The stock market has a way of delivering its own holiday magic — bullish runs that often begin just before Christmas. Bitcoin has experienced these Santa Claus rallies eight times in the past decade. Will 2024 bring another festive surge for the cryptocurrency?

❄️ What is Santa Claus rally?

Like the “Thanksgiving effect,” the term “Santa Claus rally” originates from the stock market. It refers to a tendency for stock prices to rise in the week before Christmas or between Christmas Day and the New Year.

Yale Hirsch, founder of the Stock Trader’s Almanac, introduced the phrase in 1972. He identified a specific seven-day window: the last five trading days of December and January’s first two trading days.

Over time, the definition has broadened to include asset rallies from late December into mid-January. For instance, Bitcoin’s jump to $44K during the first week of December 2023 was labeled an “early Santa Claus rally,” as it marked a return to levels last seen in April 2022.

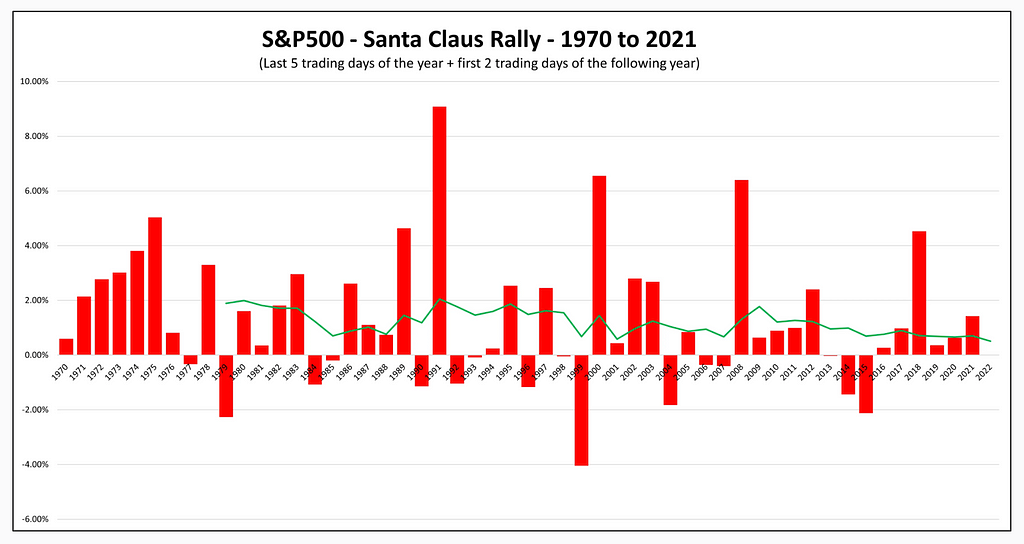

S&P 500's Santa Claus rally period performance from 1970 to 2021. Source: Reddit

S&P 500's Santa Claus rally period performance from 1970 to 2021. Source: Reddit🎄 Santa Claus rallies in stocks: Myth or reality?

At a glance, traditional markets do exhibit a bullish bias during this period, but the data is far from conclusive. Let’s examine key statistics from the Standard & Poor’s 500 index (S&P 500):

- Over the past 70 years, this seven-day stretch has seen gains 79.2% of the time.

- Between 1950 and 2022, the S&P 500 rose 57 times, averaging a +1.3% increase, according to the Stock Trader’s Almanac.

- The 2022–2023 rally was more modest, delivering just +0.8%.

- The 2023–2024 dip snapped a seven-year streak for the phenomenon.

The week before Christmas offers even more mixed results, with performance swinging from +5.4% in 2021 to -10.7% in 2018. Between 2002 and 2021, the S&P 500 ended the week in the green 13 times, dropped five times, and recorded two neutral outcomes.

❓Why do Santa Claus rallies occur?

Several theories attempt to explain this phenomenon:

- Seasonal optimism. The holiday season’s cheer and increased consumer spending may lift market sentiment.

