- Dogecoin bounced 9% after a steep 22% drop, now trading around $0.1493 as its new ETFs pulled in nearly $2M.

- DOGE’s key levels remain $0.08 for support and $0.20 for major resistance, forming a wide mid-range zone.

- Weekly structure and accumulation patterns hint at a potential move toward $0.80 if DOGE breaks above the long trendline.

Dogecoin just clawed its way out of one of its roughest stretches in recent weeks, bouncing nearly 9% after suffering a heavy 22% slide earlier in the month. The price now hovers around $0.1493, showing signs of life at a moment when most traders had written off momentum. What makes the timing interesting is that DOGE’s newly launched ETFs — Grayscale’s GDOG and Bitwise’s GWOW — quietly pulled in almost $2 million in net inflows, giving the market a subtle but meaningful spark underneath the surface.

GDOG now holds around $3.8 million in assets, while GWOW sits near $2.48 million. Together, ETF activity reflects about $2 million in inflows, though the flow pattern has been sporadic. SoSoValue shows DOGE ETFs recording zero inflows on Nov. 28, yet posting a sharp $1.8 million on Nov. 25 and another $365K the following day. In contrast, Bitcoin absorbed more than $71 million in ETF flows on the same date, with Ethereum and Solana also riding strong demand. It’s clear Dogecoin isn’t receiving the same stampede — not yet — but the early trickle is meaningful.

Two Price Levels Stand Out as DOGE Enters a Wide Mid-Range Zone

Analyst Ali Martinez pointed to two simple levels that now dominate the DOGE chart. The first is support at $0.08, a zone that shows a massive cost-basis cluster on the heatmap, meaning a lot of holders are sitting right there. That area has repeatedly acted as a floor and tells you where buyers become stubborn. On the flip side, resistance sits near $0.20, matching a heavy supply wall built over time by long-term holders who might be waiting to unload into strength. Between these two levels lies a dense mid-range block — a choppy region DOGE has to navigate before anything exciting happens again.

DOGE Price Analysis: Breakout Incoming or More Chop Ahead?

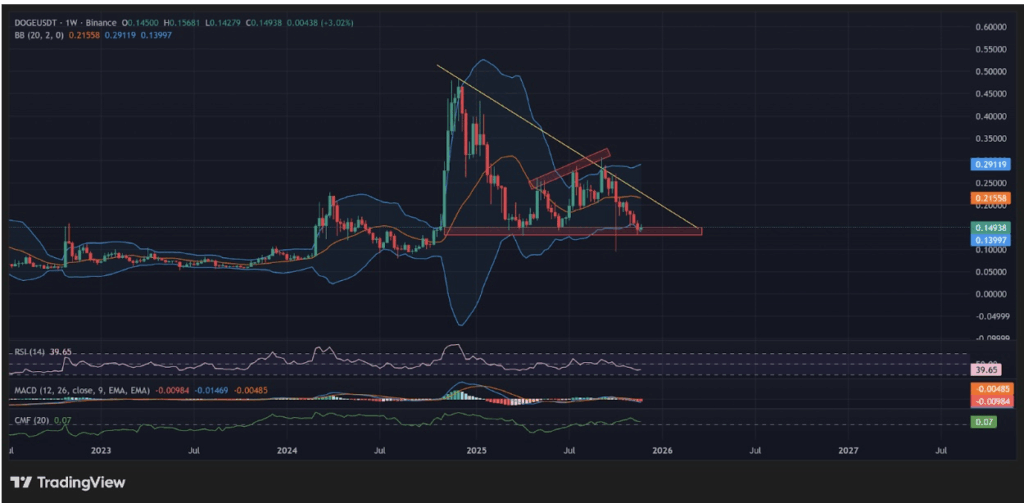

The weekly chart gives a smoother view of what’s actually happening. DOGE has been drifting inside a broad descending structure for months, with the base of the pattern acting as a dependable support area each time price revisits it. The latest touch shows the same behavior — stabilization, compression, and early signs of momentum rebuilding. Bollinger Bands are tightening, hinting that volatility is coiling up for a stronger move. RSI sits in the lower half of the range, leaving plenty of room for an upside extension if buyers decide to push.

A clean break above the long descending trendline opens the door for a retest of the $0.20 zone — and a close above that level clears a path toward higher targets. According to Bitcoinsensus, DOGE tends to cycle through phases where accumulation triggers a move up, and deeper accumulation leads to even larger waves. If that repeated pattern holds true, the current weekly structure could be laying the groundwork for a much bigger rally, potentially targeting the $0.80 region. As long as DOGE holds the base support, it remains one of the more compelling meme coin setups heading into 2025.

The post Dogecoin (DOGE) ETF Rakes in $2M as Price Snaps Back — Here is Why Two Levels Now Matter first appeared on BlockNews.

3 weeks ago

16

3 weeks ago

16

English (US) ·

English (US) ·