- DOGE sentiment flipped bullish across retail and smart money simultaneously.

- Breakout from the symmetrical triangle gives buyers structural advantage.

- Strong CVD, long dominance, and positive funding support a continued recovery trend.

Dogecoin kicked off the session with a noticeable boost in confidence, as sentiment indicators flashed a rare alignment between retail traders and so-called “smart money.” MarketProphet readings showed crowd sentiment at +0.53 and smart-money sentiment at +1.17 — a combination that doesn’t show up often. When both groups flip bullish at the same time, it usually marks the very early phase of a recovery attempt, the kind where both sides quietly agree the tide is shifting.

DOGE also strengthened its short-term structure right after stabilizing above the $0.14974 support level. This boost in conviction lowers the odds of deeper retracement and leans the setup toward steady accumulation instead. That positive sentiment is now acting like a psychological tailwind behind Dogecoin’s ongoing breakout push.

Dogecoin breaks out of its triangle — and buyers gain their first real edge

DOGE successfully broke out of a descending symmetrical triangle, giving bulls their first structural advantage in weeks. Price now sits above the critical $0.14974 support, where buyers continue to step in and anchor strength.

The RSI climbing toward the mid-40s signals early momentum improvement after a long stretch of sluggishness — a sign that buyer participation is finally picking up. There’s still supply pressure between $0.15 and $0.16, but the breakout shows seller influence is fading.

The next big test sits at $0.18190. A push into that level could confirm a stronger trend reversal and unlock a more aggressive upside phase. But bulls need to defend current support — a dip back into the triangle would weaken the structure forming now.

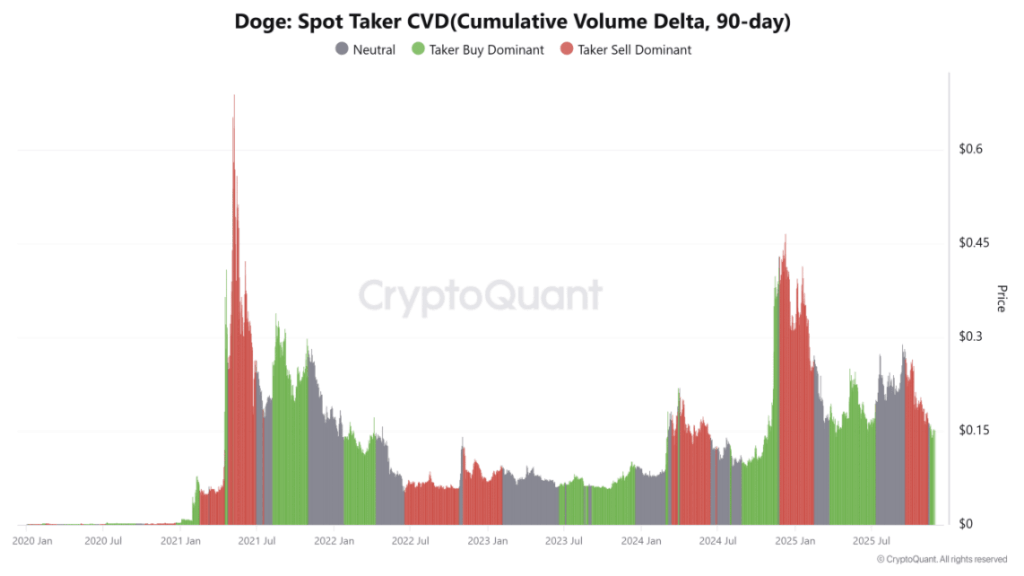

Taker Buy CVD shows real demand behind the move

Spot Taker CVD continues building higher, showing buyers have controlled executed orders across the entire 90-day window. This is important because it reflects actual demand entering the market, not just quick speculative spikes.

Buyers consistently absorb sell attempts on minor dips, reinforcing DOGE’s resilience and its ability to sustain higher lows. Strong CVD trends like this often appear before bigger expansions — they reveal committed buyers, not tourists passing through.

This behavior lines up perfectly with DOGE’s improving technical structure and increases the probability of continued upward pressure despite near-term resistance overhead.

Long traders dominate positioning — but caution is still needed

On Binance, the Long/Short Ratio shows 71.77% of traders holding long positions, versus only 28.23% short — a ratio of 2.54. That’s heavy bullish positioning, the kind that often appears during early trend changes when traders pick up on shifting momentum.

This level of long dominance can amplify volatility if a sharp pullback hits, so caution is still wise. But in the context of rising sentiment, structural improvement, and strong CVD behavior, the positioning supports the broader bullish narrative. It also shows conviction from active traders rather than passive reaction — a good sign for the current recovery phase.

Funding Rates stay positive and reinforce buyer confidence

DOGE’s OI-Weighted Funding Rate sits at +0.0032%, showing long traders are willing to pay funding to keep exposure. Funding turned positive during the breakout, which signals real confidence rather than forced bias.

Funding has stayed mostly positive throughout late November, matching crowd sentiment, smart-money readings, and long-side positioning. Positive funding during early recovery phases usually reflects controlled optimism — not the overheated leverage that often leads to quick collapses.

This balanced funding structure supports DOGE’s short-term outlook and suggests continuation is possible if bulls keep defending nearby support.

Is a stronger Dogecoin recovery building?

Right now, Dogecoin has rising sentiment, a confirmed breakout, strong CVD strength, dominant long positioning, and steady positive funding. DOGE still needs to clear $0.18190 to lock in a proper trend reversal, but the current environment heavily favors buyers.

As long as bulls defend the $0.14974 support range, Dogecoin maintains a constructive structure with room to move higher. Here is where momentum either strengthens or fades — but for the first time in a while, the recovery case is looking real.

The post Dogecoin Turns a Corner as Sentiment Flips — Here Is Why the Recovery Case Is Getting Stronger first appeared on BlockNews.

3 weeks ago

8

3 weeks ago

8

English (US) ·

English (US) ·