- January effect. Investors often buy stocks in January, expecting further seasonal gains, or use holiday bonuses to enter new positions.

- Tax-loss harvesting. Investors sell underperforming stocks to offset taxable gains from profitable assets.

- Lower trading volumes. With institutional investors often on holiday, retail traders dominate, leading to heightened price volatility and upward pressure.

- Year-end performance boosts. Some investors purchase top-performing stocks to polish their portfolios for year-end reporting.

📈 Santa Claus rallies in crypto

Bitcoin’s performance during December and January has been unpredictable, with rallies in some years and significant downturns in others.

Technical analysis

Andrew Kamsky of CCN studied a hypothetical trade: buying Bitcoin on Christmas Day and selling around mid-January. His findings showed:

- Bitcoin enjoyed a rally six times — in 2011–2013, 2019, 2020, and 2022.

- The average gain during these rallies was 31%, starkly contrasting with the average loss of 21% in 2014, 2015, 2017, and 2021.

☝️ It is important to note that in late 2022, BTC traded in the red. On Jan. 14, 2023, it surged to $21K after lingering below $17K since Dec. 16. Strictly speaking, the gains occurred after the Santa Claus rally period.

Bitcoin’s largest Santa Claus rally to date — adding 13.19% — materialized in the pre-Christmas week in 2016, as the price jumped to reclaim the $1K level.

