This morning the crypto market woke up in red panic mode, dragged down by a distinctly bear price action. Bitcoin lost the key support of $90,000 while Ethereum fell below the psychological threshold of $2,500.

What are the causes that are leading to such a significant retracement of the crypto sector? Are we at the dawn of the beginning of a new bear market?

Let’s take a deep breath and calmly analyze the entire situation.

Bloodbath for the crypto market: BTC -7.4%, ETH -10.8%

The crypto market just doesn’t want to recover: after a month of deep corrections, here comes another heavy decline. In the last 24 hours, Bitcoin loses 7.4%, dropping from $95,000 to the current $88,000. Ethereum, on the other hand, records a double-digit percentage drawdown, failing the attack on $2,700 and collapsing below $2,400. Overall, the capitalization of the entire digital asset sector has lost $146 billion, with a contraction of about 5%.

Even on the altcoin front, we do not see positive signals: at the moment we can only draw a veil over all those coins that have almost wiped out the profits of the last bull wave. SOL drops by 14.2% approaching 130 dollars, XRP falls by 13.3% to 2.1 dollars, and DOGE loses 12.1% returning to 0.19 dollars. Only Pi network and some stablecoin manage to maintain a neutral price structure, while isolated cases like BNB register less intense declines compared to those of the bear benchmark Bitcoin.

Situation on the open interest and funding rate side: where are we headed?

Very interesting to highlight how the open interest of almost all crypto assets is scaling downwards. While the decline observed yesterday seemed driven by a speculative spirit, justified by the increase in futures positions, in this case it seems that several players are exiting the market. On BTC, for example, according to Coinalyze data, we notice a significant drop of about 2 billion dollars in open interest, approaching new monthly lows at 28.2 billion dollars.

At the same time, the funding rate has remained in positive territory across all crypto assets, which means that longs continue to pay shorts to keep their positions open. This fuels a scenario of interest from derivative exchange investors, who still find the search for a bull pattern appealing. This trend appears more pronounced on coins like HYPE, XRP, and DOGE.

The situation on the macro front remains bullish, especially for Bitcoin which, unlike altcoins, had not yet fallen so aggressively. There are still all the conditions in place for a new potential bullish leg up, even if in the short term the ball is controlled by the bears. At this point, a return above 100,000 dollars would offer the orange currency the confidence needed for a new rally. On the contrary, however, a drop below 75,000 dollars (EMA 50 weekly) would increase the chances of an extended bear market.

What are the factors triggering the bear market?

In the midst of this bear storm, investors are looking for a scapegoat to blame for the crypto market crash. Although we cannot say with certainty that there was a particular event that triggered the dump, we can still delve into the impact of some scenarios that have hit the industry in recent days.

First of all, there was the $1.4 billion hack at Bybit which contributed to creating a climate of uncertainty, which then resulted in a selling trend. Although there were no direct consequences for Bybit investors, many users were frightened by the incident, comparing the episode to the FTX saga. Additionally, some inaccuracies leaked on X, erroneously explaining how the hackers would have sold all the stolen ether on the market. This hoax facilitated the market decline, helping to bring FUD.

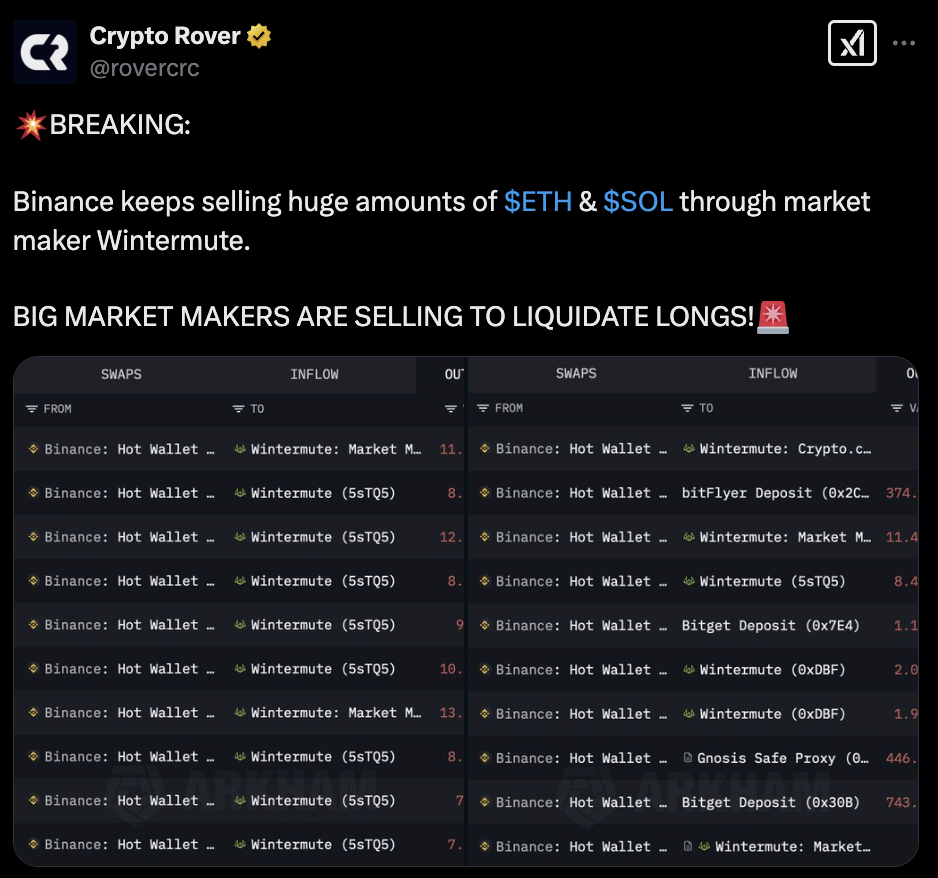

Another factor that partly explains today’s decline is represented by the continuous sales of the giant market maker Wintermute. The latter, which provides liquidity for trading on a wide range of exchanges, has chosen in recent hours to liquidate large positions of BTC, ETH, and SOL on the market, creating strong downward selling pressure.

As a result, there have been cascades of liquidations of long positions, which have accelerated the bearish dynamic. In the last 24 hours, according to Coinglass data, we find liquidations amounting to 1.47 billion dollars, of which 1.36 billion came from longs. Over 600 million have evaporated from Bitcoin futures while about 300 million have been wiped out on Ethereum.

The only possible comment in such circumstances is: REKT!

Source: https://x.com/rovercrc/status/1894020229652427249

Source: https://x.com/rovercrc/status/1894020229652427249

8 months ago

41

8 months ago

41

English (US) ·

English (US) ·