- The crypto market’s first flash crash of 2025 wiped $269 billion in value and liquidated $930 million in leveraged positions.

- Chinese AI app DeepSeek’s disruptive launch triggered panic, leading to selloffs in tech stocks and a ripple effect on crypto markets.

- The Trump administration is pushing a $500 billion AI investment and pro-crypto policies to integrate these emerging sectors.

On Monday, the cryptocurrency market experienced its first major flash crash of the year, sending shockwaves across traders and investors alike. Bitcoin (BTC) and nearly all altcoins saw double-digit losses, wiping $269 billion from the market’s overall capitalization in mere hours.

The crash also obliterated $930 million in leveraged positions, making it one of the most significant liquidations in recent memory. This market rout comes just weeks after Donald Trump’s inauguration as the 47th President and coincided with the sudden launch of DeepSeek, a Chinese AI bot developed at a fraction of the cost of OpenAI’s ChatGPT.

$930 Million Liquidated in 24 Hours

Leverage traders bore the brunt of the bloodbath. Data from Coinglass revealed that over 312,000 traders were liquidated, amounting to $851.44 million in losses. Long traders were hit hardest, losing a staggering $790 million, while short positions saw $59 million in liquidations.

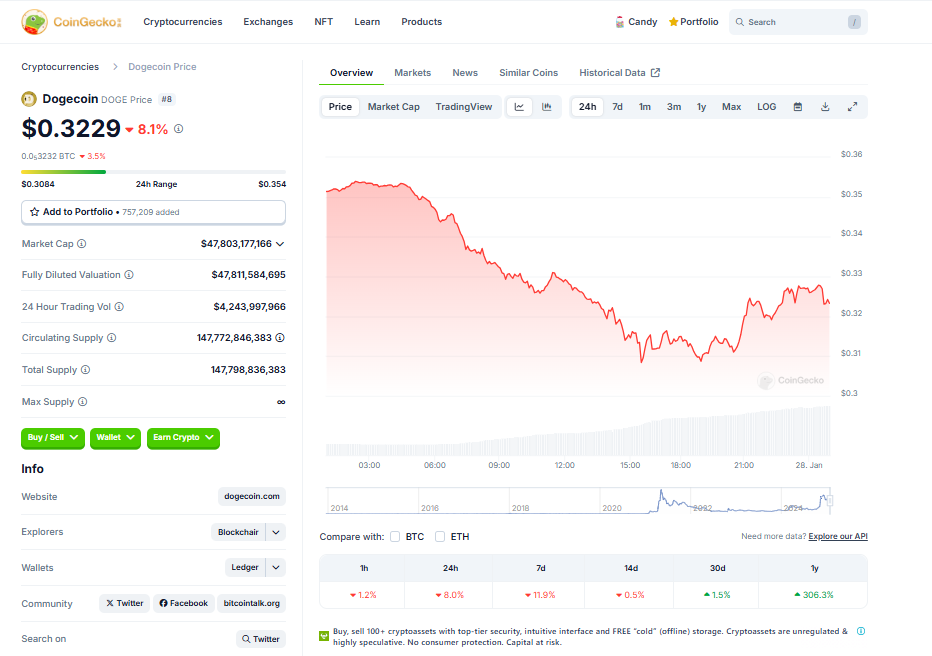

Bitcoin traders accounted for $260 million of the total, with Ethereum (ETH) traders losing another $110 million. Memecoin traders weren’t spared either, with excessive bets on speculative assets amplifying the chaos. Dogecoin (DOGE) plunged 15%, PEPE saw a staggering 30% drop, and Trump’s newly launched memecoin tumbled over 20%.

BTC itself plummeted by 10%, falling from $105,277 to $97,785, while Ethereum mirrored this decline, sliding from $3,343 to $3,024. Memecoins fared worse overall, highlighting the volatile nature of the sector.

DeepSeek’s Launch Sparks Chaos

Observers point to the launch of DeepSeek, a Chinese AI app, as a potential trigger for the market turbulence. The app, positioned as a rival to ChatGPT, caused ripples in both traditional stock markets and crypto due to its disruptive potential.

DeepSeek, created on a budget of just $5.5 million compared to the billions spent on ChatGPT, quickly rose to the top of the Apple App Store’s free software rankings. Its success has spooked investors, leading to selloffs in tech-heavy U.S. stocks like Nvidia. This ripple effect extended to crypto markets, where AI-related tokens nosedived, with many losing 20%-70% of their value.

Trump Administration’s Crypto-AI Push

Interestingly, the Trump administration has taken an aggressive stance on crypto and AI innovation. President Trump announced a $500 billion investment to bolster the American AI ecosystem, pairing it with pro-crypto executive orders aimed at integrating these two transformative industries.

While these initiatives show promise, the immediate aftermath of DeepSeek’s launch and the overleveraged state of the market have exposed just how fragile the current landscape remains. Investors and analysts are left wondering: is this just a hiccup, or a sign of more turbulence to come?

8 months ago

61

8 months ago

61

English (US) ·

English (US) ·