Bitcoin’s (BTC) price appears to be in a precarious situation as major stakeholders, often referred to as crypto whales, have reportedly paused their buying activities.

This halt in purchases has sparked concerns about Bitcoin’s future valuation, particularly as technical patterns indicate a bearish trend. Historically, such trends have been associated with prolonged downswings or periods of consolidation.

Crypto Whales Step Back as Bitcoin Turns Bearish

Recent data from Lookonchain suggests that institutions have stepped back from Bitcoin purchases, coinciding with a 1.44% decline in Bitcoin’s value over the past 24 hours. Currently, Bitcoin is trading around $58,300, a drop from last Monday’s high above $61,900.

The recent price decline below the $60,000 mark seems to have impacted institutions’ interest in Bitcoin.

“Institutions seem to have temporarily stopped buying, and the price of BTC dropped 4.5% today! We noticed that institutions stopped receiving USDT from Tether’s Treasury and transferring it to exchanges 2 days ago,” Lookonchain stated.

Additionally, stablecoin deposits to Tether’s Treasury have declined, and an outflow of 1.3 billion USDT has been made to exchanges since the August 5 crypto market crash, indicating reduced buying pressure and a more cautious approach from investors.

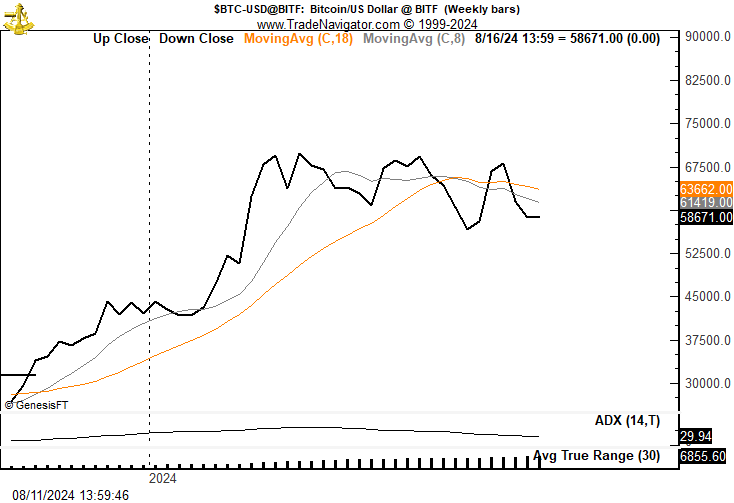

Amid these concerns, trading veteran Peter Brandt pointed out that Bitcoin could have witnessed a trend reversal from bullish to bearish. The analyst spotted a “death cross” on the weekly chart between the 8 and 19 simple moving averages (SMA).

Although this is not always a reliable predictor of future price, it suggests the beginning of a downtrend.

Bitcoin Weekly Chart. Source: Trade Navigator

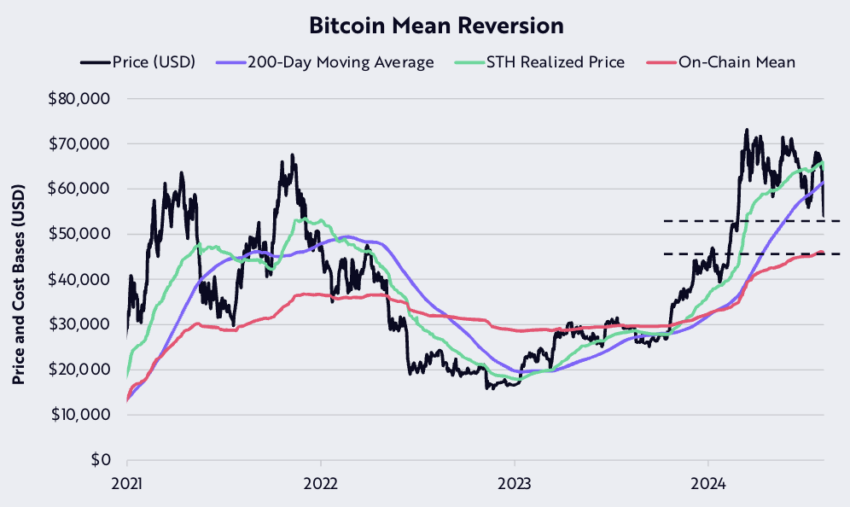

Bitcoin Weekly Chart. Source: Trade NavigatorInterestingly, David Puell, a Research Associate at ARK Invest, provided insights into Bitcoin’s critical support levels in the event of a price correction.

“Bitcoin’s most important price supports are at $52,000 and $46,000, the latter confirmed by its on-chain mean, the red line on the chart,” Puell explained.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Bitcoin Mean Reversion. Source: Ark Invest

Bitcoin Mean Reversion. Source: Ark InvestIn summary, Bitcoin’s current technical conditions, marked by the pause in institutional buying and the emergence of a death cross, suggest a cautious outlook in the short term. With critical support levels identified and market sentiment leaning towards risk off, the coming weeks will be pivotal in determining whether Bitcoin can stabilize or if further declines are on the horizon.

The post Crypto Whales Halt Bitcoin Buys Amid Death Cross and $46,000 Target appeared first on BeInCrypto.

2 months ago

33

2 months ago

33

English (US) ·

English (US) ·