After a rough start to the week with massive liquidations, the crypto market has finally experienced some relief, with a rebound driven by favorable broader macroeconomic changes.

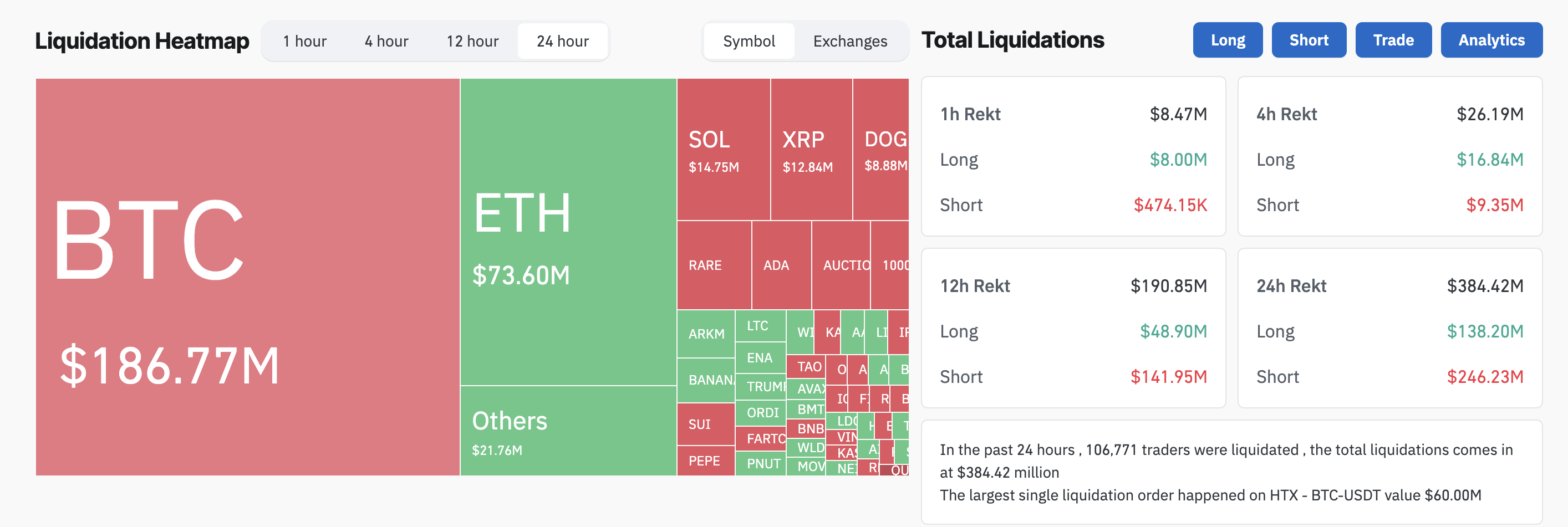

Liquidations over the past day totaled $384.4 million, a significant drop from previous days. Meanwhile, the global market cap rose 1.1% over the last day.

Crypto Market Recovers After Massive Liquidations

The market’s dip was primarily driven by fears of a global recession, trade wars, and broader macroeconomic uncertainty. As a result, Bitcoin (BTC) and Ethereum (ETH) plunged to monthly and yearly lows.

This sharp decline led to widespread liquidations. Nearly $1 billion was liquidated from the market yesterday. Nonetheless, the latest data paints a slightly more favorable picture.

According to Coinglass data, $384.4 million was liquidated in the past 24 hours. Of this, $138.2 million came from long positions, while $246.2 million were short positions.

Crypto Market Liquidation. Source: Coinglass

Crypto Market Liquidation. Source: CoinglassSpecifically, Bitcoin saw $186.7 million in liquidations, with $146.0 million attributed to short positions. Ethereum experienced $73.6 million in liquidations, with $40.3 million from long positions and $33.1 million from short positions.

