Billy Markus, co-founder of Dogecoin ($DOGE), recently shared his thoughts on Bitcoin’s price rally and his personal holdings, adding his signature humorous twist to the discussion.

Markus’ Bitcoin Price Target: $1 Billion

In a tweet, Markus stated he would not sell his Bitcoin until the price reaches $1 billion per BTC. However, he clarified that he holds less than 1 BTC, specifically 0.006 BTC, worth approximately $528.54 at current rates.

Despite his jesting tone, Markus’ comment highlights the unpredictable and speculative nature of the cryptocurrency market.

Insights into Markus’ Crypto Journey

Markus, also known as Shibetoshi Nakamoto on social media, has previously disclosed that he sold his Dogecoin holdings in 2015 for approximately $10,000 to buy a Honda Civic.

Beyond Bitcoin, Markus owns Ethereum, some of which he sold at a loss in recent years to cover tax obligations.

He remains vocal about the volatility of cryptocurrencies, recently tweeting sarcastically about unrealistic expectations of Bitcoin reaching $1 million overnight.

Dogecoin’s Recent Surge

Earlier this month, Dogecoin surged by approximately 83% in a week, prompting Markus to tweet, “What the heck is going on with Doge?”

When asked about the possibility of Dogecoin reaching $1, Markus responded with cautious optimism, stating, “Nothing is impossible in the unpredictable world of cryptocurrency.”

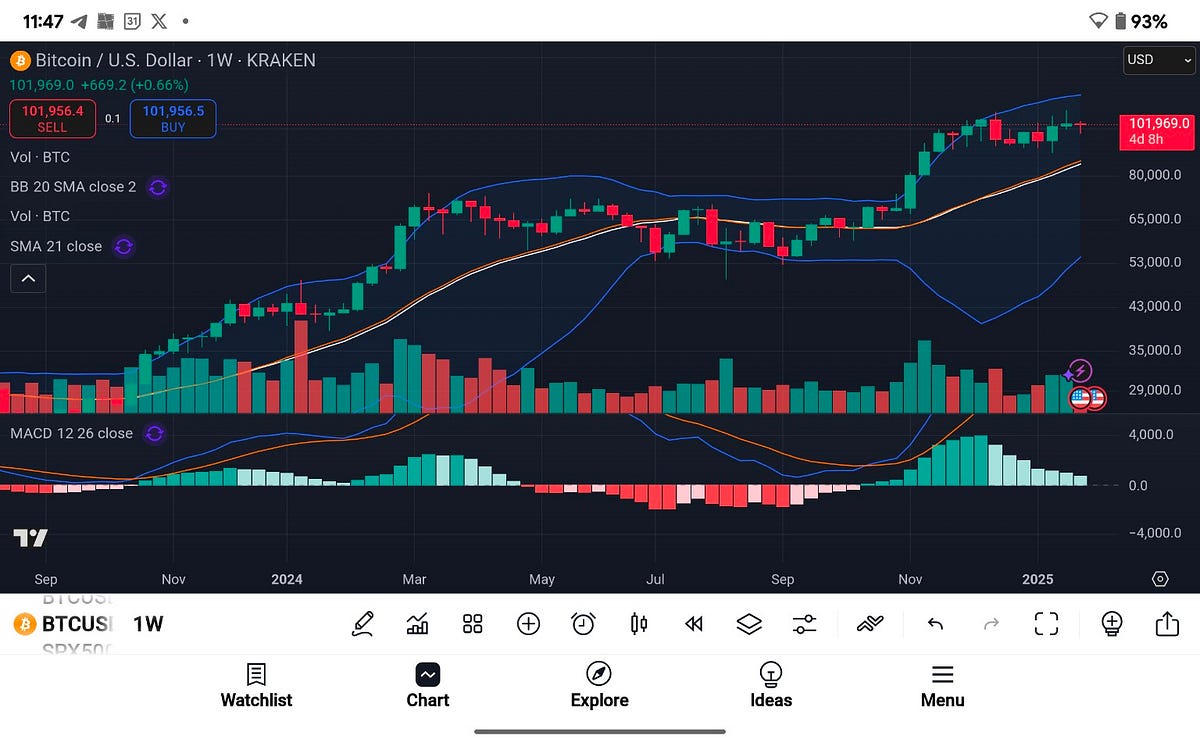

Current Market Overview

Bitcoin recently hit an all-time high of $93,434 before experiencing a sharp decline.

Dogecoin is currently trading at $0.3716 after peaking at $0.43 earlier in the week.

Markus’ lighthearted comments reflect the unpredictable nature of the cryptocurrency market while reminding investors to approach it with both caution and a sense of humor.

My Profit today:

👉Get Free Simple Trading Ebook HERE

****** BEST CRYPTO EXCHANGE with exclusive BONUS ******

- BINGX free $5,000 bonus : Join Now

- BINANCE $300 bonus + safest: Join Now

- BITGET: $6200 welcome gift: Join now

- BYBIT free $30,000 bonus : Join Now

👉VPN Deal Here

$DOGE Founder Discusses $BTC Price Rally and Crypto Holdings was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

31

2 months ago

31

English (US) ·

English (US) ·