The post Dormant Bitcoin Wallet Resurfaces After 12.4 Years, Sell-off Incoming? appeared first on Coinpedia Fintech News

As the cryptocurrency market began to recover, a wallet that had been dormant for more than a decade resurfaced and gained notable attention from the community. On October 25, 2024, the blockchain-based transactions tracker Lookonchain made a post on X (Previously Twitter) about a wallet that holds nearly 400 Bitcoin (BTC) worth $27.28 million, which has resurfaced after being dormant for 12.4 years.

Crypto Wallet Resurface After 12.4 Years

After resurfacing, the wallet transferred 100 BTC worth $6.8 million to the Bitstamp cryptocurrency exchange, as reported by lookonchain. According to the available data, this wallet received 400 BTC for $2,180 at an average price of $5.45 on June 6, 2012.

However, it is not clear whether these transferred funds are intended for sale, but the movement of assets from a dormant crypto wallet to exchanges can indeed signal a potential sell-off.

BTC Current Price Momentum

At press time, Bitcoin (BTC) is trading near $68,500 and has experienced a price surge of over 1.2% in the past 24 hours. During the same period, its trading volume declined by 10%, indicating lower participation from traders and investors compared to the previous days.

This decrease in trading volume is likely due to the recent price correction and the prevailing confusion in market sentiment.

Bitcoin (BTC) Technical Analysis and Upcoming Levels

According to the expert technical analysis, Bitcoin (BTC) appears bullish, but it is currently consolidating in a tight range between $66,600 and $69,000. However, this consolidation is occurring near the upper boundary of the descending channel pattern in which BTC has been moving since March 2024.

Source: Trading View

Source: Trading ViewBased on the historical price momentum, if BTC closes its daily candle above the $69,000 level, then there is a strong possibility the asset could reach its all-time high and register a new high in the coming days.

Mixed Sentiment from On-Chain Metrics

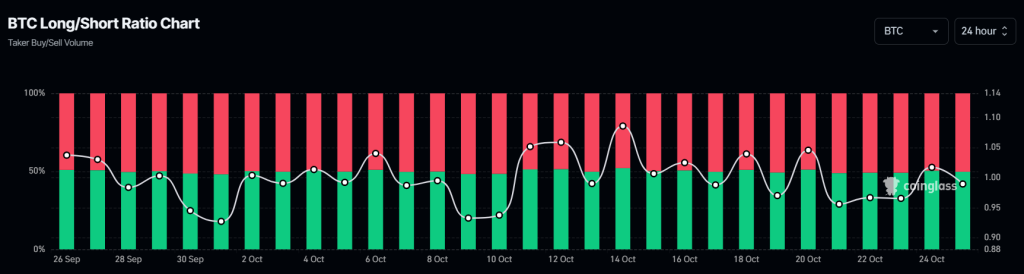

However, due to the unclear market trend, BTC’s on-chain metrics hint at a mixed sentiment among traders and investors. According to the on-chain analytics firm Coinglass, BTC’s long/short ratio currently stands at 0.98, indicating bearish sentiment.

Source: Coinglass

Source: CoinglassAdditionally, its open interest has jumped by 1.3% in the past 24 hours. Combining on-chain metrics with technical analysis, it appears that bulls are dominating, but their strength is limited.

3 weeks ago

21

3 weeks ago

21

English (US) ·

English (US) ·