A new age is upon us. Donald J. Trump’s election as the next president of the United States is a history-defining moment set to impact the lives of everyone around the globe.

Trump’s pro-crypto stance during the presidential campaign led the crypto world to regard the election results as a personal victory.

The new administration is expected to define clear market regulations and end the Securities and Exchange Commission’s anti-crypto crusade.

Optimism about the new Trump era began to show on Election Night even before a winner had officially been declared, thanks to Polymarket’s user’s ability to understand and apply known data faster than traditional electoral mechanisms.

The price of Bitcoin rallied to $80,000, with altcoins following its lead. A torrent of iconic memes making fun of SEC chair Gary Gensler flooded social media, and the narrative regarding a DeFi Renaissance came to the fore in full force.

Crypto Euphoria as Trump Wins — But Will It Last?But Web3 was already showing signs of growth before Trump was elected.

During October, venture capitalist firms more than doubled the monthly average investments in the sector, pouring over $2.5 billion into crypto startups. Solana, which on election night rallied 17%, trumping BNB as the third-largest cryptocurrency, reached a new all-time high of over 120 million monthly active addresses.

Solana’s Monthly Active Addresses Hit All-Time High in OctoberAnd while what happens in the United States is determinant for worldwide money flows, blockchain development and adoption are happening all over the world.

In Brazil, the ten largest market crypto market worldwide, Polkadot is launching a blockchain development education program that will offer free online blockchain programming courses to São Paulo’s business community in partnership with the city’s investment agency.

Polkadot Partners with São Paulo for Education as Brazil’s Crypto Market SurgesIn Singapore, the monetary authority asset tokenisation initiative Project Guardian has allowed Chainlink, Swift, and UBS Asset Management to develop a program that bridges conventional payment systems and digital assets by enabling financial institutions to settle tokenized fund transactions with Swift.

Singapore’s Project Guardian: Swift, UBS, Chainlink Pilot Connects Tokenized Assets with TradFi Systems🔥 Highlights Of The Week

- Solana Defi giant Jito reached a global deposit cap of $25 million a few hours after launching its restaking initiative;

- Chainlink has launched a “paradigm shift” upgrade with New Runtime Environment;

- MakerDAO governance has approved the Sky rebrand.

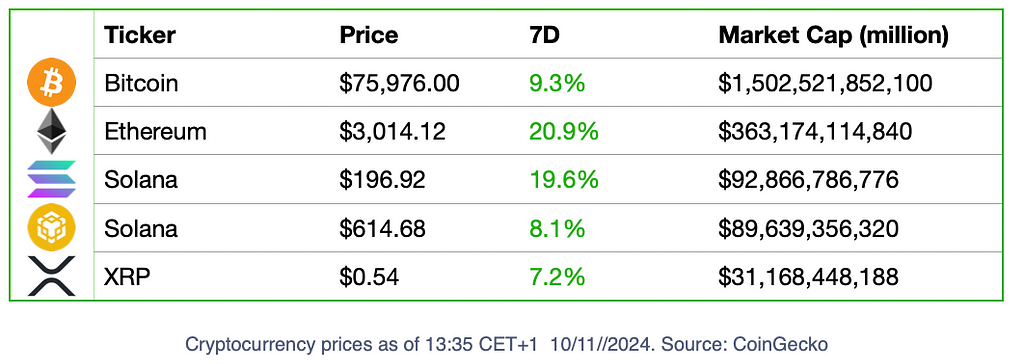

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- A common mistake in crypto: sending assets to the wrong addresses might soon be able to be reverted. Recent research has concluded that there might be a way to recover more than $12 million in cryptocurrency that was long thought to be permanently lost after being sent to the wrong networks.

- Decentralized finance protocol Ondo Finance grew 120% in the third quarter of the year, as the firm’s two flagship products outpaced competitors, leading it to secure $650 million in total value locked (TVL).

😈 Crypto Naught And Sloppy

- Hamster Kombat seems to have been just another crypto’s passing fad. The project is fighting for its survival, with monthly active users falling about 86% in the month following the $HMSTR launch.

- The two Ethereum developers who joined the EigenLayer advisory council in May inspired a controversy about conflict of interests in the Ethereum Foundation. They have quit their roles in the retaking protocol due to concerns regarding their legitimacy.

Project Of The Week: Eclipse

Eclipse Launches First Layer-2 Network Combining Ethereum and Solana Tech

The debate about which network is the best — Ethereum vs. Solana — is reaching new highs every week. Rather than joining one of the sides, Eclipse has offered a third option.

Eclipse’s layer-two network runs on Ethereum and is built on Solana Virtual Machine (SVM) to leverage both Ethereum’s decentralisation and Solana’s efficiency.

The solution seems to please developers on both fronts: on day one, it integrated more than 60 dApps across various sectors, and several prominent dApps from both ecosystems announced their launch on Layer 2.

As John Lennon said: “Make peace, not war.”

Deep Dive: Ethereum’s Mekong Testnet

Ethereum Mekong testnet is a first step into the ambitious Ethereum roadmap and will incorporate eight of the networks’ improvement proposals (EIPs) proposed for the Pectra fork.

Understand what is the purpose of this short-lived testnet and what are the changes it introduces.

Ethereum Unveils Mekong Testnet Ahead of Pectra Fork🔫 Quote Of The Week

“Binance and Coinbase listing is not fancy anymore,”Added Hitesh Malviya to an incendiary discussion on X about the fees that centralized exchanges charge for new products.

In recent months, the large number of projects with high FDV and low TVL has raised concerns regarding the predatory role of VCs and CEXs. The community angst has had practical consequences, as the share of decentralised exchanges’ spot trading volume has been growing rapidly since September.

Crypto World Weekly Overview 10/11/2024 was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

3 months ago

52

3 months ago

52

English (US) ·

English (US) ·