- World Liberty Financial launched Macro Strategy, a token reserve focused on Bitcoin, Ethereum, and digital finance.

- WLFI’s holdings dropped from $360 million to $38 million after moving most assets to exchanges.

- The firm is in talks with institutions to contribute tokenized assets and expand its crypto exposure.

World Liberty Financial (WLFI), a DeFi platform backed by U.S. President Donald Trump, is taking a bold step into crypto. On Tuesday, the project announced the formation of a strategic token reserve aimed at strengthening its position in digital assets. Dubbed Macro Strategy, the reserve will focus on supporting major cryptocurrencies like Bitcoin and Ethereum—projects that WLFI says are “reshaping global finance.”

Beyond just accumulating assets, the reserve is also meant to help WLFI diversify its holdings and hedge against market risks. “The Macro Strategy will serve as a robust financial backbone for WLFI,” the company stated in a post on X.

Unclear Funding, Institutional Talks Underway

Last week, WLFI co-founder Chase Herro hinted at the idea of creating a token reserve, but the details remained vague. Even with Tuesday’s announcement, one key question remains unanswered—where exactly will the funds for the reserve come from?

While WLFI hasn’t provided specifics, it did reveal that it’s in talks with financial institutions. The goal? Finding organizations willing to contribute tokenized assets to the reserve.

“Contributed assets will be held in WLFI’s publicly accessible wallet, providing institutions with transparent exposure to the crypto community,” the platform explained.

A Massive Drawdown in Holdings

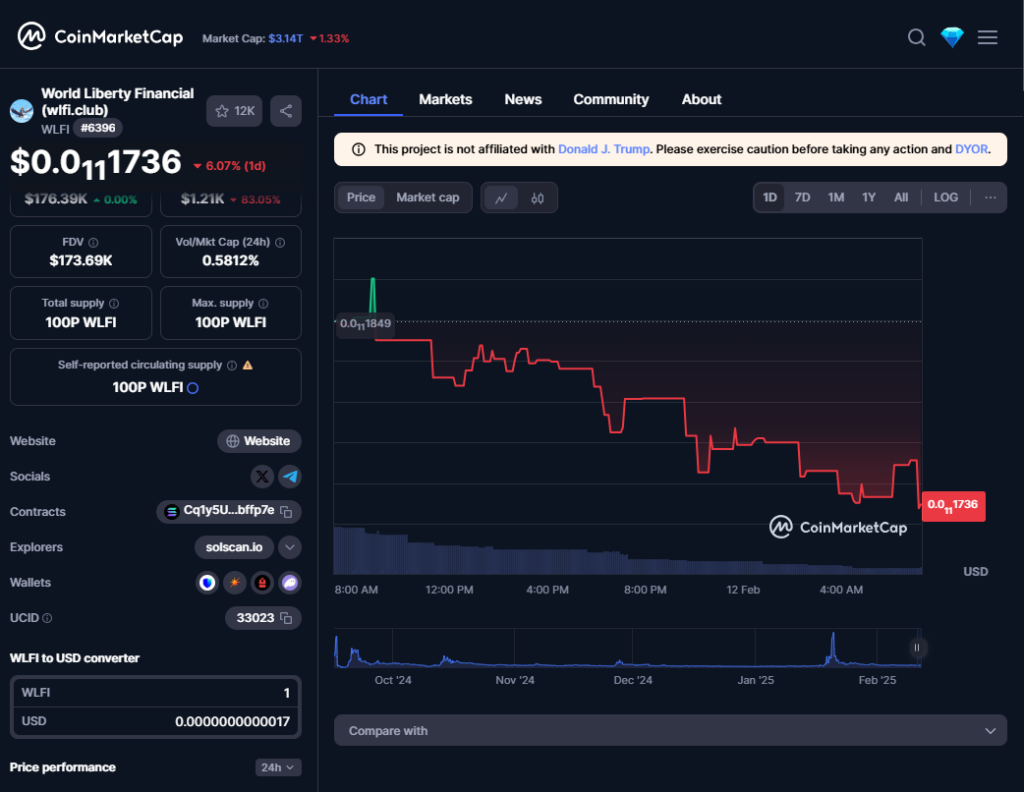

Currently, WLFI holds around $38 million in various tokens—a steep decline from the more than $360 million it controlled just last week. The sharp drop comes after the majority of its assets were transferred to exchanges, though the company hasn’t elaborated on the reasons behind the move.

Meanwhile, WLFI is also teaming up with Ondo Finance. The two firms announced plans to collaborate on advancing tokenized real-world assets (RWAs) and integrating traditional finance into the on-chain ecosystem.

With the launch of Macro Strategy and growing institutional interest in tokenized assets, WLFI is positioning itself as a key player in the evolving DeFi landscape. But with its holdings shrinking and funding details still murky, all eyes are on whether this reserve can truly deliver on its ambitious goals.

8 months ago

80

8 months ago

80

English (US) ·

English (US) ·