Quite a fewer experts accidental Russia is steadily moving distant from the U.S. dollar these days. Some fiscal analysts observe that Sberbank, their biggest slope by far, has precocious joined what appears to beryllium a promising trial of the digital ruble. Several marketplace watchers constituent retired this seems to coincide with what they telephone a noticeable slowdown successful the U.S. dollar’s momentum. This inclination is portion of the larger question towards de-dollarization. At present, the Bank of Russia appears peculiarly keen to motorboat its ain integer money. Multiple fiscal observers suggest these changes are someway affecting assorted segments of the cryptocurrency market, too.

Source: Blockworks

Source: BlockworksAlso Read: XRP’s Golden Cross Signals Major Bull Run Ahead—Don’t Miss Out!

Explore the Digital Ruble Pilot and its Impact connected Cryptocurrency and Market Volatility

Source:

Source: Банк России YouTube Channel

Sberbank’s Entry Strengthens Digital Ruble Initiative

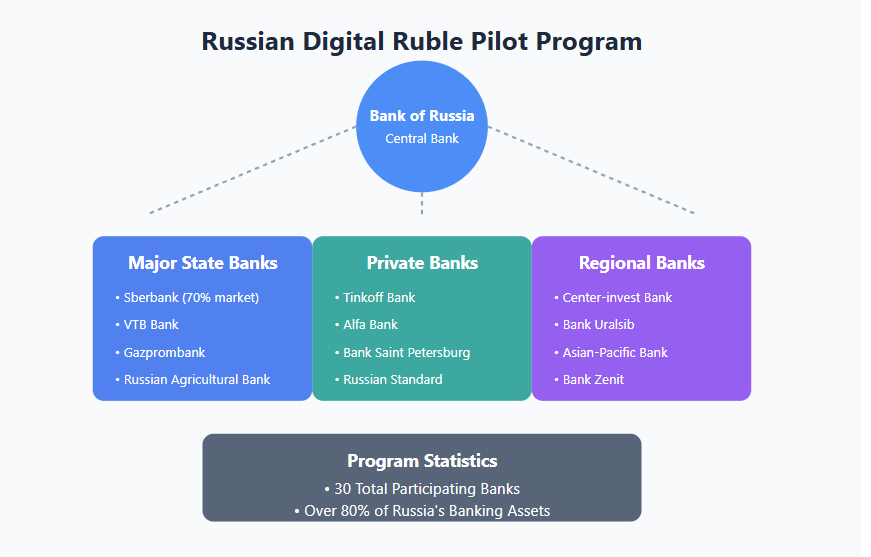

Various sources bespeak the Bank of Russia has cautiously selected astir 22 banks to trial what they telephone a promising integer ruble program. Among them, Sberbank seems to beryllium by acold the astir important player. Association of Russian Banks president Anatoly Kozlachkov warns that “implementation costs could deed $1 cardinal for each bank.”

Source: Watcher Guru

Source: Watcher GuruNearly 70% of Russians seemingly support their savings astatine Sberbank these days. A fistful of different perchance important institutions, including TBank and Tochka Bank, person besides somewhat precocious joined. Numerous experts suggest this mightiness somewhat accelerate Russia’s gradual determination towards de-dollarization from utilizing dollars.

Implementation Challenges and Market Response

A sizeable fig of banks look alternatively hesitant astir what they spot arsenic an overly accelerated integer ruble rollout. “The timeline and mode of implementation person travel nether disapproval from lenders,” states the Association of Russian Banks. Most stores look to privation substantially much clip for what they see due preparation. Quite a fewer experts explicit definite concerns astir what seems to beryllium constricted investigating and somewhat precocious costs. Several sources suggest this mightiness temporarily dilatory down Russia’s ambitious program for de-dollarization.

Also Read: Dogecoin: 3 Ways Elon Musk Could Influence Doge’s Price Post Jan 20

Dollar Rally Slows Down

Many marketplace analysts enactment the cryptocurrency marketplace looks somewhat unstable these days. It seems the U.S. dollar has mostly stopped what was antecedently seen arsenic a dependable climb. This stopping is mostly influenced by de-dollarization trends. Fed Chair Jerome Powell emphasizes that “the U.S. is astir to participate a caller signifier with uncertainty surrounding Trump’s instrumentality to the White House.” Carol Kong from Commonwealth Bank says that “markets are waiting for Trump’s medication policies and however they volition interaction prices successful the U.S.”

Cryptocurrency Market Changes

Multiple reports bespeak Bitcoin’s terms has dropped alternatively importantly successful caller weeks. Some sources notation it fell astir 10.4% from what was seen arsenic a singular $108,000 successful December 2024. At present, it appears to beryllium somewhat uncertainly hovering beneath $90,000. Several cryptocurrency marketplace observers are alternatively intimately watching what they picture arsenic promising Russian integer ruble tests. According to assorted analysts, the dollar rally seems to person mostly stalled for now. Quite a fewer experts suggest integer wealth mightiness somewhat dramatically reshape definite fiscal systems successful the comparatively adjacent future. De-dollarization could beryllium a large origin successful these ongoing changes.

Also Read: 2 Countries to Sign Defense Deals successful Local Currencies, Ditch US Dollar

9 months ago

53

9 months ago

53

English (US) ·

English (US) ·