In a dramatic 24-hour period, the crypto market saw a severe downturn, erasing nearly half a billion dollars from traders’ portfolios due to forced liquidations. Bitcoin (BTC) plummeted to $64,569, and Ethereum (ETH) dropped to $3,355, triggering over $482 million in liquidations.

This impact was most severe on long positions.

Crypto Traders Speculate That it is The Final Dip

During this market upheaval, mainstream and emerging digital assets alike suffered. The total number of traders affected reached 192,853.

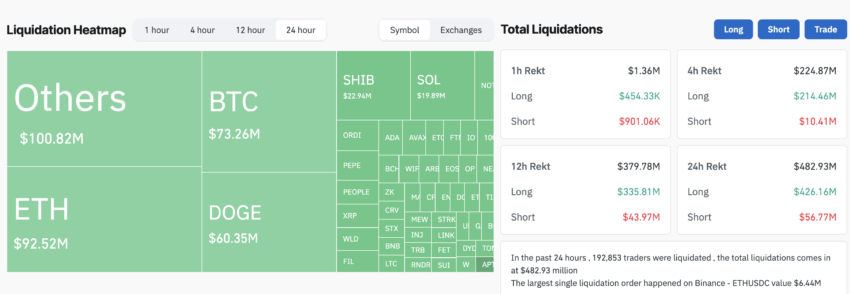

Data from CoinGlass showed Ethereum as the hardest hit, with liquidations totaling $92.52 million. It was followed by Bitcoin and Dogecoin (DOGE), with $73.26 million and $60.35 million in liquidations, respectively.

Read more: How To Trade Crypto on Binance Futures: Everything You Need To Know

The largest single liquidation event took place on Binance, where a trader lost $6.44 million on Ethereum long trade. This highlights the volatile and speculative nature of the crypto market, especially in times of market stress.

Despite these challenges, Bitcoin demonstrated resilience, slightly recovering to $65,500. Ethereum also showed some recovery, trading at $3,440. This quick bounce-back is characteristic of the crypto market, reflecting its volatility and the swift actions of its investors.

Analysts and traders have mixed views on the market’s direction. Crypto Rover, a noted analyst, suggested that a surge to $73,000 for Bitcoin could liquidate over $10 billion in short positions. Meanwhile, trader ChimpZoo predicted a major market reversal.

“This is the final dip. This is the dip to bait every bear into the market. What comes next will be a liquidation candle to send bears back into the shadow realm,” ChimpZoo boldly stated.

Crypto Market Liquidations. Source: Coinglass

Crypto Market Liquidations. Source: CoinglassOutflows from Bitcoin exchange-traded funds (ETFs) further complicate the market scenario. According to Farside Investors, notable outflows were recorded from several funds. Fidelity’s Wise Origin Bitcoin Fund recorded outflows of $92 million, and the ARK 21Shares Bitcoin ETF recorded outflows of $50 million.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Conversely, the Bitwise Bitcoin ETF managed a modest inflow of $2.9 million, showcasing a mixed investor sentiment across different investment vehicles. Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) is yet to release Monday’s flow data.

Excluding IBIT, all the ETFs recorded a combined outflow of $145.9 million on Monday.

The post Crypto Market Loses $500 Million to Liquidations as Bitcoin Falls appeared first on BeInCrypto.

4 months ago

43

4 months ago

43

English (US) ·

English (US) ·