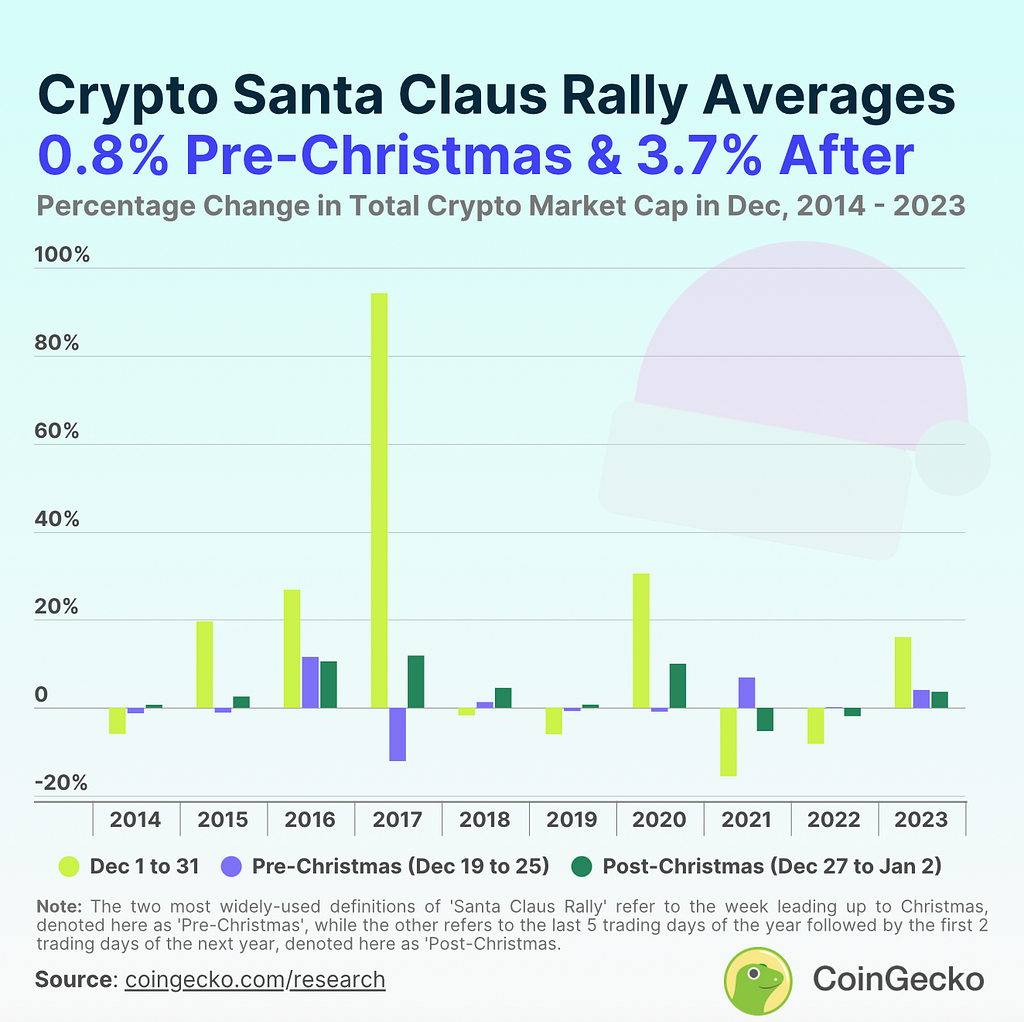

In 2023, Bitcoin surged post-Christmas, gaining 3.64%, according to CoinGecko estimates. Based on its analysis, crypto has seen a ‘Santa Claus rally’ eight times in the last decade, with post-Christmas gains more common than pre-Christmas ones.

Crypto Santa Claus rally stats 2014–2023. Source: CoinGecko

Crypto Santa Claus rally stats 2014–2023. Source: CoinGeckoThe crypto Santa Claus effect was mostly observed in the week leading up to Christmas, with just five occurrences in the period afterward.

“Specifically, the Bitcoin Santa Claus rally ranged from 0.20% to 13.19% pre-Christmas and 0.33% to 10.86% post-Christmas. This is in line with the Santa Claus rally effect on the broader crypto market.”Sentiment trends

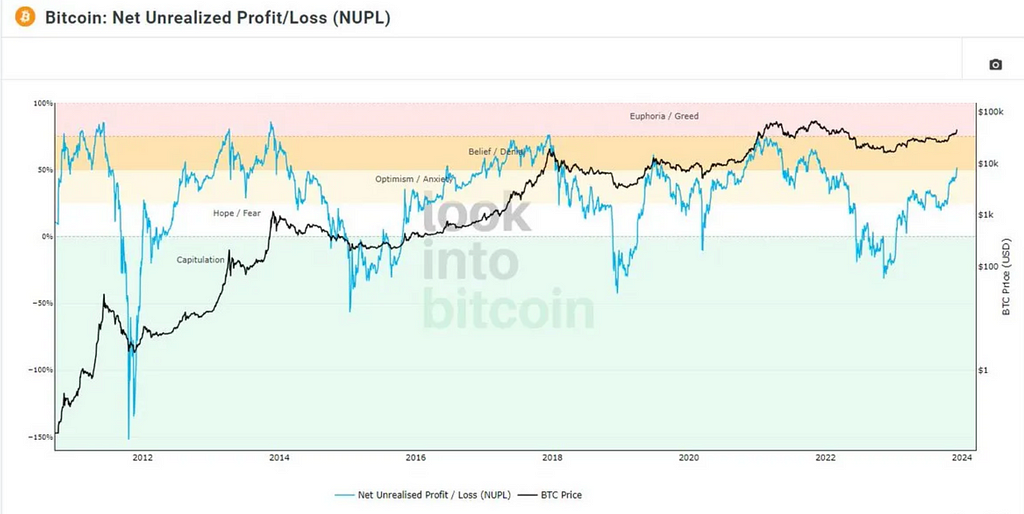

Kamsky also analyzed Bitcoin’s market sentiment from 2010 to 2022, categorizing it into five emotional states:

- Euphoria (2010, 2013): Extreme optimism led to short-term gains.

- Capitulation (2011, 2014, 2022): Predominantly bearish, though some “buy the dip” behavior was observed.

- Belief/Denial (2012, 2017, 2020, 2021): Mixed outcomes, with sentiment swinging unpredictably.

