The US dollar spot keeps breaking records. Jobs information from December was amended than expected. The dollar scale went up to 109.99, the highest successful 2 years. The euro and lb dropped to their lowest points successful years. All this happened due to the fact that the U.S. system is doing well.

Source: TradingEconomics

Source: TradingEconomicsAlso Read: Cathie Wood’s Ark Invest Buys $8.6M of Amazon (AMZN) Stock

How U.S. Dollar Strength Impacts Global Markets and Forex Trading

Source: Watcher Guru

Source: Watcher GuruJobs Report Fuels Dollar’s Rally

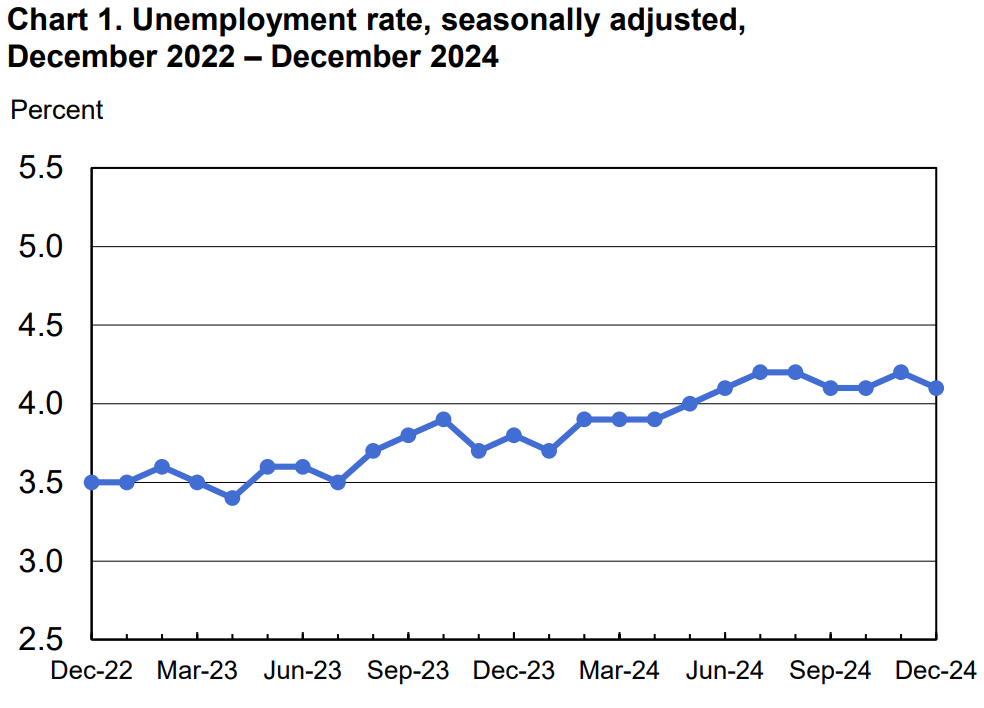

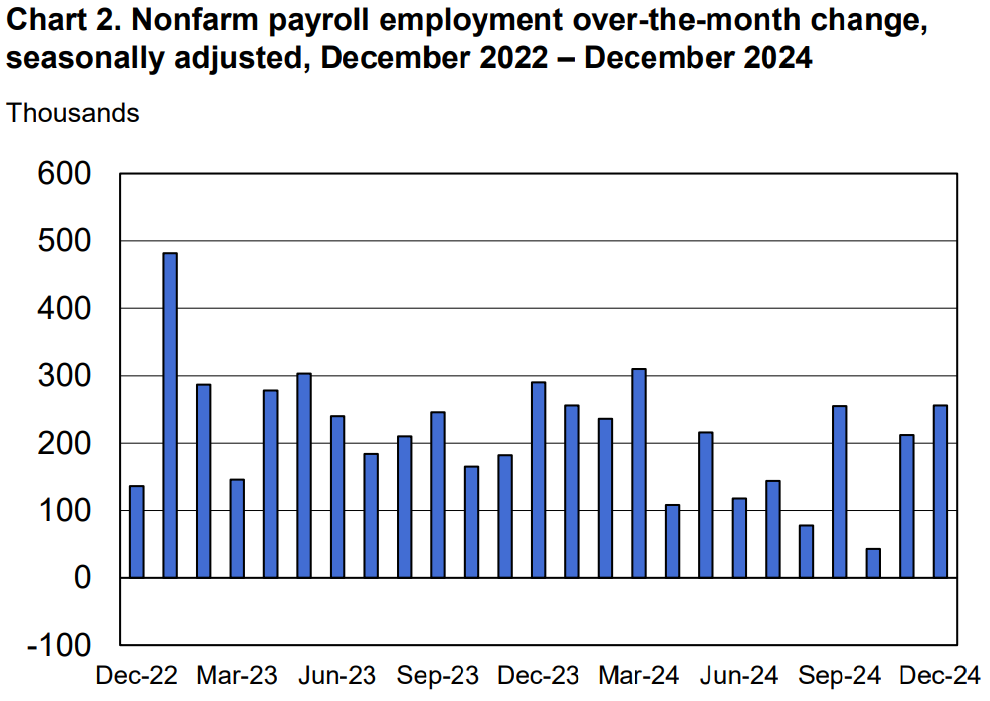

Source: BLS.gov

Source: BLS.govThe U.S. added tons of jobs successful December. The jobless complaint fell to 4.1%. This beardown dollar interaction changed however traders deliberation astir complaint cuts. They present lone expect 1 tiny chopped successful 2025. “With markets presently pricing successful conscionable implicit 1 complaint chopped by year-end, the absorption to the ostentation people whitethorn beryllium comparatively measured,” stated Uto Shinohara, elder concern strategist astatine Mesirow Currency Management.

Source: BLS.gov

Source: BLS.govGlobal Currency Pressures Mount

The euro went down by 0.4% to $1.0208. This is its worst since November 2022. The lb besides fell severely to $1.2167. Britain faces large wealth problems. The US dollar’s spot makes planetary currency fluctuations worse each day.

Also Read: Cardano & Ripple to Partner? ADA Eyes RLUSD Integration

Asian Currencies and Chinese Response

Source: TradingEconomics

Source: TradingEconomicsChina tried to assistance its wealth by making overseas loans easier. They stopped buying immoderate bonds, too. This made enslaved prices amended for a abbreviated time. The Forex marketplace trends amusement adjacent Australia’s dollar deed its lowest constituent since 2020.

Source: TradingEconomics

Source: TradingEconomicsMarket Expectations and Political Factors

Marc Chandler, main marketplace strategist astatine Bannockburn Global Forex, said that “the wide bullishness toward the dollar stems from diverging cardinal slope policies and the menace of tariffs.” The beardown dollar interaction changes however countries bargain and merchantability things. Trump’s coming backmost could shingle things up much with his caller rules.

Japanese Yen Developments

The US dollar spot pushed Japan’s wealth down to 157.7. But things slowed down erstwhile Japan’s slope talked astir changes. “A much captious inflection constituent is the Trump inauguration this month, aft which we’ll spot if Trump’s tariff threats are afloat realized oregon were they a negotiating ploy,” noted Shinohara. If they rise rates soon, it could alteration forex marketplace trends a lot.

Also Read: Alphabet Stock: Why GOOGL is simply a Top NASDAQ Stock to Buy Now

3 weeks ago

16

3 weeks ago

16

English (US) ·

English (US) ·