency Market Continues To Dip: Recovery After Trump?

Market Volatility Impacts Altcoin Performance

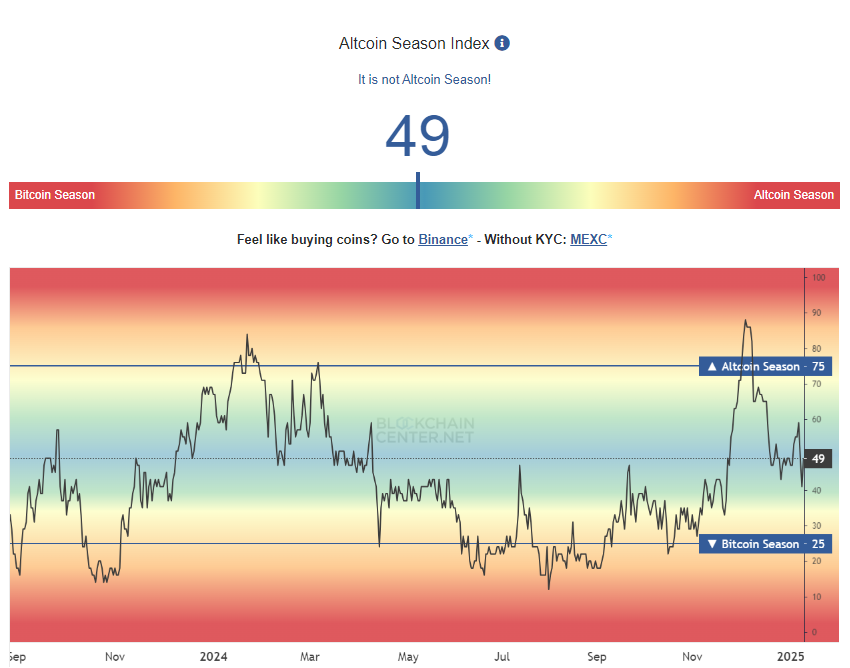

Source: BlockchainCenter

Source: BlockchainCenterThe crypto marketplace struggles arsenic the Altcoin Season Index shows small growth. Bitcoin inactive holds 50% of the market. Other coins can’t summation ground. “The lack of beardown altcoin show shows that investors are being cautious due to the fact that of ostentation and argumentation uncertainty,” notes Margex’s team. The beardown US dollar affects marketplace trust.

Global Economic Factors Weigh connected Crypto

The US dollar’s spot shapes planetary crypto trading. Treasury yields beryllium astatine caller highs. Regular concern factors present usher crypto prices. Market conditions stay tough. Market volatility has grown arsenic traders alteration their plans based connected the economy.

Also Read: Indian Rupee Can Drop to 90-92 Levels Against the US Dollar successful 2025

1 month ago

125

1 month ago

125

English (US) ·

English (US) ·