TLDR

- Dow, S&P 500, and Nasdaq 100 futures all gained approximately 0.2% Tuesday evening as traders awaited crucial ADP jobs data

- Bitcoin surged past $91,000 with an 8% gain while ethereum jumped 10% to reclaim $3,000 on Tuesday

- Vanguard reversed its crypto ETF ban and Bank of America authorized advisers to recommend 1-4% portfolio allocations to digital assets

- Fed rate cut probability for December 10 meeting increased to 87.2% from 63% a month earlier

- Crypto market cap recovered to $3.06 trillion after dipping below that threshold during weekend selling

Stock and cryptocurrency markets both moved higher Tuesday as major financial institutions eased restrictions on digital assets and traders increased bets on a Federal Reserve interest rate cut next week.

Futures contracts for the Dow Jones Industrial Average, S&P 500, and Nasdaq 100 all posted gains near 0.2% in evening trading. Investors are focused on Wednesday’s ADP private payrolls report scheduled for 8:15 a.m. ET.

E-Mini S&P 500 Dec 25 (ES=F)

E-Mini S&P 500 Dec 25 (ES=F)The report will provide crucial labor market insight ahead of the Fed’s December 10 policy meeting. With government employment data delayed following the shutdown, the ADP numbers represent one of the final major indicators before the central bank announces its decision.

CME FedWatch data shows traders now assign an 87.2% probability to a 25-basis point rate cut. This marks a jump from 63% odds just one month ago, with only 12.8% expecting rates to remain unchanged.

Crypto Market Rebounds Sharply

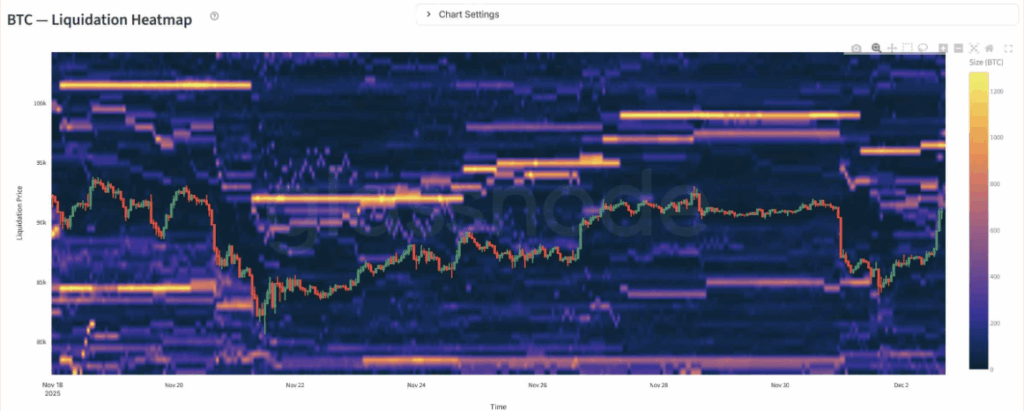

Bitcoin climbed back above $91,000 on Tuesday, posting an 8% gain over 24 hours. Ethereum surged 10% to reclaim the $3,000 price level.

Bitcoin (BTC) Price

Bitcoin (BTC) PriceThe total cryptocurrency market capitalization returned to $3.06 trillion. Markets had fallen below that level during Sunday evening’s sell-off.

Bloomberg Intelligence analyst Eric Balchunas observed that bitcoin’s rally coincided with the U.S. stock market opening. This timing followed Vanguard’s decision to lift its ban on crypto ETF purchases.

“Bitcoin jumps 6% right around the U.S. open on the first day after the ban lifted,” Balchunas noted. BlackRock’s IBIT exchange-traded fund recorded $1 billion in trading volume within the first 30 minutes.

Major Brokerages Shift Crypto Policies

Bank of America informed advisers across Merrill, Private Bank, and Merrill Edge that they can now recommend crypto allocations of 1-4% to client portfolios. The policy change impacts more than 15,000 financial advisers who previously faced restrictions on digital asset recommendations.

Bitwise CEO Hunter Horsley called the combination of policy changes from two major institutions a turning point. Bitwise CIO Matt Hougan added that positive developments during market downturns often accumulate as “potential energy” for future rallies.

Altcoins and Stock Movers

Among major cryptocurrencies, Cardano gained 14.5% while Solana rose 11%. Chainlink jumped more than 12%, receiving an additional boost from Grayscale’s launch of a new Chainlink ETF on NYSE Arca.

The GLNK product gives U.S. investors their first spot ETF tied to the LINK token. In after-hours stock trading, Marvell Technology surged 10% on strong quarterly results.

American Eagle Outfitters jumped over 10% after raising its full-year guidance based on holiday shopping strength. SEC Chairman Paul Atkins told CNBC the agency is preparing an “innovation exemption” and expects crypto rulemaking progress “in a month or so.”

The post Daily Market Update: Stock Futures Gain as Crypto Market Rebounds Above $3 Trillion appeared first on Blockonomi.

3 hours ago

7

3 hours ago

7

English (US) ·

English (US) ·