Crypto whales significantly impact market trends by offloading substantial amounts of Bitcoin (BTC) and Ethereum (ETH). Recent data indicate a continued pattern of these extensive sales, totaling over $148 million in crypto, moved to various exchanges for probable liquidation.

Since last week, Bitcoin has been trying to recover after dipping to $58,500. Attempts to rally were evident; Bitcoin nearly reached $64,000 on Monday. However, increased selling pressure forced prices below $63,000.

Bitcoin ETFs Recorded $129 Million in Inflows While Crypto Whales Sell

On Monday, a prominent crypto whale linked to the wallet address 3G98j transferred 1,800 BTC valued at $114 million to Binance at around $63,333. This move typically signals an intent to cash out, reflecting a common strategy among crypto whales during market volatility.

“The Bitcoin price started declining after the whale unloaded BTC,” Spot On Chain said.

Further analysis highlights a significant shift in trading behavior. From June 19 to 21, the crypto whale withdrew 6,725 BTC, valued at $437 million, from Binance and OKX at an average price of $65,008.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

This marked the crypto whale’s first major BTC accumulation in over 1.5 years. However, as prices declined by over 4.11%, the crypto whale has sent 3,481 BTC back to Binance in the past five days, indicating a bearish sentiment.

Historically, this crypto whale has shown strategic trading acumen, netting about $1 billion from BTC transactions between 2022 and 2024. During the 2022 bear market, he amassed 41,000 BTC at an average of only $19,000. He later capitalized on this by unloading 37,000 BTC at around $46,800 during the bull markets of 2023 and 2024.

Ethereum has also seen similar whale activities. On early Monday, the crypto wallet 0xedo, allegedly associated with Abraxas Capital, deposited 42,000 ETH, worth approximately $34.78 million to Bitfinex. Despite these large transactions, this crypto whale still holds a significant position in ETH, with over $112 million currently spread across lending and farming platforms like Spark, GearBox, and Stargate, securing a profit of $4.53 million.

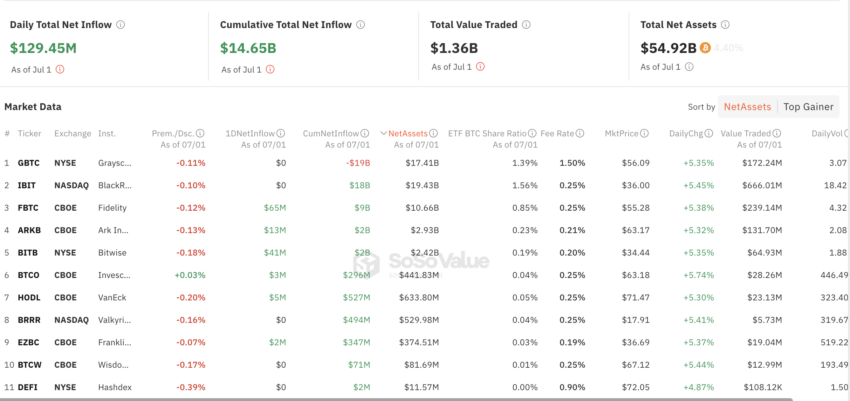

Meanwhile, there has been a glimmer of hope for Bitcoin investors. Spot Bitcoin ETFs recorded a substantial inflow on Monday, with $129 million entering the market.

This is the highest in the past 16 trading days. The Fidelity Wise Origin Bitcoin Fund attracted the largest inflow, with $65 million. Moreover, both BlackRock’s iShares Bitcoin Trust and Grayscale Bitcoin Trust reported 0 inflows on Monday.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Spot Bitcoin ETFs Net Flows. Source; SoSoValue

Spot Bitcoin ETFs Net Flows. Source; SoSoValueThis contrast between whale sell-offs and significant ETF inflows illustrates the complex and often contradictory forces shaping the crypto market. Such insights are essential for anticipating market shifts and protecting investments, ensuring stakeholders remain informed and vigilant.

The post Crypto Whales Shake Up Market: Over $148 Million in Bitcoin and Ethereum Moved for Sale appeared first on BeInCrypto.

4 months ago

38

4 months ago

38

English (US) ·

English (US) ·