Crypto investors lose $80 billion because of the crypto market selloff on Monday, with the market cap dwindling from $2.1 trillion to $2.03 trillion. Bitcoin and Ethereum prices saw a sudden selloff amid another assassination attempt on Republican presidential candidate Donald Trump at his Florida golf club Sunday.

Moreover, the crypto market fear & greed index has slipped from 51 (neutral) to 39 (fear) in a day. Altcoins such as Solana (SOL), XRP, Cardano (ADA), and Dogecoin (DOGE) also dropped mirroring Bitcoin and Ethereum fall. However, the traders are upbeat overall as they focus on the FOMC meeting and Jerome Powell’s decision on Wednesday.

Why Is Bitcoin Price Dropping?

Bitcoin price fell as traders turned cautious ahead of the highly-anticipated pivot from the Federal Reserve this week. The market expects rate cuts for the first time since 2020, with speculation of a 50 bps rate cut.

According to CME FedWatch tool, there’s a 61% probability of a 50 bps rate cut and 39% odds of a 25 bps in after the FOMC meeting. Also, the data indicates a total of 125 bps Fed rate cuts this year.

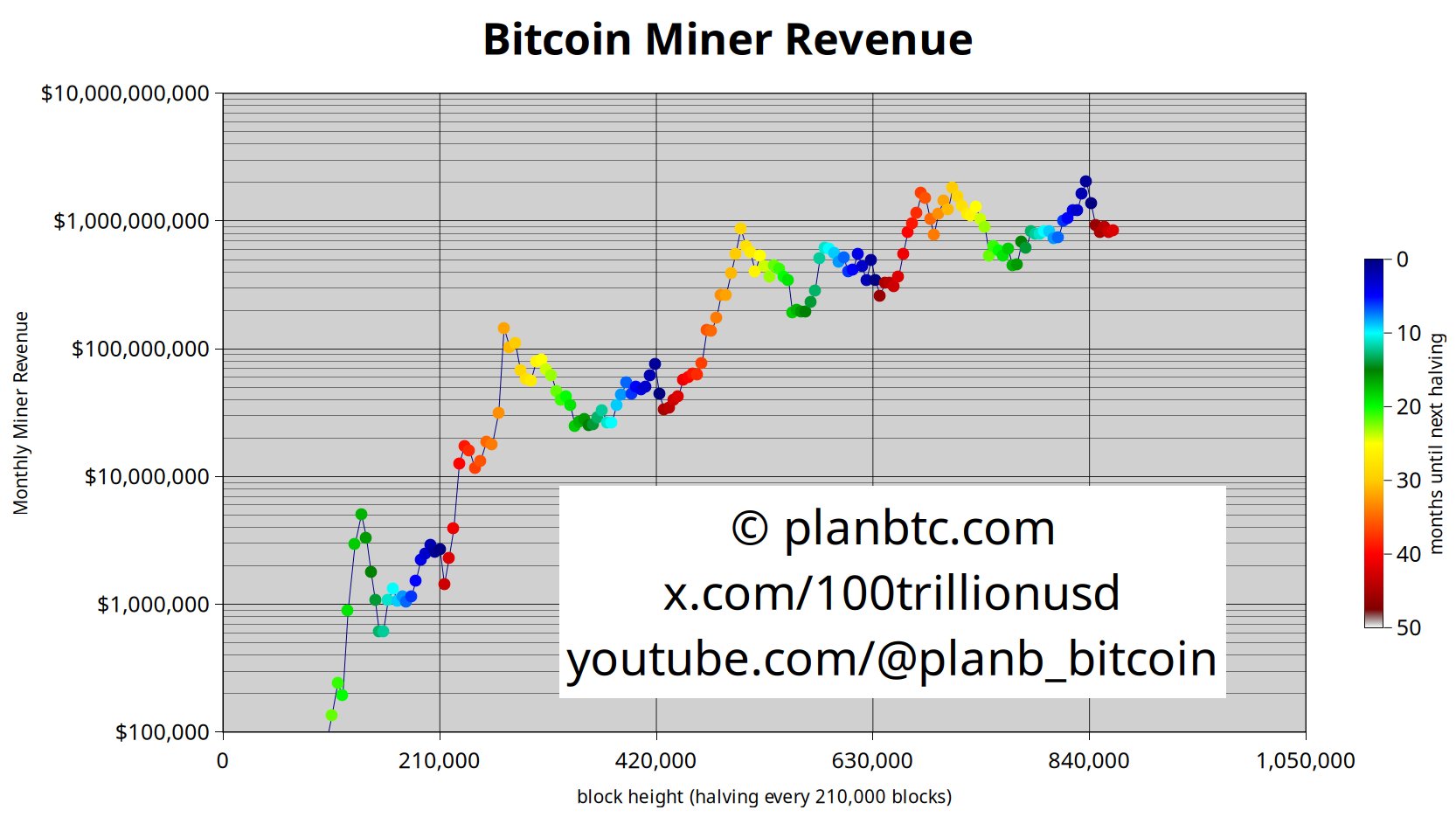

PlanB, creator of the bitcoin stock-to-flow (S2F) model, shared a Bitcoin miner revenue chart on X. He warned that miners are still struggling after Bitcoin halving and liquidating their holdings gradually. He said, “We need 2x current BTC price to kick-start the bull pump.” This aligns with historical patterns where BTC price post halving sustained miner profitability.

Crypto analyst Credible Crypto noted that BTC price retraced perfectly from the ideal $61-62K resistance zone. However, the price is currently holding above the $58,500 level, which is crucial to prevent further flush to the downside.

Coinglass data shows nearly $35 million in BTC liquidation, with $30 million in longs liquidated. Bitcoin price fell to a 24-hour low of $58,112 as traders sold BTC when the price fell below 50-SMA (blue).

Moreover, the price successfully reversed from the 0.618 Fib retracement level to the 0.5 Fib retracement level in the daily timeframe. The price is expected to move sideways near the $59,000 level until the FOMC meeting. A 50 bps rate cut will boost sentiment, but prices momentum will remain volatile.

Why Ethereum Price Tumbled Below $2,300?

A dormant ‘diamond hand’ Ethereum whale has become active after eight years and selling its ETH holdings. Also, other whales have been bearish after Ethereum Foundation and Vitalik Buterin sold ETH recently.

Popular analyst Ali Martinez noted that ETH price risks dropping further if it fails to hold key support between $2,290 and $2,360. Notably, 1.90 million addresses hold around 52 million ETH in this range. He added that a break below this demand zone could lead to a wave of sell-off, driving the price toward $1,800.

ETH price tumbled 6% in the past 24 hours, with the price currently trading at $2,308. The 24-hour low and high are $0.643 and $0.664, respectively.

The fall in Bitcoin price and Ethereum has triggered a fall in other altcoins such as SOL, XRP, DOGE, and ADA. The market is to focus completely on the FOMC meeting for further cues on direction.

The post Crypto Market Selloff: Here’s Why Bitcoin, ETH, SOL, XRP, DOGE Fell Sharply appeared first on CoinGape.

4 days ago

15

4 days ago

15

English (US) ·

English (US) ·