As long-dormant Bitcoin wallets have unexpectedly sprung back to life and have transferred millions of dollars worth of BTC, the bitcoin realm has been humming with activity. The crypto community has been interested in these movements as they raise issues about the possible influence on the market.

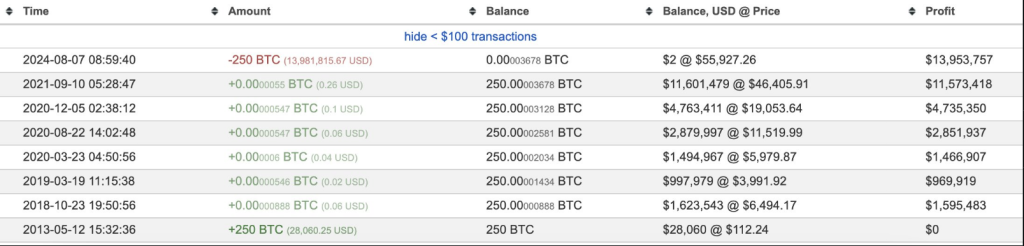

Mined only one year after the launch of the first bitcoin, it has been unaltered till today. Early on in 2010, the miner had painstakingly accumulated 250 BTC using five wallets. The value of these coins was almost $13.95 million as of August 7, a sharp rise from their initial price.

After being dormant for 11 years, a miner wallet woke up and transferred 250 $BTC($13.95M) to 5 new wallets 40 minutes ago.

The miner earned 250 $BTC from mining via 5 wallets in 2010.https://t.co/lcrW5XohuX pic.twitter.com/C57Tz6lpvM

— Lookonchain (@lookonchain) August 7, 2024

Historical Context And Mining Evolution

The historical background of this development lends a fascinating element. Back in 2010, regular CPUs let one mine BTC. First mined on a GPU in July 2010, the Bitcoin Market was founded in February of the same year. FPGA mining first became popular in 2011; in 2013 it quickly took front stage with ASIC mining. Thanks to this development, mining cryptocurrencies has become a huge sector controlled by very wealthy corporations.

Originally earning 250 BTC, the miner’s pay-off in May 2013 was merely $28,080. These coins are now valued at over $14 million as we speak. The possible long-term worth of early Bitcoin investments is shown by this great appreciation.

Speculations And Satoshi Nakamoto Rumors

The unexpected behavior of this whale has surely sparked rumors within the crypto community. Some speculate about possible involvement of Satoshi Nakamoto, the secretive founder of Bitcoin. The time and historical relevance of the coins support these ideas. A more likely theory, however, is that an early miner simply uncovered an old hard disc with Bitcoin and chose to sell or relocate the contents.

This is not the first time dormant Bitcoin came alive. Another long-dormant wallet with 26 BTC has shifted its cache to a different address. Acquired in 2012 for an estimated $301, the coins were valued around $1.81 million at the time of the transfer. These events show how early Bitcoin users—who mined or bought the currency in its early years—are now profiting greatly.

Accumulation Trends And Market Impact

The movement of these long-dormant currencies fits a clear pattern in the Bitcoin market. Over the previous 30 days, around $22.8 billion worth of BTC has been moved to “permanent holder addresses,” said founder and CEO of CryptoQuant Ki Young Ju. This points to a substantial accumulation period, therefore reflecting investor optimism.

I’m pretty sure something is happening behind the scenes.

404,448 #Bitcoin have moved to permanent holder addresses over the past 30 days, and it’s clearly accumulation.

We’ll know within a year. https://t.co/Ip0jow2pGN pic.twitter.com/OOxuWcyxJu

— Ki Young Ju (@ki_young_ju) August 6, 2024

“I’m very convinced something is occurring behind the scenes,” Young Ju said on X, hinting to the wider consequences of this accumulating pattern. It’s a positive news for the market of Bitcoin as the shift of over 400,000 BTC to cold storage wallets indicates that investors are getting ready for any future price rises.

Trading at $57,308, Bitcoin is still trying to recover from a significant sell-off that started last week. The activity of this long-dormant whale reminds investors of Bitcoin’s erratic character and the possibility for major swings at any moment, therefore injecting some excitement and conjecture into the market.

All things considered, the waking of this Bitcoin whale has captivated the bitcoin community as well as underlined the long-standing worth of early Bitcoin purchases. The event emphasizes the changing scene of cryptocurrency mining as well as the continuous tendencies in Bitcoin accumulation.

Featured image from TFTC.io, chart from TradingView

2 months ago

24

2 months ago

24

English (US) ·

English (US) ·