- Optimism/Anxiety (2015, 2016, 2019): Diverse investor behavior resulted in varied outcomes.

- Hope/Fear (2018): Market indecision caused a neutral result.

BTC price trajectory between Dec. 24 and Jan. 4, 2024. Source: CoinGecko

BTC price trajectory between Dec. 24 and Jan. 4, 2024. Source: CoinGeckoOn Jan. 2, 2024, BTC dashed past $45K for the first time in almost two years as the deadline for the SEC’s approval of spot Bitcoin ETFs drew close. The spirits were high, with hopes for broader acceptance and regulatory clarity. In stark contrast, US stocks dipped to start the new year.

Bitcoin sentiment analysis. Source: Jamie Coutts (X)

Bitcoin sentiment analysis. Source: Jamie Coutts (X)🟢 Bitcoin Santa Claus rally 2024/2025: Drivers to watch

Bitcoin has just hit a fresh ATH at $106,352. The optimism around the US president-elect has already fueled the longest winning streak since 2021 (seven days as of Dec. 16, 2024. Investors have many reasons to expect another Santa Claus rally this year — here are the top five.

1. Fed’s interest rate cut in December

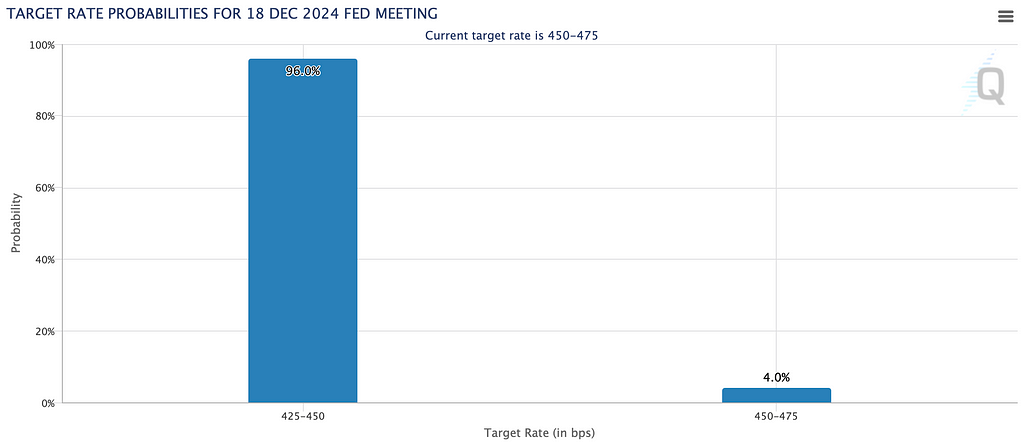

The last FOMC meeting this year is scheduled for Dec. 17–18. The markets anticipate a 25-basis-point reduction, which could significantly benefit digital assets. CME FedWatch reflects a 96% chance of this outcome.

When the regulator hiked rates throughout 2018, the BTC price collapsed as money got tight. In 2020, the rates were reduced to zero to cope with the global coronavirus pandemic, facilitating new ATHs for BTC and altcoins.

Bitcoins’ rise in Q4 2024 came amid another Fed pivot. Continued cuts of the benchmark borrowing rate helped it roar with bullish approval as daily exchange volumes grew.

Probability of a Fed rate cut on Dec. 18. Source: CME FedWatch

Probability of a Fed rate cut on Dec. 18. Source: CME FedWatch💡 Learn more about the impact of Fed pivots in our guide: Fed policy and Bitcoin in 2024: Impact of Fed pivots 📖

2. Crypto-friendly Republican administration

The US president-elect has made important moves reflecting his embrace of crypto. In mid-December, Donald Trump introduced a new White House position, selecting David Sacks as his AI and crypto czar.

The former PayPal senior executive will guide policy in these areas, “critical to the future of American competitiveness.” Previously, Trump nominated another pro-crypto candidate — Paul Atkins, a former SEC commissioner — as the next SEC chairman.