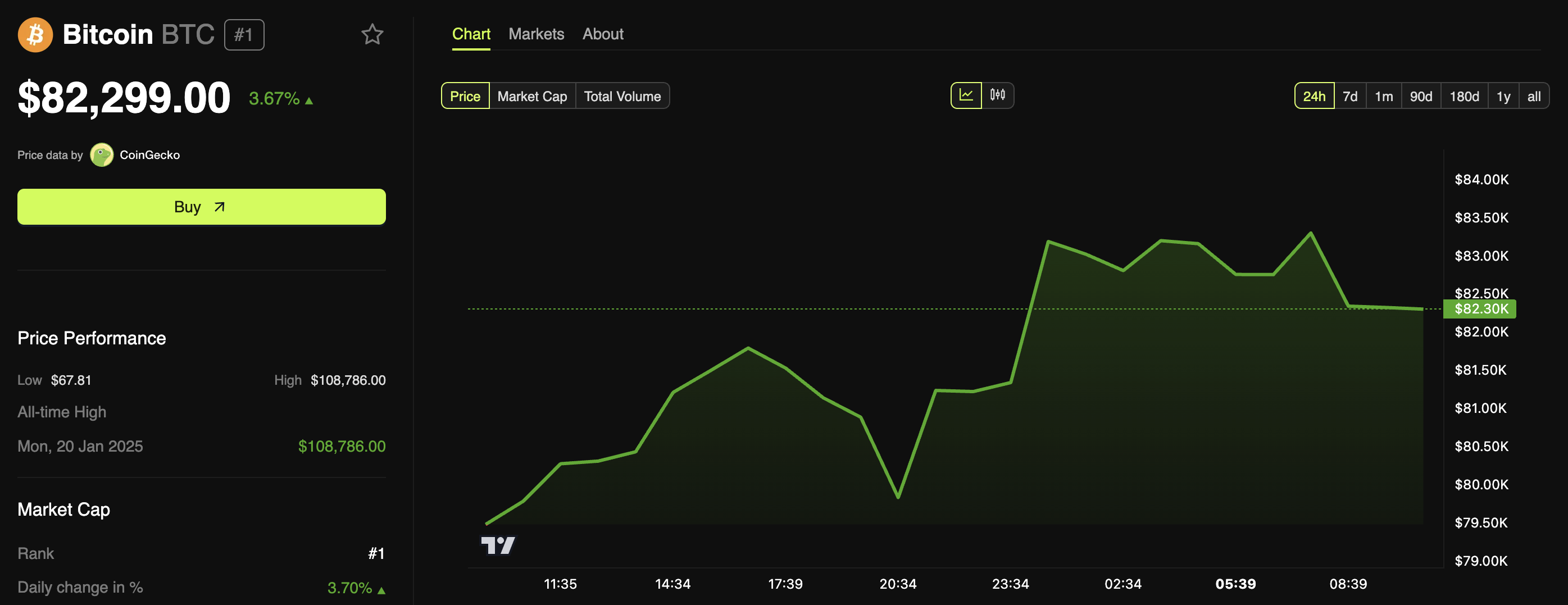

Meanwhile, Bitcoin regained ground over $80,000, trading at $82,299. This marked a 3.6% increase over the past day.

Bitcoin Price Performance. Source: BeInCrypto

Bitcoin Price Performance. Source: BeInCryptoNotably, the recovery could be attributed to recent diplomatic developments. According to Bloomberg, Ukraine agreed to a temporary 30-day ceasefire in response to a US proposal. This has reduced geopolitical tensions that had previously weighed on the market.

Furthermore, Ontario suspended 25% tariffs on electricity exports to Michigan, New York, and Minnesota. This was also a major step towards easing trade tensions.

US political figures, including House Speaker Mike Johnson, have also provided much-needed reassurance to the markets. Johnson suggested that President Trump’s economic policies, which initially contributed to market instability, would eventually stabilize the economy.

“Give the president a chance to have these policies play out,” he said.

In addition, White House Press Secretary Karoline Leavitt noted that the market dip represented a temporary state rather than a definitive or permanent trend.

“We are in a period of economic transition,” Leavitt stated.

She emphasized the idea that market numbers, such as stock prices, trading volumes, and liquidations, reflect a specific point in time and can evolve. These combined factors—political reassurances, easing trade tensions, and a reduction in geopolitical risks—have contributed to the crypto market’s recent recovery.

The post Crypto Market Recovers from Heavy Sell-Offs, Boosted by Macro Trends appeared first on BeInCrypto.

7 months ago

58

7 months ago

58

English (US) ·

English (US) ·