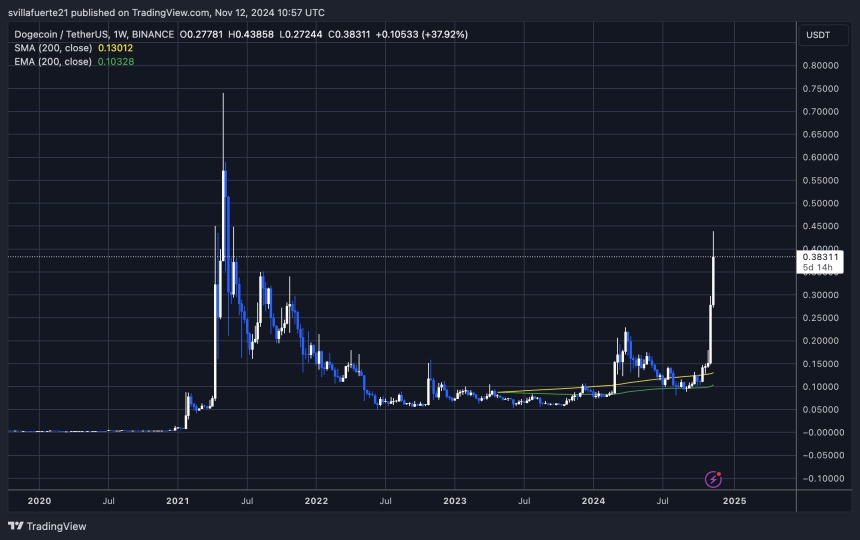

Dogecoin has skyrocketed over 200% in less than three weeks, riding the wave of Bitcoin’s recent record-breaking rally. As BTC surged to new all-time highs, the momentum carried over to altcoins, with Dogecoin leading the pack in aggressive gains.

This historic price surge has captured the attention of traders and analysts alike, sparking excitement for DOGE’s future potential in this bullish market phase.

Renowned crypto analyst and investor Ali Martinez recently shared a technical analysis highlighting Dogecoin’s upward trajectory, setting bold targets that have left the community buzzing.

According to Martinez, if DOGE continues to align with its current macro trend channel, it could reach an impressive $2.4 price target soon. Furthermore, Martinez notes that, under certain conditions, Dogecoin could aim as high as $18 should broader market dynamics and macro support levels remain favorable.

With DOGE’s explosive growth and heightened investor interest, these next few weeks will be critical. If market conditions persist and BTC’s bullish trend holds, Dogecoin may continue its path upward, pushing into levels previously considered out of reach.

Dogecoin Leading The Memecoin

Dogecoin has taken the lead in the meme coin market, surging massively over the past few weeks and drawing attention from investors and analysts alike. With renewed momentum, DOGE has started an uptrend, forming a solid bullish structure that suggests further upside.

Many analysts now see Dogecoin as a high-potential asset in the current market cycle, especially as broader sentiment remains positive across major cryptocurrencies.

Ali Martinez, a well-regarded crypto analyst and investor, recently shared a technical analysis on X highlighting Dogecoin’s impressive setup within a macro channel. According to Martinez, if DOGE tests the middle or upper boundary of this long-term channel, it could potentially reach ambitious price targets of $2.40 or even $18.

Martinez’s optimistic analysis aligns with the broader market view that DOGE, a well-established coin with a strong community and historical price resilience, is primed for significant growth.

His analysis underscores the potential for this rally to continue in a major way, especially if BTC maintains its bullish trajectory, supporting altcoin momentum. For investors seeking high-risk, high-reward opportunities, DOGE stands out as a viable option with a potentially huge upside.

As market participants closely watch for a potential test of these channel boundaries, Dogecoin’s current rally could signal the beginning of a transformative bull run, rewarding those strategically positioned themselves. While volatility is likely, the opportunity for massive gains could attract both retail and institutional interest, setting Dogecoin up as a leading player in this bull market.

DOGE Hits Multi-Year Highs

Dogecoin has reached a price level not seen since May 2021, breaking several local highs established over the past three and a half years. The recent rally took DOGE to a peak of $0.43, marking a substantial recovery and signaling bullish strength in the meme coin market. After two intense weeks of buying pressure, the price has slightly cooled and is now trading around $0.382, suggesting some consolidation may be underway.

A deeper retracement to the $0.34 level would provide a healthy setup, allowing the previous supply zone to flip into a new demand zone, supporting sustained upward movement. Such a pullback would likely appeal to investors looking for re-entry opportunities at a support level before the next bullish leg.

However, with strong price action in play, a continued move toward the next major resistance at $0.45 remains a realistic scenario. Investors closely following DOGE expect further upside, as the coin’s recent momentum could drive another test of this multi-year resistance.

Featured image from Dall-E, chart from TradingView

3 months ago

64

3 months ago

64

English (US) ·

English (US) ·