Meanwhile, Brian Quintenz, a16z crypto’s Head of Policy, is now the leading candidate for the CFTC chair position. The agency is expected to play a key part in digital asset regulation. These developments signal a promising future for the industry under the new administration.

3. End-of-year sales bump

Historically, Bitcoin has seen the largest gains in Q4, with November as a particularly successful month. Based on Coinglass data, December is also promising.

Bitcoin’s monthly returns. Source: Coinglass

Bitcoin’s monthly returns. Source: CoinglassThis November, the BTC price shot up 37.29% — higher than in any historical month. The hike is also far above last November (+8.81%). This quarter is outperforming Q4 2023 at press time with +64.95% vs. +56.9%.

The final stretch of the calendar from Nov. 1 to New Year’s Eve is traditionally when annual revenue quotas are exceeded. The crypto industry is no exception, and a strong November could be a promising sign for a potential Santa Claus rally if the sentiment holds.

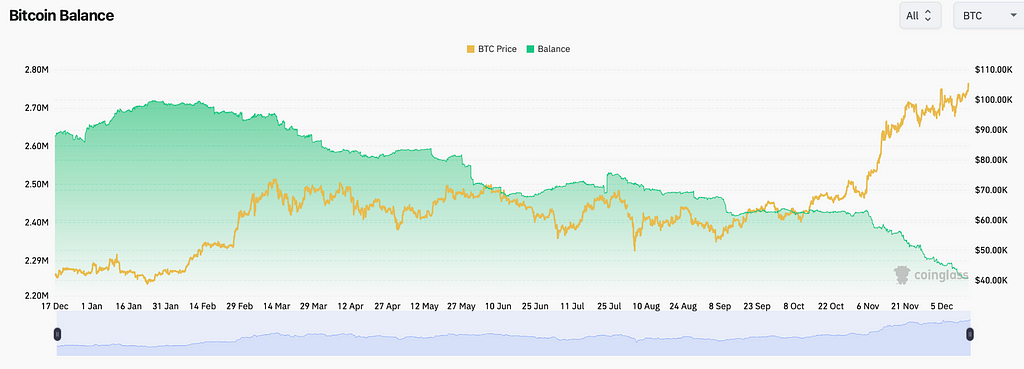

4. Crypto exchange outflows

Following the halving, which slashed the daily new supplies in BTC, exchange availability has also shrunk. The dip in exchange liquidity is a long-term price support.

Exchange balances have declined since early November, with over 120K BTC withdrawn over the past 30 days. Just under 14% of the total supply remains on the platforms.

BTC balance on exchanges. Source: Coinglass

BTC balance on exchanges. Source: CoinglassHODLers own — and effectively lock — 15 million coins, or 75% of the total circulating supply. Growing illiquid supply is a sign of long-term investor confidence. This gauge hit a new ATH in early December.

5. Bitcoin’s supply cycle

The fourth Bitcoin halving happened on Aug. 21, 2024. The quadrennial 50% cut in daily new supply makes BTC deflationary due to its fixed supply limit of 21 million coins.

Halvings may be likened to the Fed raising its rates every four years. This measure should make the USD stronger in purchasing power over time. However, the agency also lowers its rates to weaken the USD, allowing spending to accelerate while economic growth makes up the difference.

For Bitcoin, the spending power is only designed to rise over time. The halving mechanism decreases the rate of new supply, shoring up and consolidating the buying power in the long run.

In a nutshell

From 2014 to 2023, Bitcoin logged eight December-January rallies, proving it has a modestly bullish historical edge during this period. This year, the spirits are high, supported by Trump’s reelection and the Fed’s easing. Yet, as always, market behavior is subject to change.

Crypto Santa Claus rally: 5 top catalysts in 2024/2025 was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

5 days ago

12

5 days ago

12

English (US) ·

English (US) ·